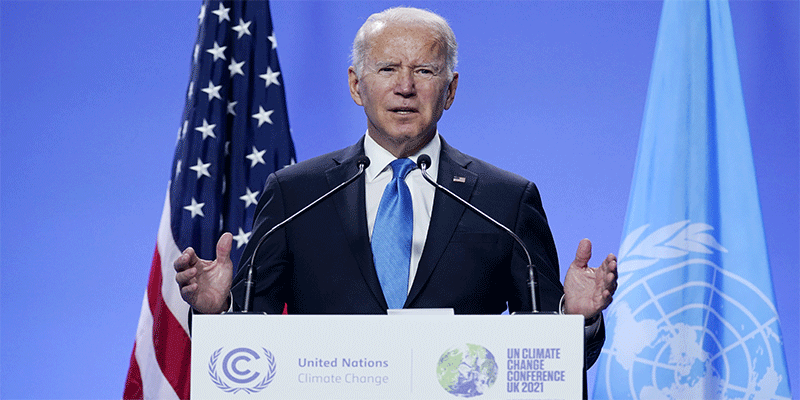

Joe Biden wants to protect your money from climate change.

You read that correctly.

Last month, the White House released a 40-page report titled, "A Roadmap to Build a Climate-Resilient Economy.” The report, according to Business Insider, “focuses on mitigating the financial risks climate change puts on people's retirements, pensions, savings, and more.”

The Department of Labor is also investigating how investors can account for climate change.

This might seem like an odd objective.

After all, it’s not like the government goes out of its way to protect your hard-earned savings from recessions, financial crises, or inflation.

So, what’s this all about?

Well, climate change is rapidly accelerating our transition away from dirty energy sources like coal and oil… to cleaner energy sources like wind and solar. Despite their recent rebound, oil stocks have plunged since 2014… and will probably never approach their former highs again.

Regardless, I won’t waste your time analyzing Biden’s announcement. It’s incredibly light on details, and full of bureaucrat speak.

More importantly…

-

If you’re expecting the government to have your back, you’re bound to end up disappointed.

“I’m from the government, and I’m here to help” is a punchline for a reason.

If you want to protect your money, you’ll have to take matters into your own hands.

The best way to do that is by investing in green energy stocks.

Green energy used to be a niche market. But it’s becoming accessible for everyday investors.

The industry includes solar energy, hydrogen, wind companies, and electric vehicle (EV) manufacturers.

Today, I’ll share my top two ways to profit off climate change. But let me first tell you why I’m bullish on clean energy stocks.

-

Green energy is the future…

I’ve been pounding the table on green energy stocks since February 2020…

As I explained at the time, climate change is the #1 issue for nearly half of millennials. It’s far more important to young people than war or even income inequality.

MSCI—which manages some of the world’s biggest stock indices—believes millennial investors could put between $15 trillion and $20 trillion into US-domiciled environmental, social, and governance (ESG) investments over the next couple decades.

Green energy is also one of the only industries on the planet that has the full weight of extremely powerful governments behind it.

But here’s the thing.

I would never buy a stock simply because the story is good. The price action must also be extremely bullish.

-

Right now, investor appetite for green energy stocks is through the roof…

Tesla (TSLA)—the world’s largest EV maker—has rallied 58% since the start of this year.

And it’s not alone.

Lucid (LCID)—another EV maker—has soared 187% since September.

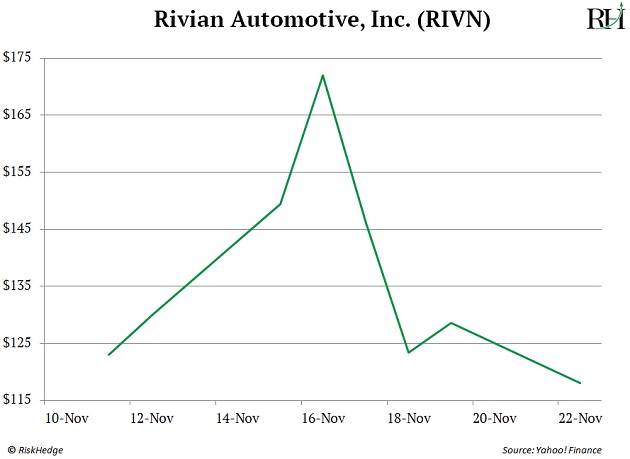

Then there’s Rivian (RIVN), a newcomer in the EV space. Rivian’s share price surged 72% during its first five days as a publicly traded company.

Keep in mind, Rivian hasn’t sold a single car yet. And yet, its market cap hit $109 billion, which made it the world’s third largest car company!

As I mentioned yesterday, I don’t recommend buying Rivian. But it shows you how much investors love anything “green.”

And it’s not just EV stocks…

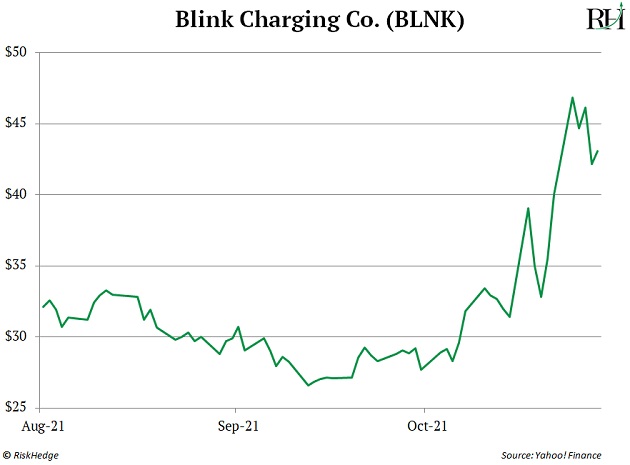

Blink Charging (BLNK)—a company that sells charging infrastructure for EVs—has shot up 35% since the beginning of October.

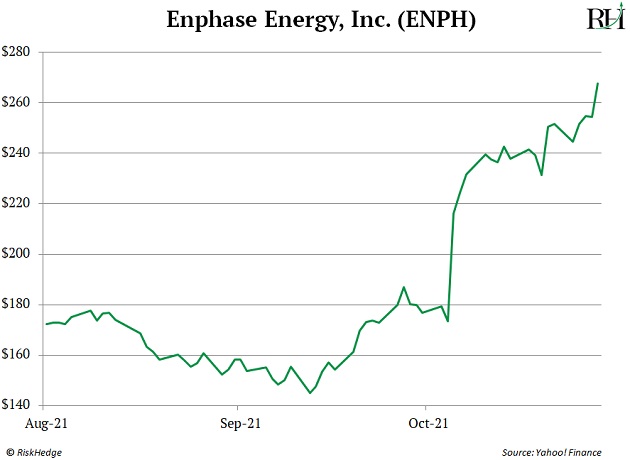

Enphase (ENPH)—one of the world’s top solar companies—has also been a standout performer. It’s rallied over 68% over the same timeframe.

It’s easy to see these big moves and think you already missed out on the opportunity.

But green energy stocks as a whole are likely just getting warmed up…

- The recent surge in green energy stocks is pointing to much higher prices.

In short, it marks a huge change of character in the sector.

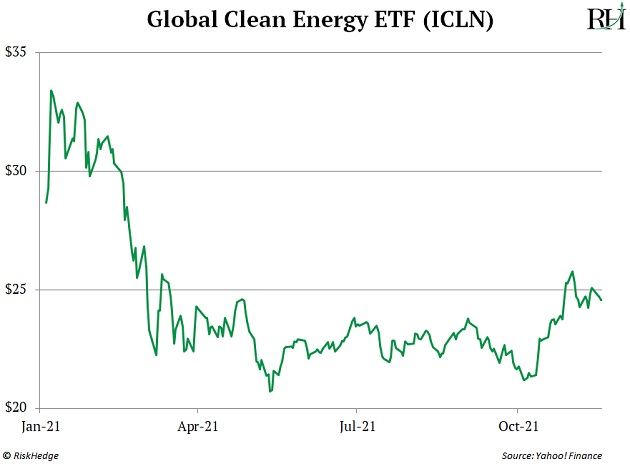

Take a look at this chart.

It shows the performance of the iShares Global Clean Energy ETF (ICLN). This fund invests in a basket of clean energy stocks, including Plug Power (PLUG) and SolarEdge Technologies (SEDG).

As you can see, ICLN topped out in January and had been falling for most of the year. But it changed course in October, and is now up 10% over the past eight weeks.

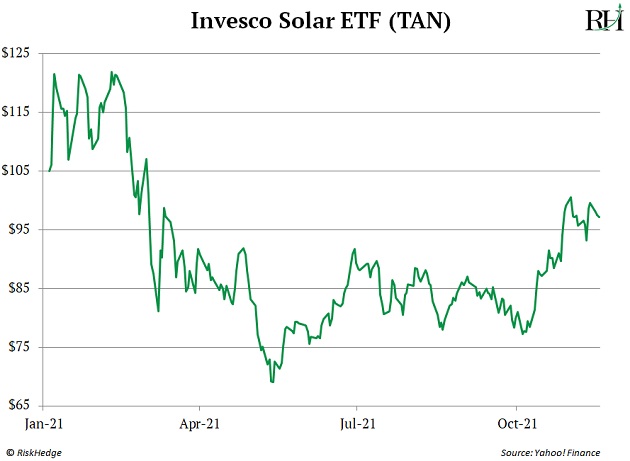

The same sort of setup is playing out in solar energy stocks…

This chart shows the performance of the Invesco Solar ETF (TAN), which invests in a basket of solar energy stocks.

TAN has also struggled for most of this year… until recently. It’s jumped 24% since early October.

These are classic “bottoming out” patterns. They tell me sellers are exhausted… and buyers have taken control in green energy stocks.

You can easily cash in on this opportunity by investing in a clean energy fund like ICLN or TAN. But you will make far more money positioning yourself in top-tier green energy stocks.

One name to keep an eye on is Livent Corporation (LTHM).

Livent is a global leader in lithium technology.

Lithium is one of today’s most important materials. It’s used in everything from smartphones to lightweight alloys in airplanes. It’s also crucial to the battery technology of the electric vehicle (EV) industry.

We currently rate LTHM a “hold” in our Disruption Trader advisory. The stock has been on a tear… and our premium members are currently up 61% on the trade.

But it’s a top name to watch. Consider taking a small stake when shares cool off.

Justin Spittler

Chief Trader, RiskHedge