The S&P 500 has jumped 5% since last Monday’s vicious selloff, but we’re not out of the woods yet.

Data from Ned Davis Research shows stocks typically retest the lows after big spikes in volatility before making new highs.

We’re also nearing September, the worst month for stocks over the past decade. The S&P 500 has fallen in 7/10 of the last Septembers.

And stocks are usually weak ahead of US presential elections.

Use any potential weakness to scale into great businesses in long-term megatrends. Quality disruptors will power ahead, no matter what markets do in the short term.

1. How I learned to stop worrying and buy expensive stocks.

The 10-year average price-to-earnings (P/E) ratio (called the CAPE ratio) is a commonly used way to measure how expensive or cheap US stocks are from a long-term perspective.

Guess the number of months stocks have been “cheap” based on this metric since 2010, if you consider “cheap” to be below the long-term average…

Zero.

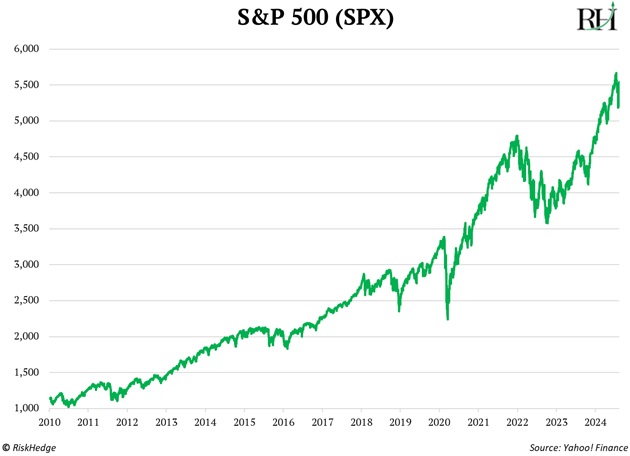

Investors who were allergic to high valuations have missed the chance to quadruple their money in the S&P 500 since 2010:

It’s not that buying expensive stocks is a smart strategy (it’s not). It’s that comparing the valuations of stocks today to those of 40 years ago is a big mistake. Stocks deserve to be more expensive today because the businesses they represent are so much better.

Today’s crop of S&P 500 companies are faster-growing… more profitable… and more predictable than ever.

Why wouldn’t you pay a premium for Microsoft (MSFT)—which grows its earnings by 10% like clockwork—compared to a steel miner whose sales bounce around like a Yo-Yo?

America is a business, and one that just keeps improving.

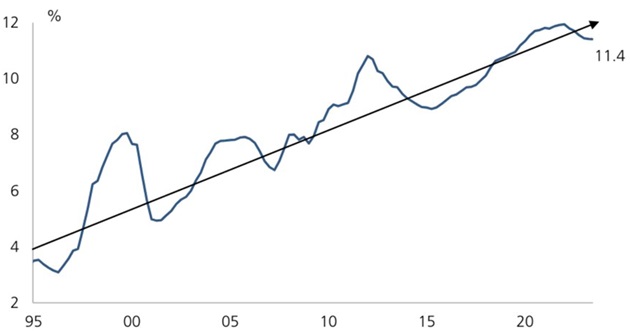

Look at this chart. It shows what percent of sales S&P 500 companies turn into pure profit. It’s nearly tripled since 1995!

Source: Standard & Poor’s

Invest in great businesses at reasonable prices, and the rest will take care of itself.

2. The writing was on the wall for Nvidia (NVDA).

Nvidia eclipsed Microsoft to become the world’s most valuable company on June 18.

That’s also the day Nvidia’s stock peaked, and it’s fallen 12% since. Many other artificial intelligence (AI) winners have slipped, too.

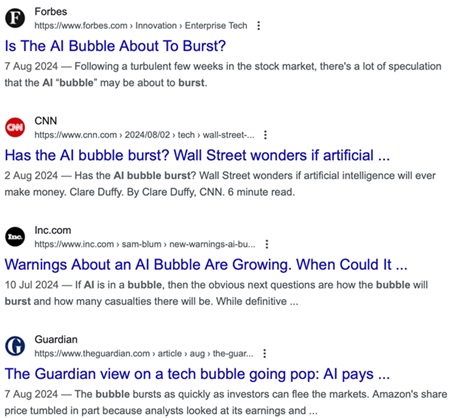

The corporate media mill is in overdrive writing about the AI bubble bursting. Have a look:

Source: Google

What bubble are they talking about? This is just lazy reporting.

Yes, Nvidia’s stock has surged 600%+ in the past two years. Its profits have also jumped 600% in the past two years. Its stock price basically tracked earnings tick for tick!

Dozens of AI winners have soared 50%+ since the start of 2024. The current lull in AI stocks is a healthy correction within a multi-year uptrend.

Two signals that’ll warn of an AI bubble:

#1: AI stocks trading at insanely high valuations. Not there yet.

#2: Big AI IPOs. When the leading company in a hot sector goes public, it often marks “the top.” We’re likely a year away from OpenAI or Anthropic IPOing.

I told my readers to take profits on Nvidia earlier this year. We’re reinvesting those gains into lesser-known winners from the AI infrastructure buildout.

This selloff is a great buying opportunity for long-term investors.

3. Do you know who manufacturers Nvidia’s AI chips?

Taiwan Semiconductor (TSM), or “TSMC” for short.

Nvidia basically sends TSMC an email once a year with a new chip design. Then, engineers in Taiwan use $300 million machines to print these designs onto large silicon wafers. I’m oversimplifying, but only a little.

Guess who makes Google’s (GOOG) chips? TSMC.

How about Apple (AAPL)… Microsoft… Amazon (AMZN)… and Facebook’s (META) processors? Yep, also Taiwan Semiconductor.

AI runs on cutting-edge chips, which really means AI runs on TSMC.

Goldman Sachs recently sounded the alarm about how little money companies are earning from AI. It should’ve read TSMC’s earnings report.

Little-known fact: Unlike in the US, the Taiwan Stock Exchange requires companies to report monthly earnings. Last month, TSMC’s sales surged 44% to a new record high, driven by AI chip demand.

New technologies follow the predictable I.P.A. pattern. Infrastructure comes first, followed by platforms, then apps.

Continue to invest in companies drinking from the firehose of AI infrastructure spending.

4. Today’s dose of optimism…

I’ve been critical of US colleges for radicalizing kids and burying them in mountains of debt.

But one thing they’re great at is making Olympians.

Athletes from four top California schools won a combined 89 Olympic medals in Paris. If Stanford were a country, it would have placed eighth in the medal rankings! Ahead of Canada, Germany, and Spain.

Here’s the list of the most “winning” US schools. Did your school make the list?

Source: CBK Report

Stephen McBride

Chief Analyst, RiskHedge

PS: When the AI bubble everyone’s been calling for finally emerges—and it will, eventually—my readers will be the first to hear about it.

By signing up for my free letter, The Jolt, you can prepare for this market shift and learn where to invest in the “rotation” that comes after. Join here today.