Right on cue, the S&P 500 has fallen 4% over the past week.

As we discussed, September is the worst month for stocks over the past decade. The S&P 500 has fallen in 7/10 of the last Septembers.

And remember, stocks are usually weak ahead of US presential elections.

My market “script” for the next few months: Stocks trade sideways to down heading into November, then rip higher once the election is done and dusted.

Keep some cash dry and use any potential weakness to scale into great businesses in long-term megatrends, like the ones we recommend inside the Disruptor 20.

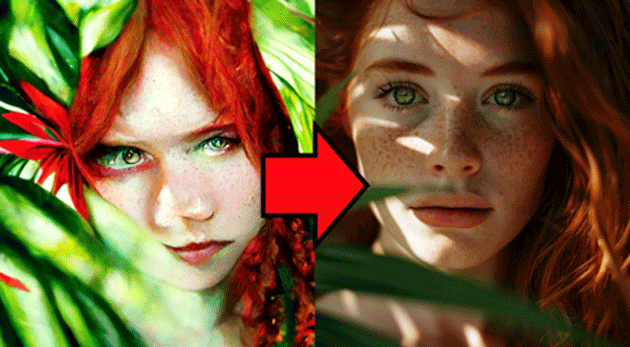

- People said AI would never be able to create art…

Now you can’t tell an artificial intelligence (AI) image and a real photo apart.

Compare “V1” of image generator Midjourney’s attempt at creating “A woman with red hair and green eyes” to the latest version.

We’ve gone from laughably bad to scarily good in two years.

Source: Midjourney

Source: Midjourney

It pays to invest in technologies which give you that “wow” feeling when you get your hands on the new version. And right now, no other tech is advancing as fast as AI.

A few months ago, AI video generators spat out people with distorted limbs. They were like horror movies gone wrong.

Now you can make Hollywood-quality short films by typing a few words into a text box.

Check out what Flux, a new AI video tool, can produce. Spoiler: She’s not real.

And remember, this is the worst AI tools will ever be.

It’s only a matter of time before we have AIs that dream up a brand-new movie idea and then tailor-make it just for you.

I bet we’ll soon see brands like Louis Vuitton spin up whole marketing campaigns in seconds by simply telling the AI “Give me a fashion shoot inspired by da Vinci.”

Folks who think AI isn’t going to transform the world simply aren’t paying attention.

I suggest keeping an AI “can’t do” list. The list of things AI fails at is shrinking by the day.

Continue to invest in the companies powering this revolution. We own five great businesses drinking from the firehose of AI spending in Disruption Investor.

- Jeff Bezos made a bold prediction back in 2013...

Buzzing drones would soon be crisscrossing the sky carrying Amazon (AMZN) parcels.

But 11 years later delivery guys are still dropping cardboard boxes at my doorstep. What went wrong?

US government red tape essentially made drone deliveries illegal. The rules said drones had to be in the “pilot’s” line of sight at all times… making it impossible to launch a service that could deliver thousands of parcels daily.

Good news: Washington recently gave Amazon… Walmart (WMT)… Zipline… and Google’s (GOOG) drone arm Wing permission to make deliveries without someone watching from the ground.

Prepare the doors for landing! This is the game changer we’ve been waiting for.

In a year or two the skies will be swarming with flying robots delivering everything from jars of baby food… to medications… to coffee beans.

Amazon Prime members will be able to order thousands of items and have a drone gently drop them on their doorstep in less than 30 minutes. No more driving to the pharmacy. Your medications just show up at your door.

Our kids’ kids will wonder why we used heavy trucks to deliver 5 lb. parcels. “You’re telling me a human driving a car used to deliver your pizza, huh?”

Three investing observations.

#1: Avoid drone stocks. The world’s largest drone companies aren’t great businesses. Fast-growing startups like Zipline are the ones you want to invest in, but it’s still private.

#2: Amazon and Walmart are the immediate winners. Amazon spent $90 billion shipping carboard boxes around the world last year. Imagine when flying robots can deliver Amazon’s light parcels. No need to buy heavy trucks… gas… or pay full-time drivers. Drones are worth billions of dollars to Amazon and Walmart.

#3: FedEx of the air. Some innovative startup will build a drone-only delivery network. It’ll be the 21st-century FedEx.

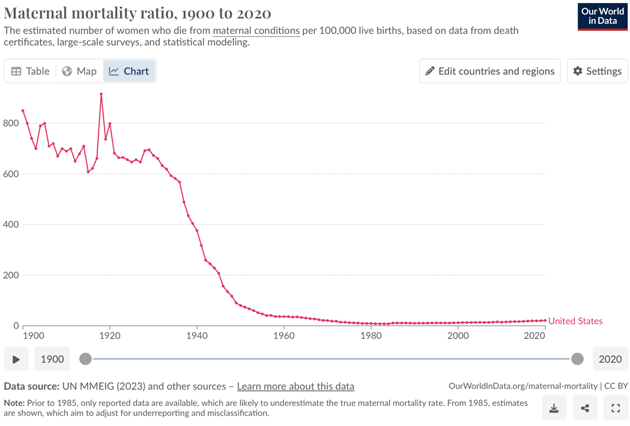

- Today’s dose of optimism…

For an American woman, giving birth in 1900 was almost as dangerous as having breast cancer today!

Thankfully, maternal mortality plunged 98% over the past century.

Source: Our World in Data

Source: Our World in Data

We can thank medical advances like antibiotics for that. Repeat after me: innovation rocks!

To get more of my insights and analysis on AI and today’s top disruptive trends (and what to do), consider joining my free investing letter. It’s called The Jolt: where innovation meets investing. Go here for details.

Stephen McBride

Chief Analyst, RiskHedge