Was Obamacare good for the average American family? Before you answer, look at this chart...

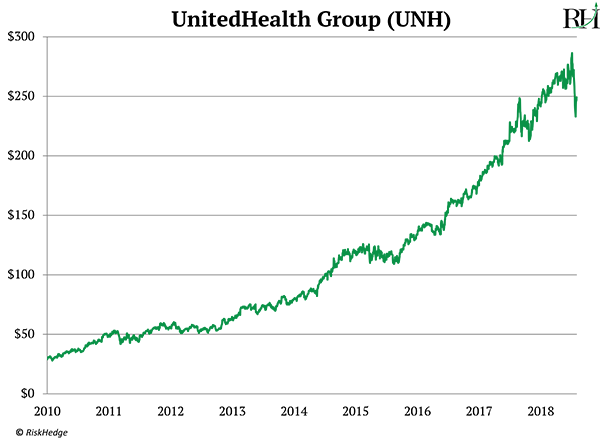

It shows the stock performance of UnitedHealth (UNH), America’s biggest health insurance company, since 2010:

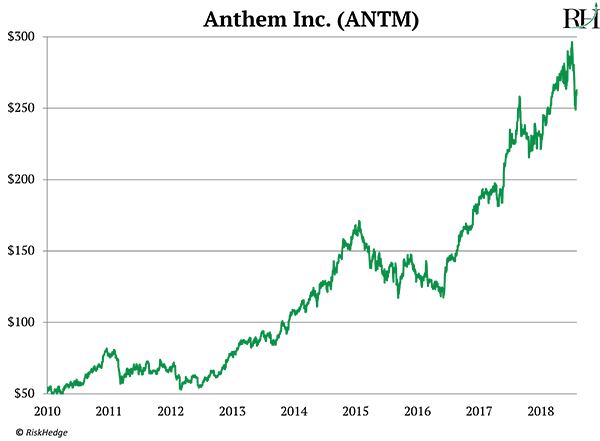

Now here’s Anthem (ANTM), America’s second-largest health insurer:

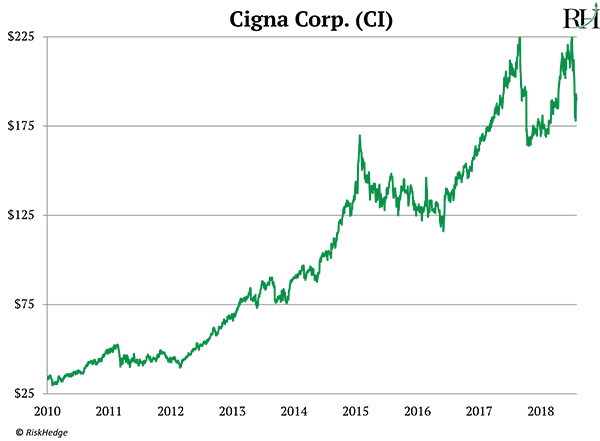

And here’s Cigna (CI), America’s third-largest health insurance stock:

Since March 2010, the S&P 500 has gained 154%. These three rocketed 589%, 286%, and 332%.

Talk about a boom!

Obamacare Was the Greatest Thing Ever to Happen to Health Insurance Stocks

In 2009—the year before Obamacare—UnitedHealth turned a $3.8 billion profit. This year it’s on track to rake in $13.5 billion.

You might expect to see a 3.5X surge in profits in a cutting-edge tech stock. But in a tired old industry like health insurance? Since 2009, UnitedHealth’s profits have ballooned roughly as much as Google’s!

So... Did Obamacare Help the Little Guy Like It Was Supposed To?

There’s no question Obamacare propelled health insurance stocks to their best decade in history. And the profit boom enjoyed by health insurers came straight from families’ pockets.

Keep in mind, health insurance premiums were already rising before Obamacare. From 1999 to 2009, they climbed 125%. Then from 2009 through today, premiums got another 150% more expensive.

Roughly one in every five dollars spent in the US today goes toward healthcare. In fact, Americans now spend more on healthcare than anything except housing.

Are you familiar with the crowdfunding website GoFundMe? It allows people to raise money for all kinds of things.

Sadly, every one in three dollars raised on GoFundMe goes toward medical bills today. In total, $650 million was raised to pay medical bills in 2018.

Despite paying through our teeth for insurance, only one in six folks are happy with their health coverage, according to a Gallup poll.

In short, healthcare—and health insurance in particular—is America’s most broken industry.

What Makes an Industry Ripe for Disruption?

My team and I set out to figure out what makes an industry “disruptable.”

For the most part, it all comes down to the difference between the price you pay for something and what you get for it. Too big a gap means an industry is ripe for disruption.

Take cable TV. From 1998 to 2013, the price of cable TV more than doubled. Yet TV didn’t change all that much. You still watched the news on NBC or Fox…

Still, cable companies like Comcast (CMCSA) kept hiking prices year after year.

When prices surge without much improvement in quality, it attracts disruptors like a moth to a flame.

Of course, Netflix (NFLX) came along and wiped the floor with cable companies.

Over 35 million Americans have dumped cable TV in the past five years. Meanwhile, Netflix now has more subscribers than the largest five cable companies combined!

In this regard, healthcare is practically BEGGING to be disrupted.

As I said, healthcare premiums have shot up 275% since 2000. While there have been major breakthroughs like gene testing and 3D-printed body parts led by disruptive companies like Illumina (ILMN), they have little to do with the cost of delivering healthcare.

Believe it or not, America’s largest retailer, Walmart (WMT), is my top choice to disrupt healthcare.

“Walmart Health” Is Disrupting America’s Most Broken Industry

“Walmart Health” opened its first location next to Walmart's retail store in Dallas, Georgia this past week.

Walmart Health is essentially a mini-hospital. You can now walk in and get basic medical services like a doctor’s checkup, your teeth cleaned, an X-ray, a hearing test, and vaccines.

And here’s the kicker: Walmart is charging between 30–50% less for these services than hospitals do.

Besides disrupting the grocery industry, Walmart aims to “unbundle” the healthcare industry.

All types of medical services are lumped into health insurance today. We pay giant premiums that cover everything from major surgery like a hip replacement, right down to something that should be routine, simple, and cheap—like a flu shot.

With everything “bundled” under one insurance policy, nobody really knows what anything costs. Say you get a blood test at the hospital. Do you know if its going to cost you $300... $1,000... or $3,000?

Chances are you don’t. Chances are you have no clue how much you owe until you get a bill in the mail.

Name another industry that works like that. Name another industry where the pricing is so arbitrary and opaque.

I expect Walmart Health and similar services to crack the healthcare “bundle” wide open.

Soon most folks will get their basic services at a local health clinic—like a Walmart Health. These local clinics won’t have ties to large hospital networks and insurance companies. And they will cost a fraction of what routine healthcare costs today.

Walmart is a Jedi-master at slashing unnecessary costs. For example, in 2006 it launched a line of generic prescription drugs, each costing $4. Today, it runs one of the biggest pharmacies in the US with $35 billion in sales last year.

Disrupting Healthcare Is a Mammoth Task

Insurance companies, many hospitals, and the government all have a vested interest in keeping the current system alive.

As I mentioned, health insurers are making record profits. So too are hospitals like HCA Holdings (HCA), which runs America’s largest chain of hospitals. HCA’s profits jumped 70% last year to a record $3.8 billion.

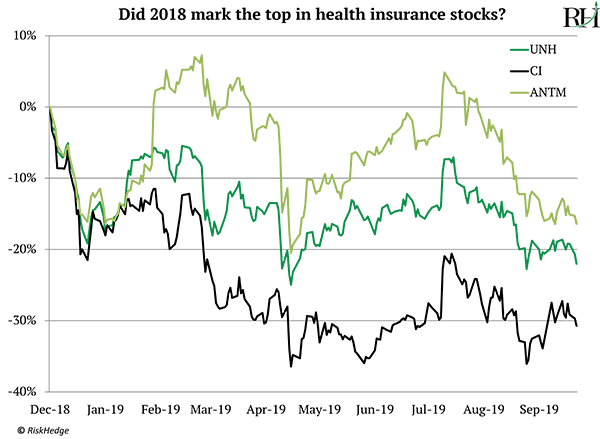

The current healthcare system has powerful friends. Expect the disruption of healthcare to meet serious resistance. But I suspect the “great healthcare” boom is winding down.

Here’s a chart of America’s three largest health insurers over the past year. After an incredible run over the past decade, they’ve plunged 16%, 19%, and 28% in the past year:

Pretty ugly trend, right?

The Great Disruptors: 3 Breakthrough Stocks Set to Double Your Money"

Get my latest report where I reveal my three favorite stocks that will hand you 100% gains as they disrupt whole industries. Get your free copy here.