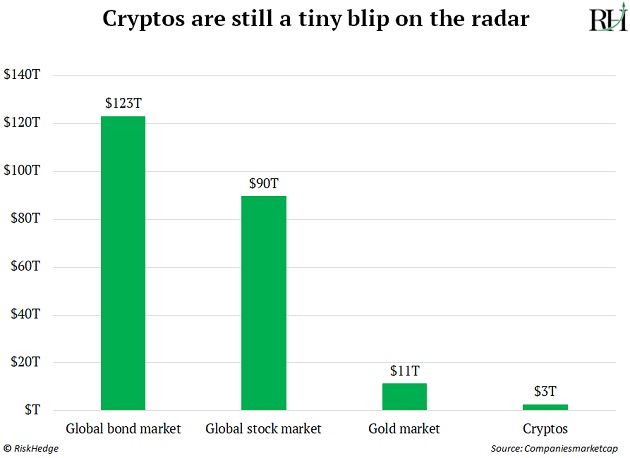

See this little green bar?

It doesn’t seem like much…

But the tiny sector it represents is minting millionaires as I type.

That’s because, as I’ll show you, this green bar is fertile ground for today’s most explosive “asymmetric bets”…

In other words, it’s an area where you can place small bets that can pay off big.

Already this year, this tiny sector has produced winners of 1,969%, 4,201%, 8,383%, 11,346%, and 21,163%…

In fact, it’s produced a total of 23 10-baggers in 2021.

By now, you may have guessed the green bar has to do with crypto, and you’d be right.

I’ll share more about it in a moment, but first…

If you haven’t signed up for Stephen’s Phase 2 Crypto Summit, registration is still open. Crypto expert Stephen McBride goes “live” this Wednesday at 2 pm ET, and he’ll explore a handful of early-stage crypto opportunities that look like bitcoin at $13. He’ll also reveal his top no-brainer crypto to buy today (not bitcoin or Ethereum).

I’ll be tuning in with thousands of RiskHedge readers who’ve already signed up. If you’d like to join us, go here. Attendance is free, but registration is required.

-

Back to the green bar…

You see, relative to stocks, bonds, and gold… the crypto market is tiny.

Year-to-date, the global bond market is worth a massive $123 trillion…

The value of all stocks? $90 trillion…

Even the gold market is nearly 4X bigger than crypto. Take a look:

In fact, the whole crypto market is barely bigger than Apple (AAPL)!

This might surprise some folks. After all, cryptos have been all over the news lately. And bitcoin, the world’s largest crypto—worth over $1 trillion—just soared to an all-time high.

It’s easy to assume cryptos are big… or that the opportunity already passed you by.

But if you zoom out and look at the big picture, you’ll see that’s clearly not the case.

-

And because the crypto market is so small and new… it’s the perfect spot to place smart asymmetric bets.

Simply put: An asymmetric bet is when the potential upside of an investment is much, much greater than the potential downside.

Most investors do the opposite. They make symmetric bets. They risk $500 for a chance to make $500. Or $10,000 for a chance to make $10,000.

An asymmetric bet is when you bet $500 for the chance to make $5,000 or $50,000.

Now, booking 1,000%+ gains is easier said than done.

That’s why asymmetric bets shouldn’t be a large part of your overall investing strategy.

But they deserve a place in any serious investor’s portfolio. And that’s not just according to me.

-

Have you heard of the barbell strategy?

It’s a powerful investment strategy recommended by renowned analyst and bestselling author, Nassim Nicholas Taleb.

In short, you want to structure your investments like a barbell. On one side, you have extremely safe investments that offer limited upside. Think long-term bonds, certificates of deposit, and very safe stocks.

On the other side, you have your high-risk bets that offer extremely high upside. Think microcaps, options, and most of all, cryptos.

Taleb recommends allocating 85–90% of your capital in the ultra-safe investments, and the remaining 10–15% in the riskier speculations.

This approach limits your risk while giving you a ton of upside.

Of course, how much you allocate to each side of the barbell is up to you. The point is, most investors should have at least a little exposure to the asymmetric bets that can 10X your money or more.

-

Stephen McBride says cryptos are the “most asymmetric payoff opportunity of our lifetime.”

You can’t make asymmetric bets in large stocks like Amazon (AMZN) or Apple. They’re already so large, the most you can really hope for is a double or triple.

Bitcoin is no longer an asymmetric bet, either. It has already ballooned to a $1 trillion market cap. Although Stephen says it should continue higher, it’s highly unlikely to shoot up 10X or more quickly, like the right asymmetric bets can.

Stephen says the #1 place to make asymmetric bets today, hands down, is in the smaller, lesser-known cryptos.

That’s because the crypto market is still so small and so new, the room for growth is exponential.

-

As I said earlier, small cryptos are already soaring… So far this year, there have been 23 10-baggers.

Like Terra (LUNA), up 6,753%:

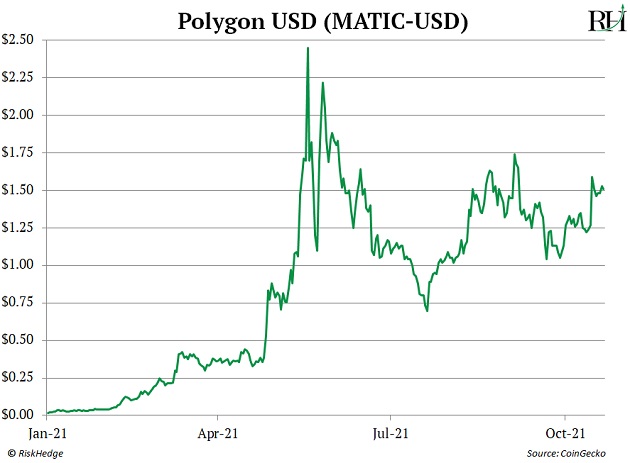

Polygon (MATIC), up 8,588%.

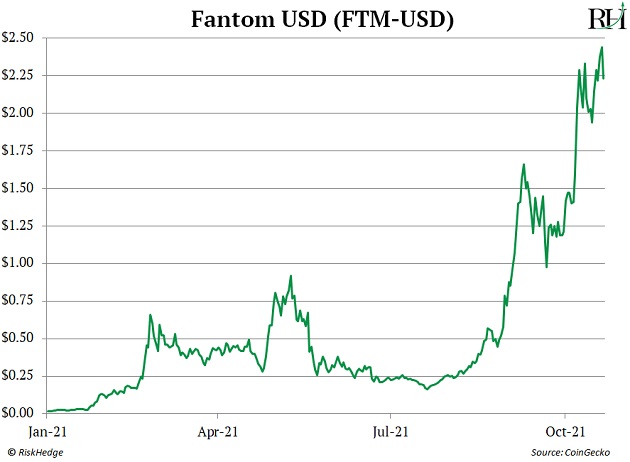

Fantom (FTM), up over 13,000%...

And Axie Infinity (AXS), up an incredible 21,163%…

Keep in mind, cryptos are the most volatile asset class on earth. So risk management is key. That’s why we recommend only betting a small amount in smart asymmetric bets.

-

I’m in Montreal right now meeting with Stephen McBride…

Over dinner last night, I asked him:

“Stephen, I know you can’t give a blanket answer about how much of one’s portfolio should be in crypto. But can you give a ballpark?“

His answer summed it up perfectly:

“Chris… the only correct answer to that question is NOT 0%.

Opportunities like this don’t come around much in life. I’d urge folks not to waste it. Almost everyone should own at least a little crypto.”

If you’re interested in learning more about crypto—and how to find the next batch of small cryptos that have the chance to shoot up 1,000% or more—I encourage you to sign up for Stephen’s Phase 2 Crypto Summit.

He’ll share all the proof of why cryptos are “the most asymmetric payoff opportunity of our lifetime.”

He’ll also reveal his #1 no-brainer crypto to buy today. Bring a pen and paper so you don’t miss it.

Hope to see you there. Just click here to sign up now.

Chris Reilly

Executive Editor, RiskHedge