Stocks are falling apart.

Last week, the S&P 500 dropped 2.9%, while the tech-heavy Nasdaq 100 fell 3.5%.

What’s worse, there was nowhere to hide...

All 11 sector groups closed last week down. Even defensive sectors like consumer staples and healthcare got whacked.

In other words, the market went from messy to downright ugly in just a few trading sessions.

It’s time to be patient. So, there will be no recommendation in this installment of Trade of Week. Instead, I’m going to share two must-see charts with you.

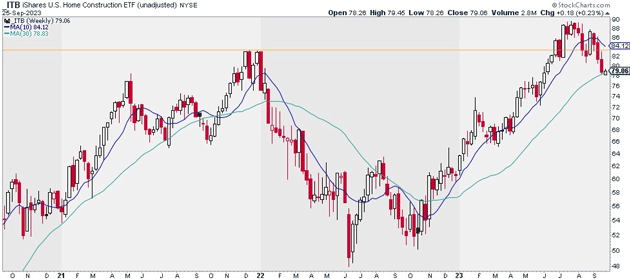

The first shows the performance of the iShares US Home Construction ETF (ITB), which invests in a basket of homebuilder stocks.

Heading into 2023, most people were bearish on homebuilders. Everyone was convinced housing would struggle due to the sharp uptick in interest rates. But the “homies” emerged as one of the strongest industry groups.

In fact, they were one of the first groups to break out to new all-time highs:

Source: StockCharts

Source: StockCharts

The problem is, homebuilders are starting to break down. Since July, ITB has dropped 13%. It’s trading back below its late 2021 highs. In short, we may have just witnessed a “false breakout” in homebuilder stocks.

This is concerning for a couple reasons…

During bull markets, it’s a bad look when leaders break down without another group taking their place.

Homebuilders are also bellwether stocks, as housing makes up nearly 20% of the US economy. If they're struggling, it could signal big problems for the economy at large.

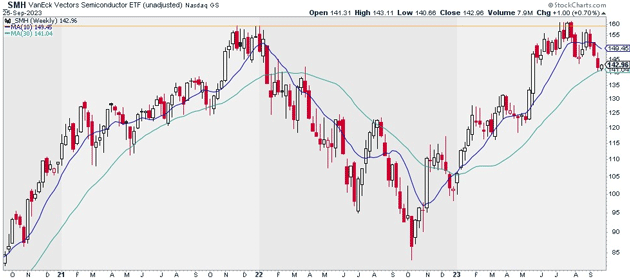

Unfortunately, they’re not the only leading group struggling. Semiconductors have also taken a turn for the worse.

You can see what I mean below. This chart shows the performance of the VanEck Semiconductor ETF (SMH).

Like homebuilders, “semis” were one of the first major industry groups to reclaim their 2021 highs. But they too couldn’t hold that key level.

Over the past couple months, SMH has dropped 12%... suggesting semi stocks may have just put in a double top:

Source: StockCharts

Source: StockCharts

In short, ITB and SMH are both struggling to get back on track. That’s a red flag for the entire stock market.

Now, that doesn’t mean the stock market is about to crash. Stocks may simply need time to build out bases and set up again before resuming their uptrends.

But we need to wait and see how this all shakes out. So, I suggest being extremely selective if you’re looking to put new money to work.

Until next week,

Justin Spittler

Chief Trader, RiskHedge