The S&P 500 is having its best start to an election year ever.

But now we’re in September, historically the worst month for stocks over the past decade. And remember, stocks are usually weak ahead of US presential elections.

Don’t panic if markets dip in the coming weeks. It would be perfectly normal.

While US stocks traded sideways over the past few weeks, there’s an interesting trend happening underneath the surface…

- Remember a handful of tech stocks were dragging the market higher?

Now, the rest of the market has joined the party. Look at the Invesco S&P 500 Equal Weight ETF (RSP) blasting to new highs:

In the “normal” S&P, larger companies have a higher weighting. Apple (AAPL) alone accounts for 7% of the S&P 500.

But in the equal weight index, all companies are ranked the same.

The fact RSP is hitting new highs tells us the bull market is broadening out.

As my friend JC Parets over at All Star Charts says, “It's a market of stocks." And right now, most stocks are going up.

The fact this is happening at a time when stocks are typically weak is important information. It shows there’s a real “bid” in this market.

We still expect markets to stay volatile until after November’s big election, then to head higher. We’re watching closely.

- The artificial intelligence (AI) boom has legs.

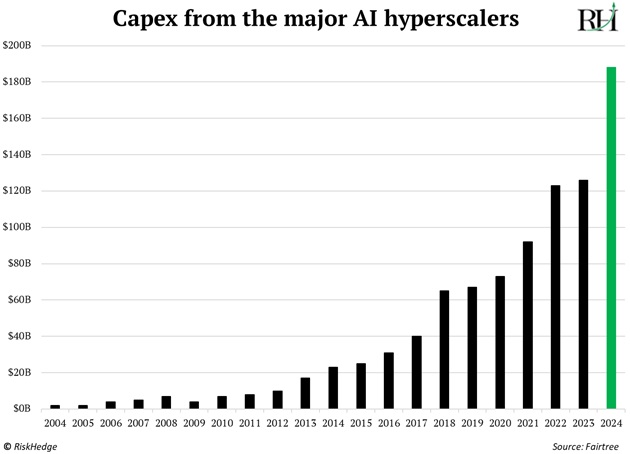

Amazon (AMZN)… Google (GOOG)… Microsoft (MSFT)… and Facebook (META) will spend roughly $180 billion building AI data centers this year.

Yet the top-earning AI startup, ChatGPT creator OpenAI, will only make a measly $3.4 billion this year!

Goldman Sachs (GS) recently sounded the alarm about how little money companies are earning from AI relative to the amount being spent.

Wall Street has it all wrong. AI is much more than ChatGPT subscription fees.

Did you know AI saved Facebook?

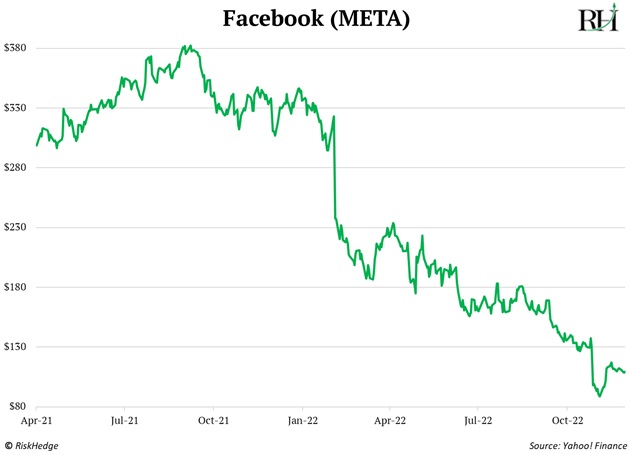

In 2021, Apple made big changes to its privacy rules on iPhones. It made it harder for Facebook to track your data… making its ads worse and less valuable for advertisers.

This cost Facebook billions of dollars, and its stock cratered 75%:

Shortly after Apple kneecapped it, Facebook invented Advantage+, an AI powered ad targeting tool.

Its sales and stock price have since bounced back to new highs. Facebook added $750 billion to its valuation since launching Advantage+. How’s that for return on investment?

People are quick to write off AI as just another stock market craze. They look at the hundreds of billions of dollars being spent on AI and scream, “Bubble!”

But when you see how companies are using this tech to do “more with less,” it’s clear this isn’t a fad. The juice is worth the squeeze.

Remember, we’re early in AI. Continue to invest in the winners.

- Will you buy this stock with me?

“Fighting” isn’t the first thing that comes to mind when you think about disruptive megatrends.

But TKO Group Holdings (TKO)—which owns World Wrestling Entertainment (WWE) and the Ultimate Fighting Championship (UFC)—is growing revenues faster than AI chip king Nvidia (NVDA)!

TKO is also hitting record highs:

I haven’t watched wresting since I was a kid. But I’m a big UFC fan. It’s the most exciting sport on Earth.

You never know what’s going to happen when you lock two people in a cage. You can watch a 25-minute brawl, or one guy get choked out in 25 seconds.

Spending three hours watching an NFL game? Snooze fest.

My investing hero Peter Lynch used to say, “Invest in what you know.” I’m taking his advice and buying some TKO shares.

- Today’s dose of optimism…

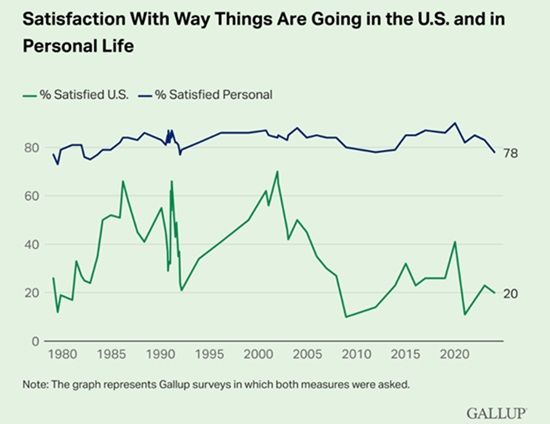

Data from polling firm Gallup shows Americans' satisfaction with their own lives is at nearly 80%... yet satisfaction with the direction of the country sits at just 20%.

Source: Gallup

I think the news—which is a never-ending feed of the worst things happening on a given day—explains this persistent gap.

We experience mostly good things in our own lives. Hitting targets in work… pursuing passions… going on vacation. So, we feel good.

But open CNN, and it’s nothing but death, destruction, and despair. Overdose on news, and you won’t feel like getting out of bed tomorrow.

The corporate media is waging a never-ending assault on your happiness.

I’m creating a new tribe to help us take back control. More soon…

Stephen McBride

Chief Analyst, RiskHedge

PS: I regularly discuss the different ways to both use and invest in AI in my free letter, The Jolt. Stay caught up on this emerging megatrend by signing up today.