Happy Monday… from the United Arab Emirates.

I’m in Abu Dhabi sorting out my visa before moving the family here in January.

My week is full of meetings with friends and (unfortunately) bureaucrats. If you happen to live nearby, reach out.

- We’re less than 50 days out from the US presidential election.

Regular readers know this is when stocks typically start selling off.

The S&P 500 dipped 8% (on average) ahead of the last five elections. Then, like clockwork, markets roared back once the political fog cleared.

Expect more volatility leading up to the big day. But that doesn’t mean we can’t make money right now.

I’m seeing a lot of “rotation” underneath the market’s surface. Rotation is when money moves from one sector to another, and it’s a sign of a healthy market.

Remember in the first half of the year when a handful of big tech stocks carried the market higher?

Over the past three months, “tech” has become one of the worst-performing sectors. Meanwhile, real estate… utilities… and financials are all up double digits.

This is bull market behavior. Money rotating from strong sectors to ones that have been lagging… allowing them to play “catch up.”

- Should you buy stocks ahead of the Fed’s “D-Day?”

The Federal Reserve is set to cut interest rates on Wednesday for the first time since COVID rocked the world.

Interest rates influence stock market valuations. Warren Buffett compares them to gravity: “Interest rates are to the value of assets what gravity is to matter.”

So lower interest rates = higher stock prices?

It depends… on the strength of America’s economy.

When the Fed cuts rates because we’re headed into a recession, things get messy. It’s happened a dozen times since 1970, and stock market performance in the next year has historically been all over the map.

Outcomes range from down 36% to up 34% for the S&P 500. Messy!

Stocks perform much better after rate cuts when the economy keeps humming.

My take: Don’t try to make money trading stocks based on big “macro” events. Instead, invest in great businesses that’ll thrive regardless of what the Fed does.

Will companies buy fewer AI chips from Nvidia (NVDA)? No. Will Tesla (TSLA) shelve its robotaxi rollout based on what Jerome Powell says on Wednesday? Not a chance.

Invest in great disruptors profiting from megatrends, and the rest will take care of itself.

- Wave goodbye to the inverted yield curve…

The yield curve has inverted before every recession since the 1960s. But it’s been almost two years since the curve inverted (the longest stretch on record), and still no recession.

Our research shows the more accurate signal is when the curve un-inverts. That’s occurred two months ahead of a recession, on average.

Well… the curve un-inverted last week. Time to flip over the hourglass and start the recession countdown?

The likelihood of a recession is much higher than it’s been in some time. But as I explained a few weeks ago, COVID messed up the “sure thing” indicators we’ve relied on for decades.

We’re still working through all the weirdness that came from shutting down the economy… handing out trillions of dollars’ worth of stimulus checks… slashing interest rates to zero… and then raising them to multi-decade highs.

My take: The economy has been red hot for a few years. European vacations galore… $2,000 Taylor Swift tickets… and Michelin-star dinners, no problem!

Now things are normalizing, which feels like a recession.

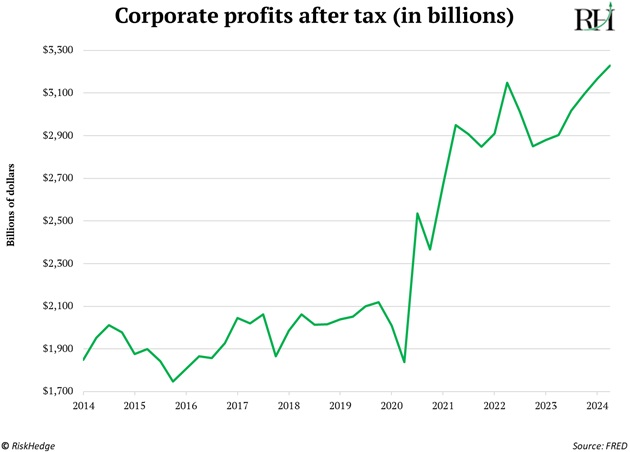

But US corporate profits are hitting record highs. No recession can take hold unless this weakens:

- Today’s dose of optimism…

I’m a big fan of nuclear energy, which is the cleanest and safest way to power our world.

Nuclear energy is so good, even oil-rich United Arab Emirates is adopting it. The UAE completed the Arab world’s first nuclear power plant last week.

These four dome-shaped reactors will produce enough electricity to power the entire country of New Zealand for a whole year!

Meanwhile, stateside… Constellation Energy (CEG) is in talks to restart reactors at Three Mile Island. And the mothballed Palisades nuclear plant in Michigan should begin pumping out clean, safe energy again within a year.

The nuclear renaissance knows no boundaries!

Stephen McBride

Chief Analyst, RiskHedge

PS: Between ongoing market rotation… the US presidential election… and an un-inverted yield curve that historically signals a recession, it’s a turbulent time to be an investor.

My take: This isn’t the time to try to “go it alone” in the stock market. Instead, consider signing up for my free letter, The Jolt. In it, I’ll chart the best course for my readers no matter which way the market turns over the coming months.