Rotation is the “lifeblood” of bull markets.

Without it, rallies quickly run out of steam.

With it, bull markets can march on for years.

You see, rotation is when money moves from one area of the stock market to another.

During bull markets, money rotates from strong sectors to ones that have been lagging… allowing them to play “catch up.”

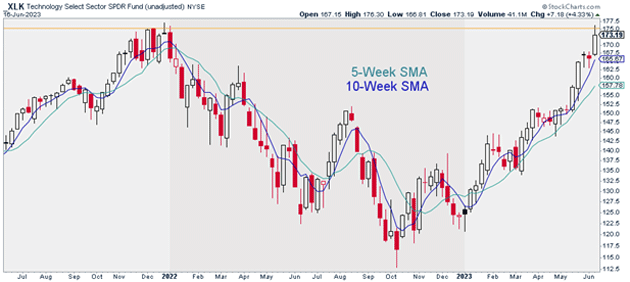

This year, technology has been the strongest sector by far.

The Technology Sector ETF (XLK) has rallied 38% since the start of 2023. To put that into perspective, the S&P 500 is up 14% on the year, while communication stocks—the second-best-performing sector—are up 32%.

This huge outperformance of tech stocks has given the market a big boost this year. After all, technology is by far the largest sector in the S&P 500.

But don’t be surprised if tech stocks cool off for a bit.

To understand why, let’s look at the recent performance of XLK. Below, we can see tech stocks nearly reached all-time highs last week.

However, sellers came in and “rejected” XLK:

Source: StockCharts

Source: StockCharts

Bears will tell you this is something to be worried about. They’ll say it’s proof the market just topped.

But I completely disagree.

It’s much more likely tech stocks will take a breather before moving higher again, giving other sectors an opportunity to shine.

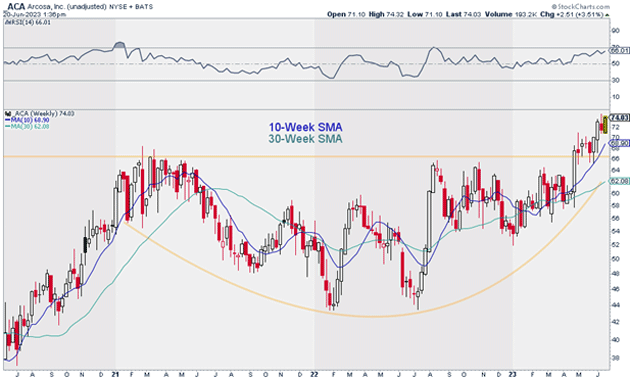

And that brings me to our new Trade of the Week, Arcosa (ACA).

Arcosa is a $3.5 billion “industrials” company. And industrials are the top sector I think will benefit most as money rotates out of tech stocks and into other areas of the market.

I’m recommending ACA for a couple reasons. For one, it’s a market leader. As you can see below, it’s already broken out to new all-time highs:

Source: StockCharts

ACA also looks like it’s just getting warmed up. Above, we can see it’s just beginning to emerge out of a base it spent nearly two years forming.

I suggest buying ACA at current market prices, and I’m targeting $100/share over the next 12 months. That’d be about a 40% move higher from today’s prices.

Exit your position if ACA closes below $66. That gives us a risk-reward ratio of 5:1 on this trade.

Action to take: Buy ACA at current market prices.

Risk management: Exit your position if ACA closes below $66.

Justin Spittler

Chief Trader, RiskHedge

PS: Markets are hot and our trades inside RiskHedge Live are working great. Go here to become a beta tester while spots remain.