There are lots of big, new things happening in the world of artificial intelligence (AI). The pace that AI’s advancing continues to shock me.

Let’s get after it!

- AI “agents” will take over your world.

Agents are tools that complete specialized tasks for you.

You can ask one to, “Watch every YouTube video about the American Civil War and distill the key points.”

It will then complete that task for you, in 99% less time than it would usually take.

Think of an AI agent like a personal assistant who does whatever you tell it… never gets tired… and works for free.

I’m convinced we’ll all have personal AI agents helping us in EVERY part of our lives within a decade.

Here are just a few examples of tasks I could offload to AI…

- Checking emails: Each morning, I wake up to 30+ new emails in my inbox that I must sift through.

Soon, my AI agent will screen them and only show me the emails I need to read.

- Online shopping: I waste time browsing sites trying to find the right shirt.

Soon, my personal AI shopper—that knows my size, brand preferences, and style quirks—will get me what I want instantly. Amazon searches will be a relic of the past.

- Healthcare: Inefficient, costly, bureaucratic.

Within a decade, I think AI healthcare agents will be able to write prescriptions.

You’ll soon be surrounded by your own team of AIs. They’ll work just for you.

AI has the potential to be the biggest boom in history because, unlike most other tech breakthroughs, it touches every part of our lives.

The investment implications are many. The biggest, easiest, and most obvious one: Buy the companies making computer chips that will power AI, like Nvidia (NVDA).

- “HollywoodGPT” is going to be awesome.

Remember the Hollywood strikes? The Writers Guild of America demanded that studios ban the usage of AI to write scripts or produce movies.

Careful what you wish for.

The big movie studios signed their own death warrants when they agreed to this demand.

A new breed of disruptors is coming to produce AI-generated movies and shows for 90% cheaper… and much faster. Take AI startup Runway, for example.

Its AI tech generates short videos from a few words of user prompts. Say you type the prompt, “A blue sedan driving in cold, snowy Baltimore.”

It will instantly generate a video clip showing just that.

The magic is that you can instantly change the whole scene with another simple prompt like, “Place the blue sedan in Nevada’s desert.”

Source: Runway

Imagine having access to this technology but refusing to use it?

It’s like if the automotive industry banned the assembly line in the 1920s and insisted on assembling cars by hand.

Here’s where this is going…

It’s only a matter of time before we get “HollywoodGPT,” an AI bot trained on the transcripts of every film ever made. It’ll be able to dream up brand-new movie ideas in seconds.

These tools will get so good, they’ll be able to make a tailor-made movie just for you.

This is still a couple years out, but we’re heading toward a world where 10,000 new movies will be made each month—all by individuals or small teams—with the help of AI.

Traditional movie studios that act like ostriches—burying their heads in the sand and hoping AI goes away—will not survive.

Avoid their stocks.

- Bitcoin can hit $150,000 in 2024.

Coinbase (COIN) has surged 160% since I recommended buying the crypto exchange back in January.

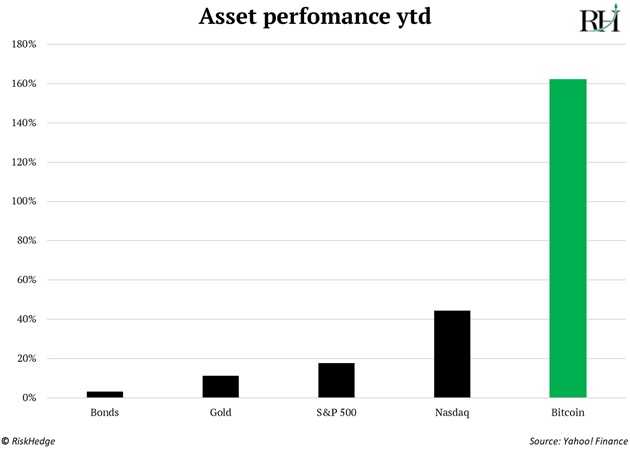

Its stock has traded in-line with Bitcoin (BTC), which is also up 160% this year. Not many people realize bitcoin is the best-performing major asset of 2023!

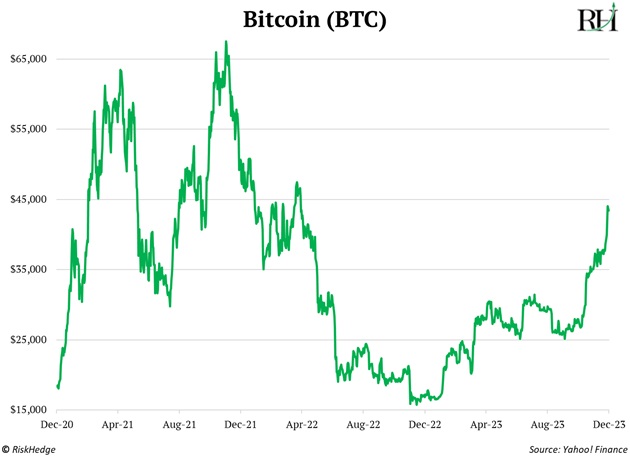

I’ve been investing in crypto since 2019, and it’s clear we’re in a new bull market.

The stars are aligning my our halving thesis. As much as bitcoin is up, it hasn’t even broken out yet:

If you’re skeptical of crypto and think it’s all sizzle and no steak, I get it. Going by the headlines, you’d think crypto is overrun with criminals.

Really, crypto is the most misunderstood asset in the world.

That’s why I founded my crypto advisory, RiskHedge Venture. We only buy crypto businesses with real products producing real revenues.

And yes, our portfolio is outperforming bitcoin this year.

I think everyone should own at least a little crypto—I’m talking 1% of your portfolio.

Stephen McBrideChief Analyst, RiskHedge

|