Are we slipping into a recession?

That’s the question on every investor’s mind right now. Because recessions are bad for stocks.

In today’s Jolt, I’ll walk you through what the three most accurate recession indicators are telling us… and suggest what to do about it.

Let’s get after it.

- First of all, how bad are recessions for stocks?

Pretty bad. During the eight recessionary bear markets since WWII, the average top-to-bottom S&P 500 decline was 36%.

You’ve likely heard the saying “the stock market is not the economy.” True, but only in the short term. Over time, stocks and the economy are joined at the hip.

That’s why, although not every recession leads to a brutal bear market, almost every brutal bear market has occurred around a recession.

Bear markets outside of recessions are rare, and they tend to be shallower and quicker.

Recessions are the dividing line between “not so bad” market declines and brutal bear markets.

- Is the US economy hitting the rocks?

We sifted through dozens of indicators to find the most reliable recession predictors.

Three stood out:

Unemployment claims usually start rising 11 months before a next recession.

The yield curve (which I explained here) inverts 19 months before a downturn, on average.

New home sales typically peak and begin falling more than two years ahead of a recession.

Here’s what they’re telling us right now:

|

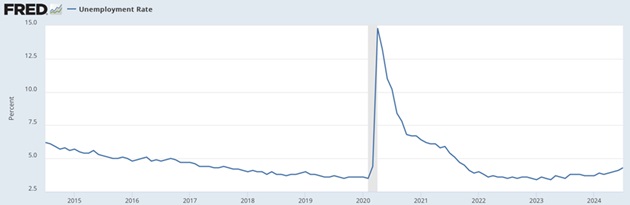

#1: Unemployment claims have inched higher since bottoming more than two years ago.

#2: The yield curve has inverted before every recession since the 1960s.

But it’s been almost two years since the curve inverted (the longest stretch on record), and still no recession.

Our research shows the more accurate signal is when the curve un-inverts. That’s occurred two months ahead of a recession, on average.

As I type, the curve is inches away from un-inverting.

#3: New home sales peaked almost four years ago and have continued to trend down.

You could dismiss any one of these warning signals on their own. It’s harder to dismiss that all three are flashing.

The likelihood of a recession is much higher than it’s been in some time.

- But there’s one giant caveat.

COVID messed up the “set in stone” indicators we relied upon for decades.

We’re still working through all the weirdness that came from shutting down the economy… handing out trillions of dollars’ worth of stimulus checks… and slashing interest rates to zero.

Just look at the unemployment rate during COVID. Never seen anything like it. You have to put an asterisk next to all these data points.

Source: Federal Reserve Economic Data

We’re listening to earnings calls to get a “read” on the economy and watching jobs numbers closely.

Remember how everyone was glued to the screen on inflation numbers for two years? Now all eyes are on jobs numbers.

There are no certainties in investing, only probabilities. I put the odds of the US entering a recession before the end of 2024 at 60%.

If we do get a recession, I think there’s a 90% chance it will be mild and short, based on a lot of data I won’t get into here.

- But here’s something important I bet you don’t know about recessions.

The S&P 500 rose in seven of the past 13 recessions. Huh?

The National Bureau of Economic Research (NBER) is the official scorekeeper of recessions. Problem is… it moves as slow as a snail.

Remember the Great Recession that began in December 2007? The NBER didn’t officially “call it” until December 2008. WAY too late for investors to act upon it. In fact, the stock market put in a generational bottom three months later—the buying opportunity of a lifetime.

Remember, stocks fall well before we know if the economy is in a recession. That’s why, if you’re going to act, now’s the time.

As I explained in the new issue of Disruption Investor, I think the period from now until the election is the most dangerous for markets.

If you’re a member, I hope you acted on our guidance.

Chris Wood and I walked through several ways to “buy insurance” on your stock portfolio in order to blunt losses and preserve the substantial gains we’ve enjoyed. Our strategy is working. (Upgrade here if you’re not a member yet.)

The #1 thing that separates investors who grow rich from those who see mediocre results is the ability to manage risk.

Making money in the first half of the year was “easy.” Recognize we’re now in a different environment.

Even if we avoid recession, expect turbulent markets heading into November’s political “Super Bowl.”

Our edge in Disruption Investor is owning great, disruptive businesses in long-term megatrends. Over a multi-year period, the companies we own will continue to power ahead, no matter what markets do.

But extra caution is warranted for now.

- Today’s dose of optimism…

America is winning the Olympics.

Team USA has won 30 gold medals and 103 total medals. That’s 30 more than second-place China.

Is it because America has the best athletes? Or because it’s not afraid to use air conditioning?

Someone put a bunch of environmental wingnuts in charge of the Olympic village. They wanted this to be the “greenest” games ever, and told teams air conditioning was a no-no.

“Hey, athletes. I know you worked your whole lives for this moment. It’s 80°F+ outside and it’s brutally hot in those stuffy rooms without aircon. But conserving energy is more important than your Olympic dreams, so you’ll have to make do with a small fan.”

“No problem,” said team USA. “We’ll bring our own ACs!”

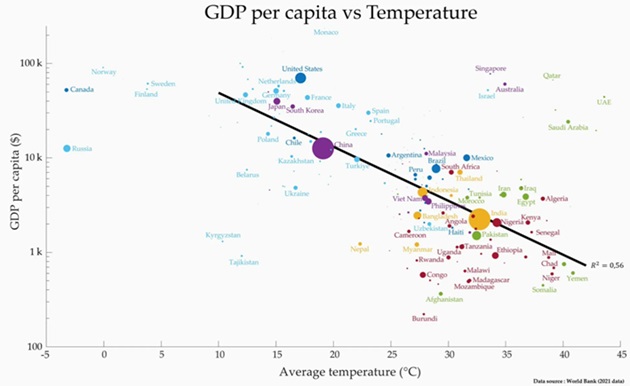

Look at this chart showing countries’ wealth compared to the average temperature. Hotter countries are poorer:

Source: World Bank

The exceptions are countries like Singapore, Australia, and the UAE, which embrace air-cooling technologies.

If you want to get rich, install AC.

Have a great weekend.

Stephen McBride

Chief Analyst, RiskHedge