September 13 marked the official five-year anniversary of one of my earliest RiskHedge Reports.

In my 2018 essay, titled, “If I Could Only Buy One Stock for the Next 5 Years…,” I laid out why Nvidia (NVDA) was my #1 pick.

Of course, I couldn’t envision the extent at which AI has taken off since then... ChatGPT’s launch... or NVDA’s epic rally this year alone (readers who acted on my original guidance in 2018 are up 562%, split-adjusted)...

But I picked NVDA because it was a world-class disruptor powering one of the world’s biggest megatrends. And that’s often a recipe for big gains.

There’s an important lesson there.

Also, note where I comment on NVDA’s lofty (2018) valuation at the end.

Lesson: The best stocks are almost always a bit expensive!

Here’s the essay in its original form...

***

If I Could Only Buy One Stock for the Next 5 Years…

[Originally published September 13, 2018]

If I could only buy one stock for the next five years… this would be it.

If you’ve been reading the RiskHedge Report, you know about the disruptive megatrends that are powering stocks to huge gains.

We’ve discussed the companies that have shoveled almost $100 billion into developing self-driving cars…

That the world’s most powerful companies, including Apple (AAPL), Amazon (AMZN), and Google (GOOG), are pouring billions into artificial intelligence…

And last week, I explained how video gaming has exploded into a $138 billion monster market.

- What if I told you one company is powering all these megatrends?

This company is Nvidia (NVDA).

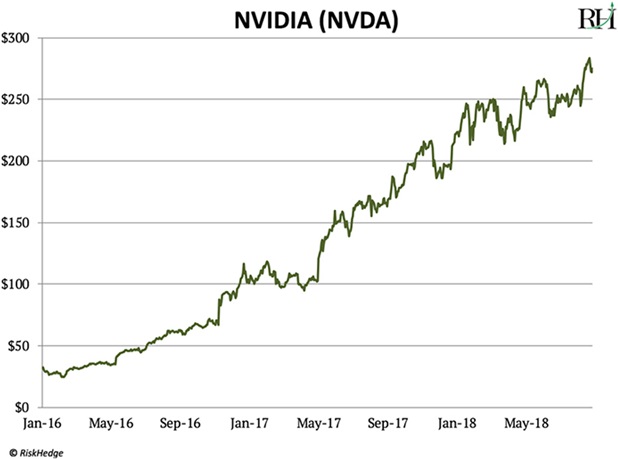

Take a look at its 720% surge since 2016:

Now, I know you might be thinking: “Stephen, this stock has already had a heck of a run… why buy it now?”

I understand the concern. But when investing in truly disruptive companies, this way of thinking is often a mistake.

From 2009–2013, AMZN stock gained 680%. Most so-called “experts” said the easy money had already been made. In 2013, CNN “reported” that “Amazon is one of the most overvalued stocks.”

Amazon has soared another 700% since 2013.

- NVDA makes high-performance computer chips called graphics processing units (GPUs).

NVDA developed the first mass-market GPU in 1999. GPUs use what’s called “parallel processing,” which allows the chips to perform millions of calculations at the same time.

That’s different from how other computer chips work. Most computer chips, like the one powering the laptop or phone you’re reading this on, calculate one by one.

At first, GPUs were mostly used to create realistic graphics in video games. Remember the blocky Nintendo graphics from the early ‘90s? The ability of GPUs to process huge amounts of data all at once helped create the movie-like video game graphics you see today.

- But it turns out that GPUs are also ideal for “training” machines to think like humans.

In other words, artificial intelligence (AI).

I’m sure you’ve seen the Hollywood movies about AI going rogue and attacking humans.

In reality, AI isn’t that glamorous. It all comes down to processing massive amounts of data.

Show a computer millions of pictures of a stop sign, for example, and it will learn to recognize stop signs on its own in the real world.

AI is the driving force behind Google’s self-driving car subsidiary, Waymo. As we talked about a few weeks ago, Waymo’s robot cars are cruising around American roads right now.

At the core of Waymo’s self-driving car fleet is a centralized “brain.” It has learned to recognize stop signs, pedestrian crossings, red lights, and all the other obstacles human drivers navigate.

- The recipe for AI success is simple…

The faster a computer can process data, the faster it can “learn” by recognizing patterns in the data.

NVDA’s latest chips process 125X faster than traditional computer chips. They can process 125 trillion data points per second… which slashes AI “learn” times from 8 days to 8 hours.

This is why more than 2,000 companies, including Amazon, Google, and Microsoft, use NVDA’s hardware to “train” their AI programs.

Last quarter, the revenue NVDA earned from selling AI chips and hardware jumped 82%. In the last two years, AI-related sales have accounted for over 70% of the surge in NVDA’s revenue. AI sales now make up 24% of its total revenue.

- NVDA will earn around $600 million from its automotive business this year.

As I mentioned, it supplies self-driving car companies with chips that “train” cars’ brains. It also sells hardware that processes data from the cars’ many cameras and sensors.

For example, NVDA’s self-driving supercomputer, named Pegasus, can tackle 320 trillion operations per second. And it does so using one-third the electricity at just one-fifth the cost of its closest competitor.

Over 370 companies working on self-driving cars now use NVDA’s products. Auto sales make up just 5% of NVDA’s total revenue today; I see this exploding higher over the next few years as true self-driving cars roll out.

I mentioned earlier that $100 billion has been spent on developing self-driving cars so far. With the likes of Google and Apple pouring billions into driverless projects, I see that jumping to $1 trillion over the next 2–3 years.

Thanks to its superior technology, I expect NVDA to capture a large chunk of this.

- NVDA is considered a “high-flying” tech company…

But please understand, it’s nothing like many of the profitless tech darlings out there.

While many high-flying tech stocks get by on stories and hype, NVDA is extremely profitable.

It has a net profit margin of 33%. That is, for every $1 in sales, $0.33 becomes pure profit.

That’s better than Google’s 21% margin… and even Microsoft’s 29%.

NVDA’s high margins allow it to continually pour cash into Research & Development (R&D). It reinvests close to 20% of its revenue into R&D every year, which is a key reason why it has blown away its rivals.

NVDA is financially sound, too. It’s sitting on a record $7.95 billion in cash, which is enough to pay off its total debt four times over.

- Some may be concerned about NVDA’s price-to-earnings (P/E) ratio of 39.

Can buying a stock at such a high valuation be risky? Sure. But I believe NVDA deserves its rich valuation.

NVDA’s earnings are growing at almost six times the rate of the S&P 500. Yet its P/E ratio is not even double the S&P’s.

I think investing in a company like Ford (F), with a P/E of 5, is far riskier than buying NVDA. I can hear the groans coming from the value investors out there. But the fact is, NVDA is leading the self-driving revolution… while Ford is going to get crushed by it.

Because it is powering today’s most disruptive trends, I see NVDA doubling over the next two years. I’m buying it today at $272.

To disruptive profits,

Stephen McBride

Chief Analyst, RiskHedge

***

Stephen’s note: I still like NVDA today. And I recently shared where I see the stock headed over the next six months.

Although it’s not the same buying opportunity it was in 2018, I recommend taking advantage of the dips. You can find my latest Nvidia guidance here.

|