Warren Buffett was three years old when his diehard Republican dad taught him to hate Democrats.

Little Warren didn’t get dessert unless he said something nasty about Roosevelt at the dinner table.

Buffett bought his first stock in 1942 and has invested under every president since. His success through all kinds of political climates led him to coin the famous line: “If you mix politics and investing, you’re making a big mistake.”

- We’re 12 days out from the most hyped election in US history. Don’t waste your time trying to guess who will win and how it will affect markets.

I’ve studied the data back as far as 1897, and one thing is crystal clear: There isn’t some golden, predictable pattern when it comes to presidents and the stock market.

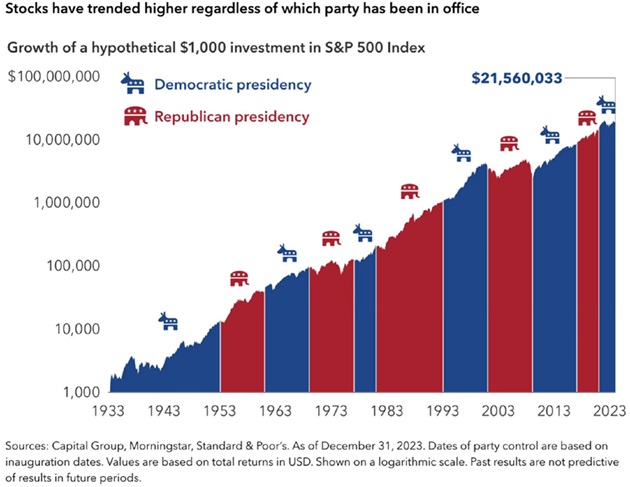

Stocks have soared when both Republicans and Democrats were in power.

Stocks have tanked when both Republicans and Democrats were in power.

However, stocks usually rise regardless of who controls the White House, as the chart below shows.

That’s not because markets “only go up.” It’s because American businesses are moneymaking machines, which drives stock prices higher. (And because of inflation, which the best US stocks are great at keeping up with.)

Source: DataTrek

The media does a terrific job at highlighting the Grand Canyon-sized differences between both candidates.

It’s easy to get caught up in the noise...

But when it comes to investing, it’s a distraction. And it may even lead you to buy “politically sensitive” stocks...

- Have you ever owned a “politically sensitive” stock?

These are companies that either soar or crater based on who sits in the White House.

For example, do you remember when Obama signed laws restricting gun sales?

Turns out he was the best gun salesman in America for six years running. Firearms company Sturm Ruger & Co. (RGR) surged 1,300% after Obama’s election:

When Trump won in 2016, he promised to rebuild the US military. That lit a fire under the largest defense contractor, Boeing Co. (BA):

When Biden was elected in 2020, it seemed like everyone was screaming, “Buy pot stocks!”

His administration was going to loosen regulations. People expected more and more US states would legalize recreational marijuana.

Those who bet on Tilray Brands (TLRY), Canopy Growth Corp. (CGC), or Aurora Cannabis (ACB) when Biden took office are down more than 90%.

At the same time, if you played Biden’s “Green New Deal” with solar stocks like First Solar (FSLR), you’re doing well. FSLR has risen around 280%.

In short, some companies live and die on election results and narratives. Buying these types of stocks is like flipping a coin.

- Wouldn’t you rather own companies that perform well no matter who’s president?

The best disruptors shrug off elections and economic concerns. Take a look at how Amazon (AMZN)… Apple (AAPL)… and DNA mapper Illumina (ILMN) recovered quickly after the 2008 election and financial crisis:

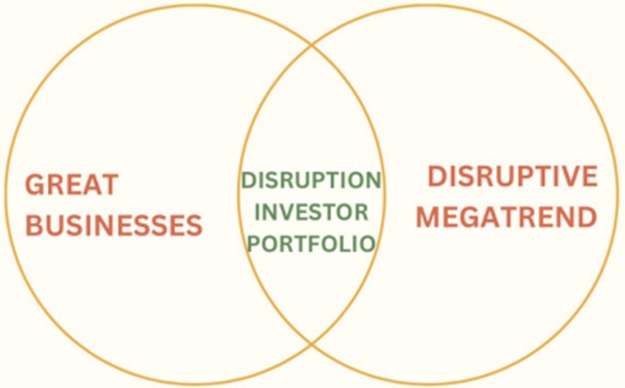

Our edge in Disruption Investor is owning great, disruptive businesses in long-term megatrends. Over a multi-year period, the companies we own will continue to power ahead no matter the political situation.

- Look for stocks in this sweet spot...

In Disruption Investor, our investing framework boils down to a simple tool you learned in school: the Venn diagram.

The first circle in the diagram represents great businesses: companies that consistently grow their revenues and profits. The second circle symbolizes disruptive megatrends: fast-growing, world-changing trends.

Where these two circles overlap is the “sweet spot:” great businesses profiting from megatrends. Only stocks that hit the sweet spot in the middle qualify for the Disruption Investor portfolio.

(Notice: I didn’t mention anything about who’s in the White House.)

Right now, two of the big megatrends we’re capitalizing on are artificial intelligence—specifically “phase 2” of the boom, which includes the infrastructure buildout—and biotech.

But we have strict criteria for which stocks make it into our Disruptor 20 portfolio:

- The stock must have the potential to at least double within a year.

- The company must be “under the radar” and positioned to grow quickly.

- The company must be profitable. Only bona-fide cash cows.

- And again, the company must tap into a surefire megatrend.

Stephen McBride

Chief Analyst, RiskHedge

PS: I write about a lot of the megatrends we’re in—and share my insights and analysis on breakthrough disruptions—in my free M/W/F letter, The Jolt. Go here to join today.