RiskHedge Chief Analyst Stephen McBride calls them “commanding heights” stocks…

And I’ll be blunt with you:

They’re not for everyone.

You’ll hate them if you’re looking for a “sexy” opportunity.

You’ll hate them if you’re looking to make a quick buck.

But you’ll love commanding heights stocks if your goal is to build substantial wealth that can last you and your family generations.

See, the right commanding heights stocks can grow your money not for months… not for years…

But for decades.

And it’s all because they share 1 key trait, which I’ll explain in a second.

I’ll also show you where today’s new "commanding heights” stocks are being born.

Now, Stephen didn’t come up with the phrase commanding heights.

That was Vladimir Lenin. As Stephen explains:

In the early 1900s, Russia’s economy had been ravaged by war. To steady the ship, Lenin legalized some profit-making enterprise. This shocked Bolsheviks who had risked their lives in the Revolution for communism.

Lenin told them not to worry. The Soviets would still control what he called Russia’s “commanding heights.” In other words, the beating heart of its economy—booming industries like steel, railroads, and coal.

Lenin might have been a crazy Communist, but he was onto something. He knew whoever controls the commanding heights has the power. It was true in Soviet Russia… and the freedom-loving USA.

Simply put:

Commanding heights stocks control the lifeblood of entire economies.

They dominate the world’s most important industries—and they do it for 20… 30… sometimes even 50 years!

- Banks were one of the original “commanding heights” industries...

If you’ve been following along, you know traditional banks are as good as dead today. “New money” disruptors like PayPal have seized banks’ most profitable businesses one by one.

But for hundreds of years, owning banks was a surefire way to get rich.

Thanks to banking, John D. Rockefeller (who’s considered to be the richest American of all time) was worth an estimated $420 billion in today’s dollars. For perspective, that’s more than twice as rich as Jeff Bezos!

And the Rothschilds’ banking dynasty owned the largest private fortune the world had ever seen in the 19th century.

Then there’s the auto industry. For decades, it held a commanding position in America. From 1956 to 2000, General Motors never fell outside America’s five most valuable publicly traded companies. Ford only fell outside the top 5 twice during the same timeframe.

Oil occupied America’s commanding heights for a long time too. By 1980, oil companies accounted for 7 of the 10 largest firms in the world.

ExxonMobil reigned as one of the world’s most dominant companies for years. In fact, from 1985 to 2014, its stock climbed more than 1,500%.

But it’s been a completely different story since. Exxon stock has been dead money for the past 7 years… dropping 41%.

And that brings me to today’s NEW commanding heights.

- Stephen says in America’s new commanding heights, data is oil.

Here’s how he put it in his recent issue of Disruption Investor:

Oil was the face of America’s old commanding heights. It drove the economy for decades... and oil stocks turned tens of thousands of investors into millionaires.

Today, the world’s most powerful firms aren’t pumping thick, black liquid out of the ground. Instead, they’re raking in trillions of dollars catching and crunching digital data.

But don’t just take his word for it. According to The Economist:

Fact is, whether you’re aware of it or not…

- You generate A LOT of data every day.

Every time you shop online, use your phone for driving directions, send an email, browse Facebook, or watch YouTube… you’re generating data that savvy companies turn into cash. Stephen:

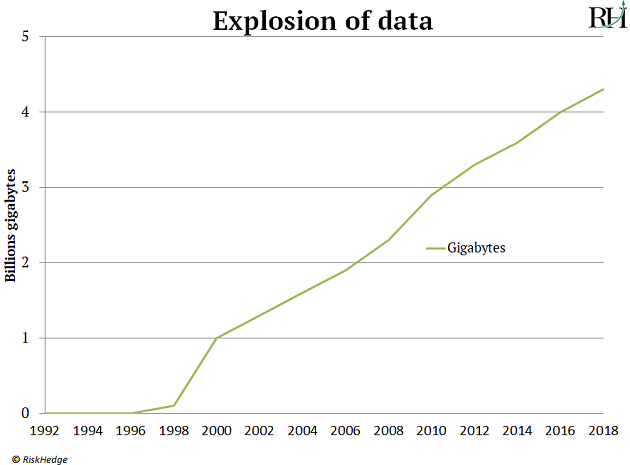

Several decades ago, the whole world generated just 100 gigabytes of data a day. That’s equal to downloading 30 HD movies.

Today we generate roughly 4.3 billion gigabytes per day… which is a 4,300,000,000% explosion from 25 years ago!

Here’s how this incredible growth looks on a chart:

- Amazon, Google, and Facebook are three of the largest, most powerful companies on earth… and data is the lifeblood of their businesses.

Stephen:

Google raked in $135 billion from selling online ads last year. It has mastered the art of collecting your personal information and using it to figure out who you are and what you’re likely to buy.

For example, try doing a Google search for a ski vacation. Chances are ads for skis, mittens, and lift tickets will start following you around the internet.

Ever gotten an email from Amazon (AMZN) with a list of items that you want? The online shopping pioneer created a tool which sends you recommendations based on your viewing history. Get this… Amazon generates 1/3rd of its sales from these emails. In other words, digital data brought in $98 billion in sales last year.

And Stephen says while tech giants like Amazon, Google, and Facebook have figured out how to turn data into cash…

- Most firms don’t have a clue how to unlock the value of their data.

Stephen:

Data, just like oil, must also be “refined” before we can use it.

In fact, the #1 most valuable “skill” a company can have today is the ability to collect, refine, and interpret data.

Think about an airline, which might have 20 years of customer data in its system. There are extremely valuable insights locked in that data. What kinds of comforts are people likely to buy on a long flight? Are families with children willing to pay more for extra leg room? Do folks in the back of the plane order fewer drinks?

This information could be worth billions.

That’s just a tiny example of why the ability to interpret data—and use it to make smart decisions—is arguably the #1 competitive edge a company can have today. It’s what turned Amazon, Google, and Facebook from run-of-the-mill tech companies into stock market dominators.

Problem is... most companies don’t have the resources of Amazon or Google. Turning raw information into valuable insights takes lots of cash, know-how, and manpower that 99.5% of companies simply don’t have access to today.

- That’s why Stephen’s been pounding the table on the “world’s #1 data ‘refinery’ stock.”

According to Stephen, this disruptor is a game-changer:

This company is, hand down, the world leader at helping businesses explore, share, and unlock the value of their data. A Silicon Valley-based software developer recently told me that this disruptor “makes big data work the way you’d imagine it worked… if you didn’t spend so much time actually analyzing data.”

This company now processes over 500 million customer queries per day. And it changes what’s possible with data. One of the UK’s largest grocery chains, Sainsbury’s, said: “Query times have plunged from six hours to three seconds.”

Stephen says if this company can achieve its targets, it has a real shot at becoming a $1 trillion disruptor by 2025.

That would hand you 12X gains from today’s prices as it leads America’s new commanding heights.

Current Disruption Investor subscribers can access this recommendation here.

You can learn more about this stock—and see why Millennials will be a driving force behind digital oil—in Stephen’s brand-new briefing.

Chris Reilly

Executive Editor, RiskHedge

P.S. Longtime readers might remember the last time Stephen made a big call like this on a data disruptor. That was back in 2018... We invested in data analytics pioneer Alteryx (AYX) and it shot up 244% over the following 14 months.

Stephen thinks this stock will be an even better play. Go here to see why.