Bitcoin (BTC) is leading.

It’s surged 14% over the past week and is trading back above $90K for the first time since early March.

This explosive move has caught many traders by surprise. But you could have seen it coming.

In fact, I predicted this on X last week:

Source: JSpitTrades on X

Source: JSpitTrades on X

I don’t say this to stroke my own ego. Instead, I want to explain what I saw that made me bullish on bitcoin.

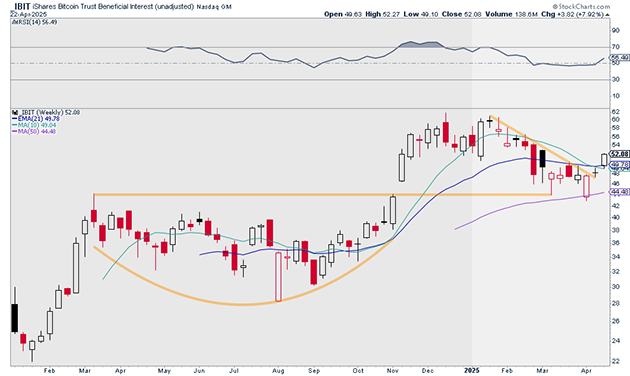

Let’s dig into some charts, starting with the weekly chart of the iShares Bitcoin Trust ETF (IBIT). This fund invests in bitcoin.

The introduction of bitcoin ETFs have turned bitcoin into an institutional asset. Flows into funds like IBIT drive the performance of bitcoin. So, it’s crucial to understanding what they’re doing.

A few weeks ago, IBIT filled its election week “gap up.” This was a major level I was watching. It was imperative that bulls defended it, and they did.

On Friday, IBIT also broke the downtrend that it had been in since January. That made me even more bullish on bitcoin.

Source: StockCharts

Source: StockCharts

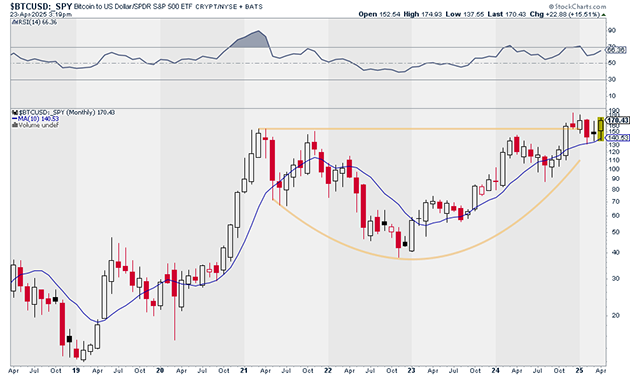

Bitcoin has also been displaying a ton of strength relative to stocks. Take a look at this chart below. It shows the performance of bitcoin versus the S&P 500 ETF (SPY).

This ratio has spent the past several weeks consolidating near all-time highs. This is a super bullish chart. It tells me that bitcoin is poised to outperform US stocks in the coming weeks and months.

Source: StockCharts

Source: StockCharts

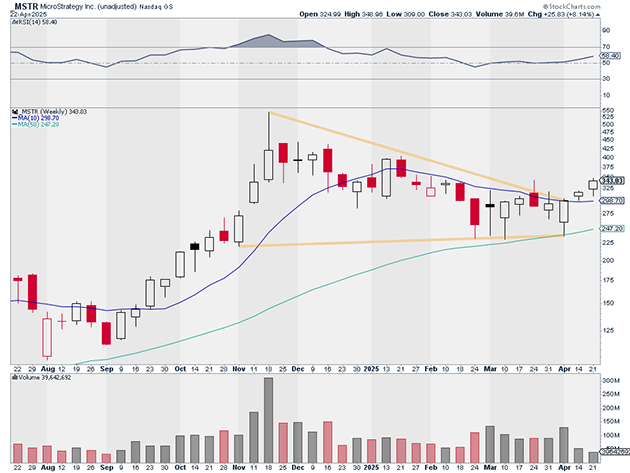

Finally, MicroStrategy (MSTR) has been displaying tremendous strength.

As you may know, MicroStrategy isn’t your typical software company. It’s a hyper leveraged bet on bitcoin.

MSTR tends to lead the crypto market. In fact, it topped out in November. Last week, MSTR broke out of a multi-month downtrend.

This time, MSTR led to the upside. On Friday, MSTR recorded its third consecutive weekly green candle before breaking out this week:

Source: StockCharts

Source: StockCharts

In summary, I didn’t turn bullish on bitcoin just because of one chart. It was the confluence of several data points. That’s how you locate A+ trades.

It’s also why we recently put on two “bitcoin trades” in my advisory RiskHedge Live. Both of those trades are well into the green now and should deliver outsized gains as long as bitcoin stays bullish.

If you want to see the exact trades we put on—and get access to the other market leaders I’m trading in real time—you can sign up for RiskHedge Live here.

It’s the best way to piggyback off my best trade ideas the minute they hit my radar.

Justin Spittler

Chief Trader, RiskHedge