Earnings season is almost done, with 92% of S&P 500 companies having reported.

Grade: B+.

Corporate earnings grew at their fastest pace since the end of 2021.

And unlike the past few quarters, when a handful of large tech stocks accounted for all the growth, almost 80% of companies beat earnings.

As I’ve mentioned, my #1 way to “read” the economy is to listen to earnings calls.

While many economic indicators are suggesting we’re entering a “recession,” earnings tell a different story. The number of times “recession” was mentioned on earnings calls is near its lowest in three years.

We’re watching markets closely and keeping an open mind. All eyes will be on the next jobs report, which comes out September 6.

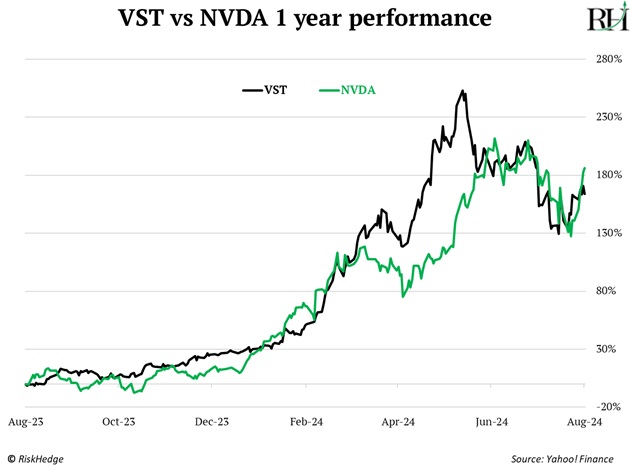

- The dog on the street knows Nvidia (NVDA) ripped higher over the past year.

But did you know Vistra Corp. (VST), a boring ol’ power provider, is keeping pace with the artificial intelligence (AI) chip king?

AI’s thirst for energy is off the charts.

Chatbots like ChatGPT are powered by tens of thousands of energy-hungry computer chips inside vast data centers.

Microsoft (MSFT) operates more than 300 data centers around the world. And its energy usage has more than doubled since 2020. Microsoft now guzzles more electricity than entire countries, like Iceland or Puerto Rico!

Electricity isn’t what you think of when you hear “fast-growing megatrend.” But powering AI will become one of the most important investing trends in the coming years.

Power providers like Vistra will benefit from AI’s bottomless appetite for energy.

But the ultimate long-term winners will be companies making data centers more efficient. That’s what I learned from chatting with one of Boston’s top money managers recently.

He told me, “Everyone expects AI to cause a huge energy crisis. You’re telling me we’re smart enough to create superhuman AIs but can’t figure out how to build the energy to power them? Doesn’t make sense.”

I agree. Great companies solve important problems. And businesses that help the likes of Microsoft and Amazon (AMZN) cut electricity usage will make investors a lot of money.

Keeping AI computers cool is the best way to cut energy consumption. Roughly 40% of data center energy usage goes toward cooling systems.

AI servers run 5X hotter than traditional data centers. The new state-of-the-art is “liquid” cooling, as opposed to giant fans blowing cold air.

Peek inside a giant rack of AI servers, and you’ll see thin tubes running everywhere. They're full of special liquid that touches the hottest parts of the computers, cooling them down.

Liquid cooling is 17X more effective at removing heat than giant fans.

- The first thing I’ll do when I land in San Francisco in October is…

Hail a robotaxi.

Waymo’s driverless taxis now run around the clock in San Fran. Waymo works like Uber (UBER). You download an app and request a ride. Except when the car pulls up, nobody’s behind the steering wheel.

“How did you go bankrupt? Two ways. Gradually, then suddenly.”

We can borrow this Ernest Hemingway quote to describe how self-driving cars will come to dominate American roads.

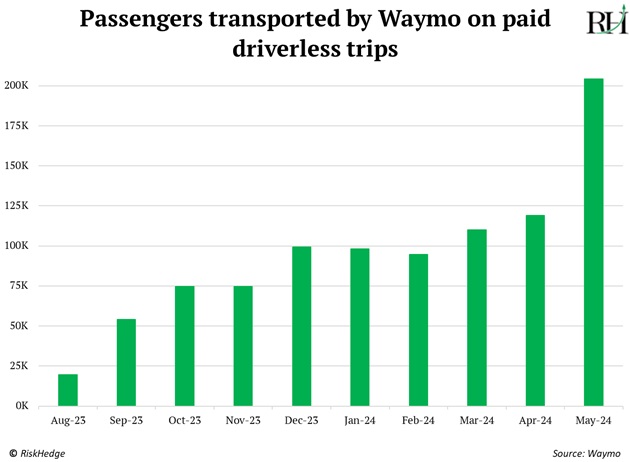

Look at Waymo’s monthly rides—gradually, then suddenly.

Waymo now provides 50,000 weekly trips, mostly in San Francisco and Phoenix, Arizona. This isn’t some future projection; it’s happening today.

Robotaxis are basically rolling supercomputers disguised as cars.

They’re fitted with dozens of cameras and sensors that feed mindboggling amounts of data into a computer in the trunk. Then, this “brain” processes the data to make split-second driving decisions.

I love this quote from Waymo’s head of driving:

Waymo's computer vision systems can, for example, isolate the movement of a pedestrian's fingers and use them as a telltale indicator of their intentions. Waymo can then make accurate projections of a pedestrian's trajectory microseconds ahead of more traditional signals.

Takeaway: We’re going to need a lot more AI chips.

I’ve ruffled feathers in the past with my bullish views on robotaxis. I’m an even bigger believer now. It’s obvious Waymos will be everywhere in a few years.

The robotaxi takeover can happen much faster than you think. Invest accordingly.

- Today’s dose of optimism…

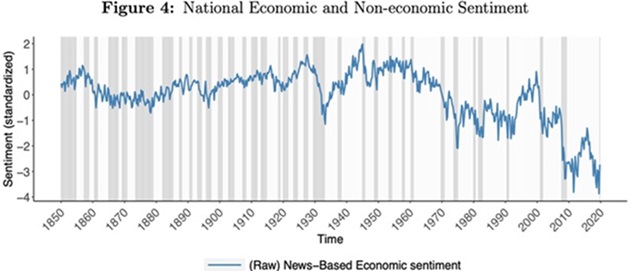

The news is a never-ending feed of the worst things happening on a given day. And a recent study from Wharton and London Business School showed it’s more negative than ever.

Researchers sifted through 200 million newspaper pages from the past 170 years. They found “sentiment” (how positive or negative the news is) is crashing to new lows:

Source: National Bureau of Economic Research

A friend of mine knows the editor of one of the UK’s most popular online news sites. It decided to report only positive news for a week. The outcome?

It lost 70% of its readers.

Most people are addicted to bad news. But you have a choice. You can tune out the corporate media, which is simply a modern-day doom machine showcasing the worst of humanity without highlighting any progress.

Instead, go outside and touch some grass. Go to the gym. Learn to cook like a chef. Spend time with your family.

Almost anything is better for you than reading the news.

Stephen McBride

Chief Analyst, RiskHedge

PS: I regularly discuss the different ways to invest in AI—and the other megetrends helping to shape our world—in my free letter, The Jolt. Stay caught up on today’s biggest innovations by signing up today.