I don’t mean in God. I mean in 2023’s stock market rally.

The Nasdaq has recorded its best start to a year since 1983.

Tech stocks just hit their highest levels ever, zooming past 2021 highs.

And dozens more stocks are surging higher, including automakers… homebuilders… even cruise liners.

Yet, I get the feeling the vast majority of investors are missing out.

Whether you’re sitting on the sidelines or wondering if it’s time to take profits… today’s letter is for you.

I’ll tell you where stocks are likely going based off seven decades of market history… and then share my top investing theme for the rest of 2023.

- If you have PTSD from last year’s bear market, you’re not alone…

2022 was brutal. Stocks suffered their worst year since 2008. Bonds had their worst year since at least the 1970s.

The main culprit?

Inflation.

Stocks HATE high inflation. And 2022 brought the worst inflation in 40 years.

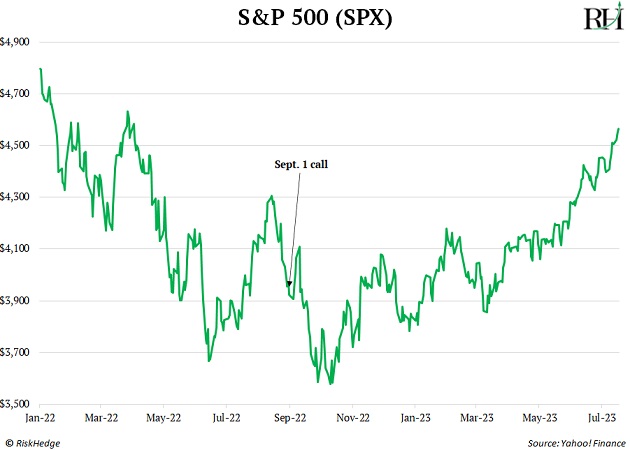

So when I told my readers it was time to buy stocks last September—when inflation was still a sky-high 8.3%—most people thought I was way too early.

But as unpopular as my opinion was, I knew I was probably right. Because everyone was fixated on the level of inflation. And the level of inflation simply doesn’t matter much to the stock market.

What matters is the direction. And inflation was about to fall… fast.

I concluded by urging folks to buy stocks:

“Using decades of stock market history as my guide, now is the time to buy.”

Look, I’ve been wrong plenty of times, too. I know better than to brag. I’m telling you this so you’ll take my next prediction seriously.

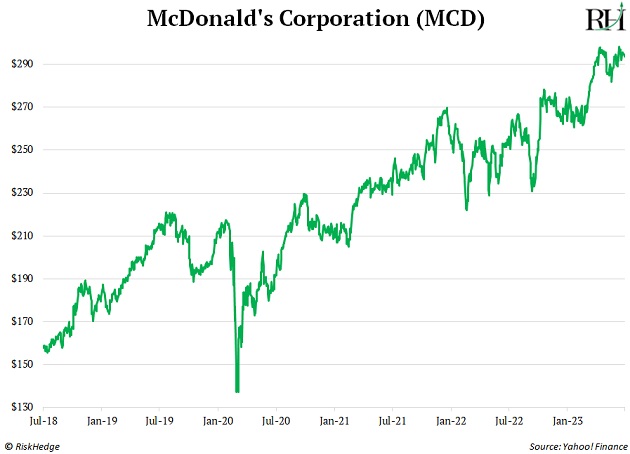

Stocks bottomed a few weeks after I made this call, and we’ve been off to the races ever since:

The big, bad inflation “wolf” is in the rearview mirror.

Wall Street has a new obsession…

- The dreaded “R” word.

To kick off 2023, Bloomberg published a collection of thoughts from top Wall Street strategists. The word “recession” was mentioned over 500 times.

Inflation is so last year.

The “R” word is now Wall Street’s top concern—and for good reason.

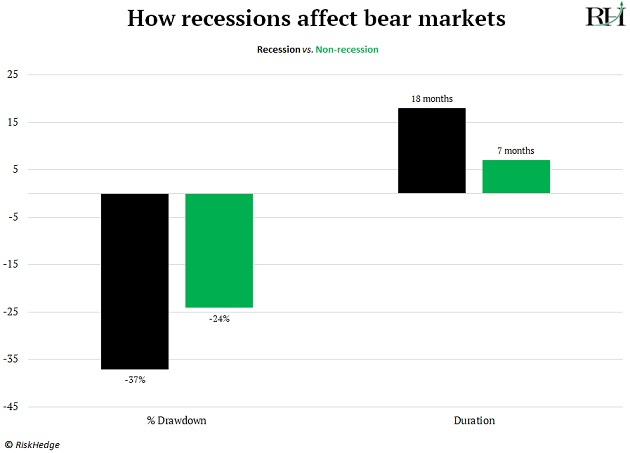

The health of the US economy typically determines how bad things can get for stocks. When bear markets arrive during a recession, stocks fall 37% over 18 months, on average.

But when the economy is chugging along, the average decline is just 24%. And the downturn typically only lasts seven months.

The dividing line here is clear.

If we’re sliding into a recession… this rally is likely a mirage, and stocks will fall further.

If we sail through and avoid a recession… the bear market is behind us.

- Listen closely: The stock market is telling us something.

Economists have been banging on about a recession for at least 18 months.

They’ve been wrong.

Instead of taking them seriously… listen to what the stock market is saying.

Stocks are screaming: “NO RECESSION.”

Let me translate its signals for you…

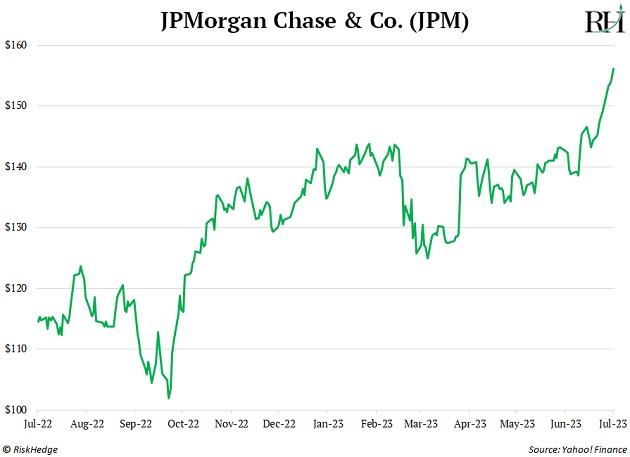

Would JPMorgan (JPM)—America’s largest bank—be hitting new yearly highs if the US were headed for a downturn? Not a chance.

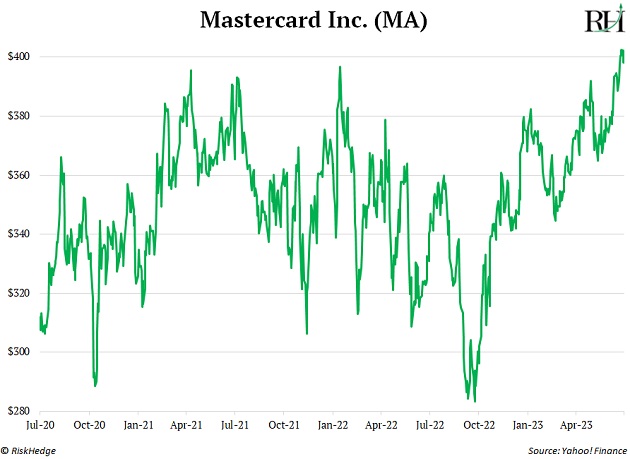

Do you think credit card giant Mastercard (MA) would be trading at all-time highs if we were about to hit the rocks? Nope.

And what about McDonald’s (MCD)? Would folks be buying more Happy Meals than ever if mass layoffs were around the corner? I don’t think so.

Legendary trader Stanley Druckenmiller often says: "The best economist I know is the guts of the stock market."

In other words, you should trust the signals coming from the stock market a lot more than some economist sitting in an ivory tower.

- Here’s my prediction for the rest of 2023…

We’ll dodge a recession and stocks will end the year higher than they are now.

Remember, stocks typically fall 24% during non-recessionary bear markets. The S&P 500 dropped 24.9% during last year’s downturn.

I was recently chatting with an investor who sold his entire portfolio “at the top of the market” in late 2021.

He was smiling like a Cheshire cat when everyone except him lost money last year.

But here’s the problem. Now he’s sitting on the sidelines, scared to jump back in in case markets take a dive. And he’s pulling his hair out as more and more stocks make new record highs.

Don’t be like this guy. Yes, he sidestepped the crash. Congratulations. But he’s now doing worse than so-called “dumb” investors who simply bought and held through the bear market.

If you’re currently out of the market, consider inching your way back in.

- “Okay, Stephen… what should I buy?”

The “Race to Zero” is one of my top investing themes for the next decade.

Remember, everyone from the UN… to the US government… to Amazon (AMZN) will spend more money on “green” initiatives than they’ve ever spent on anything over the coming decades.

That will send billions of dollars flooding into copper… lithium… and other commodities needed to power the clean energy revolution.

But commodities are HATED right now. While the market melted up this year… commodities are in the doldrums.

This is an opportunity for long-term investors to buy “Race to Zero” winners like mining company Glencore (GLNCY)… lithium producer Albemarle (ALB)… and copper giant Freeport-McMoRan (FCX) on the cheap.

These names might not be “sexy.”

But they’ll make investors rich over the next decade.

Stephen McBrideChief Analyst, RiskHedge

|