US stocks are ripping…

The S&P 500 has surged 14% since November 1. That’s roughly two years’ worth of average gains squeezed into two months.

When it feels like every stock you own is working, that’s a good time to prepare for a pullback.

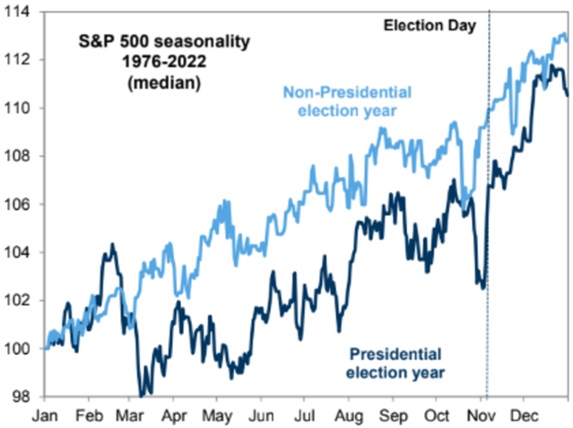

And given it’s a presidential election year, it would be perfectly normal to see a correction soon.

Look at the dark blue line (election years) in this chart. Markets typically surge out of the gate, then dip as we enter the spring:

Source: Goldman Sachs

What I’m doing: continuing to own only great businesses profiting from disruptive megatrends.

Let’s get after it…

- It’s time to fight back against our AI enemies.

There’s a group of people called “decels” (decelerationists) who think artificial intelligence (AI) will come alive and wipe out humanity.

The “decels” were behind the OpenAI coup attempt a few months ago, when CEO Sam Altman was fired for essentially doing too great of a job pushing AI progress forward.

These folks need to stop watching reruns of The Terminator. AI is a computer program. It’s not going to come alive any more than your refrigerator will.

Want to talk about real threats to humanity? Let’s talk about antibiotic resistance, which kills over 1 million people each year.

AI is coming to the rescue…

A team of MIT and Harvard researchers built an AI model from GPT-4 to discover a new class of antibiotics. The first batch they tested was effective against antibiotic-resistant “superbugs.”

AI: 1. Anti-antibiotics: 0.

The “decels” who want to halt AI progress are part of a larger problem: an anti-progress mind virus that’s infected the world and made us afraid to try new things.

All the movies are reboots or sequels (please, no more superhero films). Every ‘90s pop band is doing a reunion tour. And we talked ourselves out of adopting game-changing innovations like nuclear power (that’s changing, thankfully).

We can’t let the “decels” sink their claws into AI, too.

These people want to slow progress because of some imaginary Terminator scenario. What about all the people who will definitely die because we neutered AI and didn’t cure antibiotic resistance?

Not to mention all the lifesaving drugs that weren’t invented by AI…

It’s time to stand up and fight for technology, real capitalism, and progress. Don’t be afraid to give up the good for the great.

- A sneak peek at my 2024 surprises…

I recently sent Disruption Investor members my 10 surprises for 2024. If you’re not a member, you can learn more here.

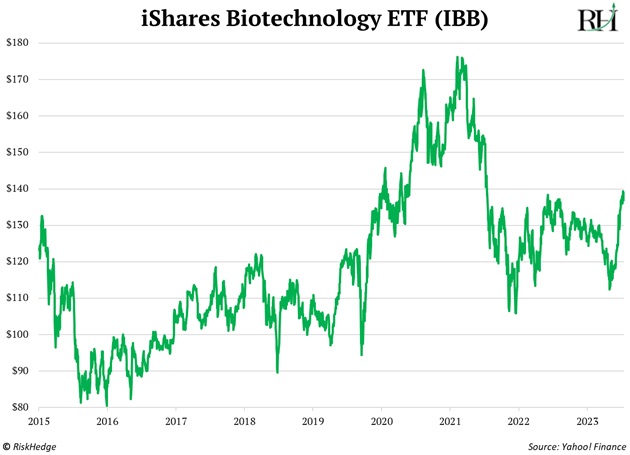

#7 is: Biotech stocks double in 2024 and end the year as the best-performing sector.

It’s been almost a lost decade for biotech stocks. The iShares Biotechnology ETF (IBB) has gone nowhere for eight years:

But with IBB rallying to its highest levels since early 2022, I think we’re on the cusp of a sea change.

There have been many biotech breakthroughs over the past decade. Next come the regulatory approvals and the moneymaking products. One that caught my eye…

The first-ever gene-editing (CRISPR) therapy was just approved in the US and the UK.

CRISPR works like DNA scissors. It allows scientists to “delete” diseases from our bodies and “insert” healthy cells.

Victoria Gray is the first CRISPR patient to be treated for sickle cell—an incurable disease that causes bouts of excruciating pain.

With her gene-edited cells, Gray lives virtually symptom-free. She told NPR, “Now I’ll be there to help my daughters pick out their wedding dresses. And we’ll be able to take family vacations.”

Read that sentence again and tell me technology isn’t absolutely amazing… which, again, is why we need to fight back against this anti-progress mindset. Let’s accelerate, not slow down.

Thanks to the stock market, we can piggyback on these innovations by investing in the companies behind them.

Chris Wood and I recently added one of the world’s best biotech companies to the Disruption Investor portfolio. It has the potential to double within a year.

- Apple and Google’s duopoly is crumbling…

Apple (AAPL) and Google (GOOG), which owns Android, rake in close to $200 billion/year by slapping a 30% tax on app purchases.

For every buck you spend on smartphone apps, 30 cents goes toward the big tech duopoly. It’s likely the most profitable toll booth in history. But I don’t think it will be around for much longer.

Fortnite maker Epic Games just won a court case against Google over its 30% tax. Bottom line: It will soon be forced to slash its fees.

Apple is likely next, and that’s really bad news for its stock. Remember, the App Store has been Apple’s biggest growth driver.

Google and Apple are no longer the beloved fast-growing tech companies we once knew.

Apple’s revenue has been flat for two years. Google is growing at its slowest pace ever.

And these once “hip” Californian tech startups are now viewed as scourges, as evidenced by them being sued by actual startups.

These are still giant companies with cash to burn. They might still turn the ship around, but I’m not holding my breath.

There are much better opportunities to be found buying up-and-coming disruptors profiting from megatrends.

- Today’s dose of optimism…

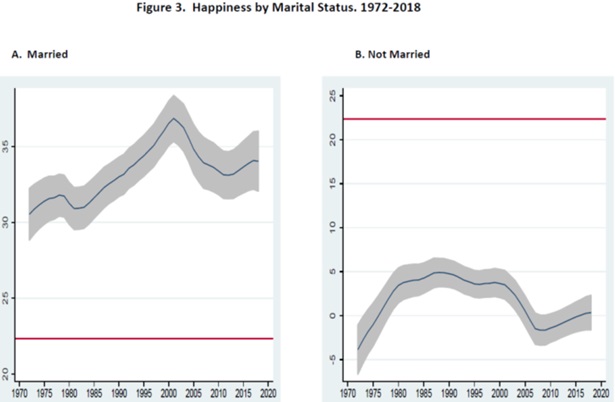

What’s the #1 predictor of happiness in America?

Marriage.

A new study titled “The Socio Political Demography of Happiness” found being married is the most important predictor of whether someone is happy or not:

Source: The Socio Political Demography of Happiness

Source: The Socio Political Demography of Happiness

But money can’t buy happiness, as they say.

There are 13 divorces among the world’s 10 richest men. Seven of the top 10 have been divorced at least once.

Marry wisely!

Stephen McBride

Chief Analyst, RiskHedge