- “Don’t be suboptimal.”

I had a great dinner in London recently with Julien Bittel. He’s the head of research at Global Macro Investor, a high-end investment research service.

The topic of conversation was “don’t be suboptimal”—as in choose the best possible way to play an investment theme, instead of the second or third best.

It was okay to be suboptimal last year when most stocks were up. And when groups of stocks (like artificial intelligence) went up in tandem.

This year is different. Leaders are separating themselves from the pack.

Nvidia (NVDA)—up 47% this year—continues to make new highs, as do other AI leaders in our Disruption Investor portfolio.

Meanwhile, other AI “contenders” like C3.ai (AI) are lagging behind (+4%).

The same trend is playing out in cybersecurity and semiconductors.

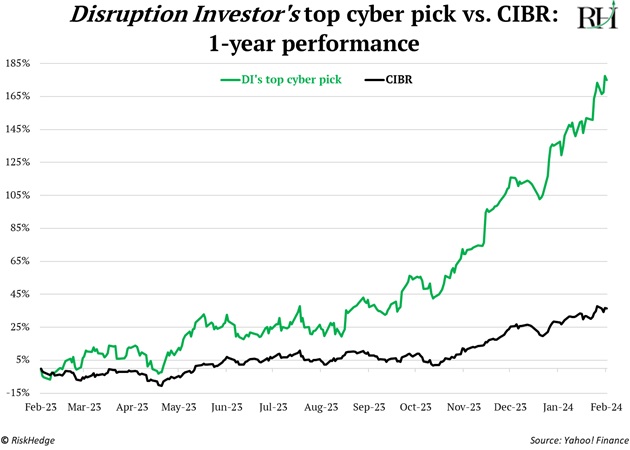

Deciding you want to invest in cybersecurity and simply buying the First Trust NASDAQ Cybersecurity ETF (CIBR) is suboptimal.

Instead, you want to do the hard work to find and invest in the best cyber businesses. That’s what we did in Disruption Investor.

As you can see, owning a great individual cyber business vs. the CIBR ETF makes a big difference:

You can access the whole Disruption Investor portfolio by upgrading to paid here.

- 2024 will be AI’s breakout year.

I know what you’re thinking...

“Stephen, was 2023 not AI’s coming-out party? Nvidia was the top-performing S&P 500 stock and ChatGPT was EVERYWHERE!”

From an investing perspective, there was still a lot of skepticism toward AI last year.

Did you know Nvidia’s stock got cheaper in 2023? Despite a 239% increase in its stock price—and becoming the poster child for AI—its price-to-earnings ratio fell last year.

Two things will wash away the AI skepticism this year:

#1...The largest infrastructure buildout ever is underway.

We’re slap-bang in the middle of the great AI infrastructure buildout.

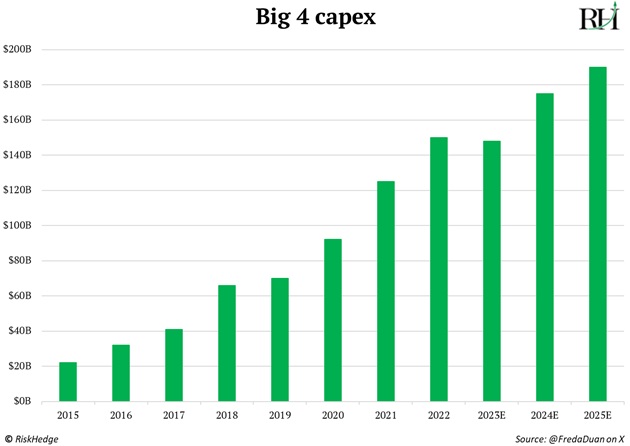

Microsoft (MSFT) alone plans to spend $50 billion expanding its AI data centers next year… and every year after that for the foreseeable future.

Facebook (META) CEO Mark Zuckerberg recently announced, “By the end of this year, we’re going to have around 350,000 Nvidia H100s.” Given these chips cost $30,000 apiece, that’s $10 billion in sales from just one customer.

Microsoft… Facebook… Amazon (AMZN)… and Google (GOOG) are expected to spend a combined $175 billion on capital expenditures this year alone, with a big chunk of that going toward AI:

This is a firehose of money. We ran the numbers and found this is one of the largest—if not the largest—infrastructure buildouts in history.

You must own the AI infrastructure companies capturing this spending.

#2...Big breakthroughs will drive more demand.

Until recently, AI was confined to the bowels of university research labs. It was something academics in lab coats played around with, not something ordinary folks touched.

ChatGPT changed that when it attracted 100 million users in two months. Now, you can overhear people talking about it on the subway.

But there won’t be one AI to rule them all. There will be millions of AIs all doing different things. Just look at what’s happening in America’s most broken industry: healthcare.

A team of MIT and Harvard researchers built an AI model from GPT-4 to discover a new class of antibiotics. The first batch they tested was effective against antibiotic-resistant “superbugs.” Given antibiotic resistance kills over 1 million people each year, this is a big deal.

And a drug discovery startup incubated by Google aims to halve the time it takes to find new medicines.

It can take up to 15 years to get a new drug approved and on pharmacy shelves. Doing so costs anywhere from a few hundred million dollars up to several billion dollars. If AI can cut that by even 20%, it’s worth $500 billion in savings.

The startup just inked deals with two of the world’s largest drug companies: Eli Lilly (LLY) and Novartis (NVS).

AI has the potential to extend life expectancy. There’s a chance we’ll all be centenarians thanks to its breakthroughs.

- Today’s dose of optimism: Could you swim 9 miles for your kids?

Being a dad is tough.

Kids swallow up our time. They zap our energy and often leave us with nothing but a few pennies in our pockets.

But what they take, they pay us back in spades.

Being a dad lights a burning fire inside me to succeed. Am I going to sit around all day when I have two mouths to feed? Hell no. Other people are relying on me; I HAVE TO make it.

I heard an incredible story recently about a dad who swam for 16 hours to get back to shore after falling overboard.

Rob Konrad fell off his boat, which then sped away from him, nine miles out to sea.

After swimming for 16 hours in the open water he eventually made it back to dry land. What kept Konrad going? “I have two beautiful daughters; I was hitting that shore."

My fellow dads, use that energy from your kids to do something great. You can’t let them down, they’re relying on you.

Stephen McBride

Chief Analyst, RiskHedge