As I write this, bitcoin (BTC) is over $92,000.

Ethereum (ETH) is over $3,000.

And many smaller cryptos are soaring.

The crypto market just entered a new boom period… and today, I’ll show you the best way to position your portfolio to capitalize.

- The crypto regulatory war is finally over.

Trump’s victory in the 2024 US presidential election marks the end of crypto’s four-year regulatory siege, and the implications are far bigger than most realize.

After four years of treating crypto companies like criminals, America just switched sides.

You can see the moment crypto emerged from the regulatory “sin bin:”

Under the old administration, crypto entrepreneurs were afraid to innovate for fear of stepping in regulatory quicksand.

Want to launch a dog joke token? No problem.

Want to build actual financial infrastructure? Here’s your subpoena.

It was a constant regulatory barrage. Crypto banks were shut down by the government. Founders and funds were sued. Protocols were subject to constant surveillance sweeps.

That era just ended.

Think of it like taking the handcuffs off thousands of entrepreneurs at once. Expect the coming innovation surge to shock people who think crypto is just about speculation... and for token prices to respond in kind.

- Regulatory clarity is great for investors.

Regulatory uncertainty has acted as a massive lid on crypto’s price.

It’s kept the big money at bay. Wall Street firms can’t touch crypto right now because authorities haven’t provided clear guidance around which tokens are securities and which are commodities.

It’s also hurt ordinary investors.

Huge swaths of tokens are currently off-limits to Americans due to a lack of regulatory clarity.

Take the “US version” of crypto exchange Binance, for example. It only offers a fraction of the tokens listed on its global platform, which US residents can’t access.

Regulatory clarity solves this problem. It’ll cause a flood of new money into crypto.

- What’s next for the crypto market?

Here are a few predictions about the things we can look forward to following America’s pro-crypto shift:

- The money tsunami: There’s been a dearth of fundraising over the past few years due to regulatory uncertainty. Who wants to invest in something that might be illegal tomorrow? Expect crypto funds to begin raising billions of dollars early next year. Most of this money will flow into smaller tokens, not bitcoin.

- Here come the ETFs: Asset managers like BlackRock (BLK) and VanEck will start filing applications for new crypto ETFs. Expect Solana (SOL) to be approved first.

- Yield, please: Ethereum ETF holders don’t currently earn staking rewards. This should change with new SEC leadership.

- Return of initial coin offerings (ICOs), crypto’s version of an IPO: Crypto startups will once again be allowed to offer their tokens to ordinary investors right out of the gate. No more 97% insider allocations.

- Crypto IPOs: Expect crypto companies like Circle—the firm behind popular stablecoin USD Coin (USDC)—to go public sometime next year.

We just got a complete reversal of crypto’s biggest headwinds. The past four years of regulatory persecution froze innovation, capital flows, and proper token economics. That freeze is now thawing.

This isn’t just another crypto bull market. This is the legitimization of an entire asset class.

- It’s time for a new playbook: A.B.B.

This has been a bitcoin-led bull market so far.

BTC now makes up roughly 57% of crypto’s total market cap, the highest since 2021.

This is a direct result of the regulatory onslaught against crypto businesses. Invest in a protocol that could get sued tomorrow? Nah, I’ll just buy BTC instead.

It’s time for a new playbook: A.B.B.—Anything But Bitcoin.

My research suggests bitcoin can hit $250,000 in the next year. But the real money will be made buying great crypto businesses emerging from regulatory hell.

Protocols will now be able to share fees with token holders without fear of SEC action. Entrepreneurs can build real products without calling up their lawyers first. Expect to see a wave of exciting announcements from crypto founders in the coming months.

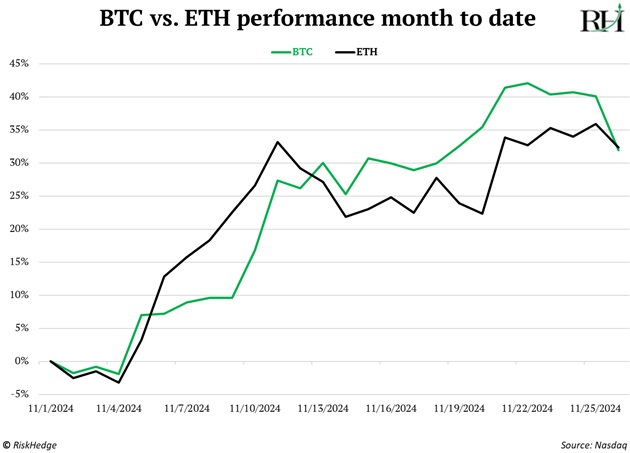

You can already see this shift in the market since Election Day.

Ethereum, Solana, Aave (AAVE), Lido DAO (LDO), Arweave (AR), and dozens of other cryptos are outperforming BTC.

Smart money isn’t waiting for official announcements. They’re buying the tokens that were handcuffed by regulation.

This is the best setup for crypto in years.

- Here’s what to do...

I recommend all investors own at least a little crypto.

If I’m right about even a few of my predictions—and I believe I am—then major tailwinds are coming to the crypto market. Invest in the right coins, and you can invest a little to make a lot during this cycle.

If you’re looking for a good starting point, Ethereum and Solana are two top “Buys” right now in my premium crypto advisory, RiskHedge Venture.

They should both benefit from regulatory clarity because developers will now have incentives to innovate again on their platforms.

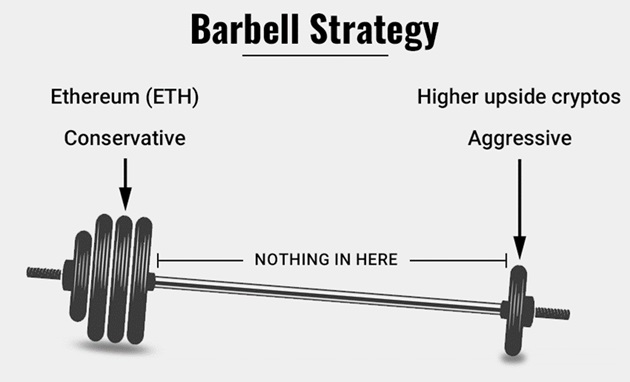

Using my barbell strategy, I suggest putting 75% of your total crypto portfolio into larger cryptos like ETH and SOL. The other 25% can be made up of smaller, higher-upside tokens.

This allows you to potentially earn higher returns… while the “safer” portion should cushion any losses. (I put “safer” in quotes because crypto is an early stage technology, and no crypto has a comparable level of safety to financial assets like government bonds, cash, and certain groups of stocks.) It should look something like this:

Of course, crypto is just one asset in an overall portfolio. You should only put a small percent, say 1% to 2%, of your investable assets into crypto.

Stephen McBride

Chief Analyst, RiskHedge

PS: We’ve now entered the best time to own crypto. If you’d like to learn more about the wave of innovation set to hit the crypto market post-election—and how to invest in it—join The Jolt today.