- Nvidia (NVDA) is still, somehow, one of the top stocks to own in 2024.

- The end of Google.com?

- Today’s dose of optimism.

- The COVID vaccine was developed in under 12 months, beating the previous record by a full three years.

- SpaceX has launched more rockets into orbit over the past two years than NASA has had crewed flights in 65 years.

- The first wonder of the digital age—Las Vegas’s Sphere—took four years to finish. A little long, yes. But this big, bold, brash project is like a bat signal in the Vegas night sky. It will galvanize a new generation of Americans to build cool stuff.

This has been Nvidia’s year.

It’s the best-performing S&P 500 stock, surging 250% at the time of writing. I'm happy we've owned it for years.

Despite this huge runup, NVDA is attractively priced. Seriously.

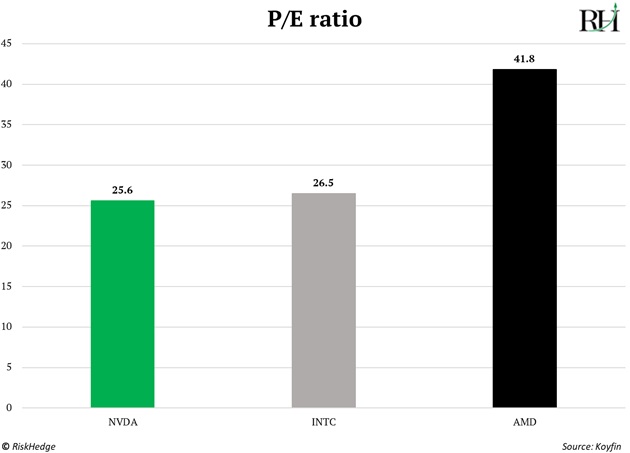

Not only does Nvidia trade BELOW its five-year average price-to-earnings (P/E) ratio, but it’s selling at a discount to many of its less-impressive peers.

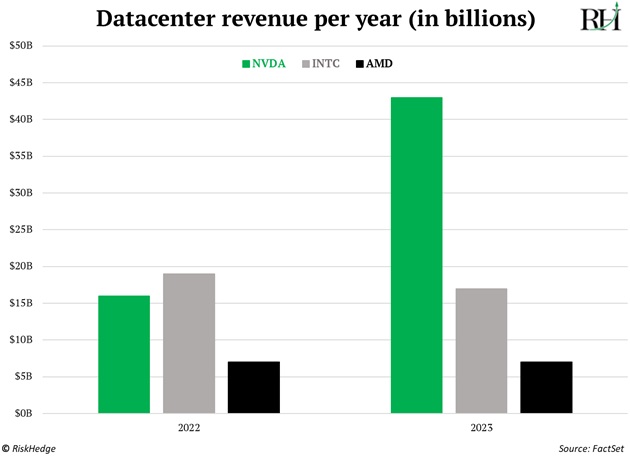

When it comes to making money from artificial intelligence (AI), Nvidia blows everyone else away. Its AI-related datacenter sales will top $40 billion this year.

That’s more than its two closest rivals—Intel (INTC) and Advanced Micro Devices (AMD)—combined:

Yet… Nvidia trades at a lower valuation than both Intel and AMD:

Most investors think they missed Nvidia’s big runup... and are scrambling to find the “next megawinner.”

But the next Nvidia is… Nvidia.

It’s delivering on the AI hype like nobody else.

There will come a time when Nvidia’s dominance has run its course and it’s time to sell.

When that time comes, I’ll tell my readers to take profits and move on to the next opportunity.

But that time is not now. Continue to own Nvidia.

The more my team and I research and tinker with AI agents, the more I realize they’re going to change everything.

Agents are like personal interns that complete specialized tasks for you.

These little AIs are going to kill websites. Google.com and Amazon.com as we know them today won’t exist in five years.

TODAY: Google (GOOG) serves you up 10 blue links. You must scroll through to find what you want.

TOMORROW: You simply tell your agent what you want, and it does the job.

You’ll soon be able to tell your AI assistant to order t-shirts on Amazon (AMZN). It’ll know your size, what colors you like, what colors you already have, and that you only want to spend $50. On command, it’ll place the order for you.

Another example: food.

I spend WAY too much time picking restaurants. I’ve spent countless hours sifting through Google and TripAdvisor reviews to find hidden gems. Things have to be perfect, right?

Soon, I’ll ask my AI agent (who will already know what cuisine we like and what times work best)…

“I’m visiting Barcelona next week. Book a table for two at the best one Michelin-star restaurant with a great wine list. I want to spend under $500.”

…and it’ll choose the best reservation, with almost no effort.

Hours of my life back. Magic.

Once agents start really working, we’ll never have to go searching for something again.

It’s clear how we profit from this. These agents require dense networking equipment and many, many more powerful chips than currently exist.

That’s why I recommend buying AI infrastructure winners.

New York built the Empire State Building in just 400 days.

NASA was founded in 1958. Just 11 years later, it successfully put a man on the moon.

But everyone knows you can’t build anything in America anymore, right?

Three recent events make me hopeful we’re headed back to the future, to a time when the U-S-A can build:

Future’s bright!

Stephen McBride

Chief Analyst, RiskHedge

|