Semis are red-hot again.

For much of this year, semiconductor stocks have been the group to own.

Nvidia (NVDA), the world’s largest semiconductor company, surged more than 250% between January and August thanks to the excitement surrounding artificial intelligence (AI).

Super Micro Computer (SMCI)—another leading AI chip company—more than quadrupled over the same period.

And those are just a couple examples. Many other semis also went ballistic.

But as often happens after explosive moves, the group cooled off.

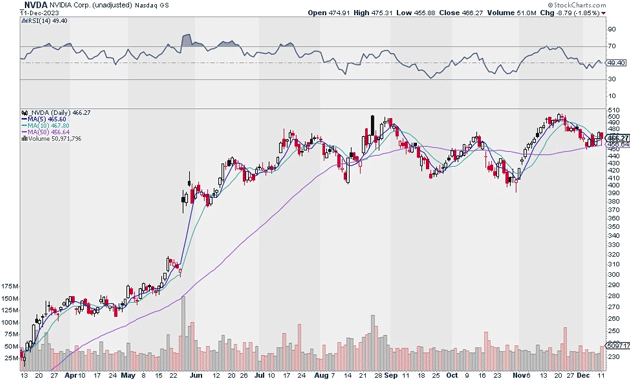

NVDA, for example, is still trading at the same price it did back in July. And SMCI has spent the past few months consolidating.

This has some traders concerned. But I see these names heading much higher in the coming weeks.

You see, many other semi stocks have woken up in a big way.

Broadcom (AVGO)—a stock I recently recommended in my trading service, RiskHedge Live—has spiked 14% over the past three days.

KLA Corp. (KLAC)—a semi I recommended back in June—has also broken out to new all-time highs.

I expect the rest of the group to follow suit in the coming days and weeks, which is why I’m making Nvidia my new Trade of the Week.

As you can see, NVDA has been consolidating since the summer. I believe this is an accumulation pattern that will ultimately break higher. And that breakout could come very soon based on the moves we’ve seen from other semi stocks:

Source: StockCharts

Source: StockCharts

I suggest buying NVDA today. I believe it can hit $650 within the next 12–18 months.

Exit your position if NVDA closes below $450. That gives us a risk-reward ratio of 16:1 on this trade.

Action to take: Buy NVDA at current market prices.

Risk management: Exit your position if NVDA closes below $450.

Justin Spittler

Chief Trader, RiskHedge