Was Obamacare good for the average American family?

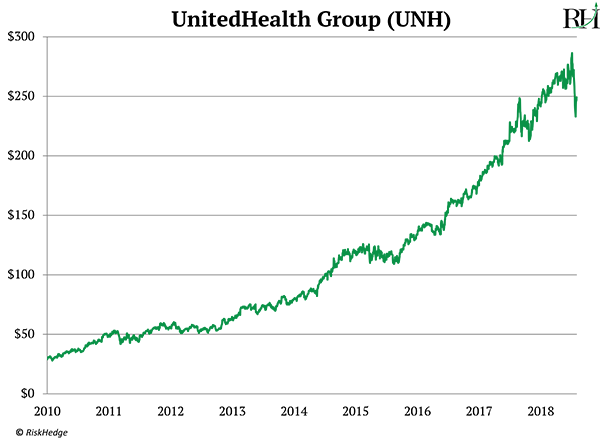

Before you answer, look at this chart...

It shows the stock performance of UnitedHealth (UNH), America’s biggest health insurance company, since 2010:

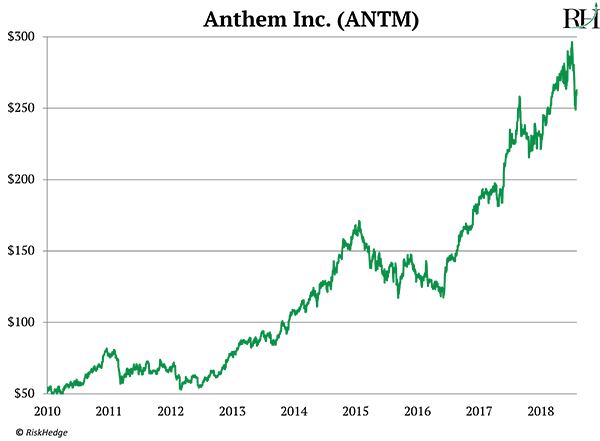

Now here’s Anthem (ANTM), America’s second-largest health insurer:

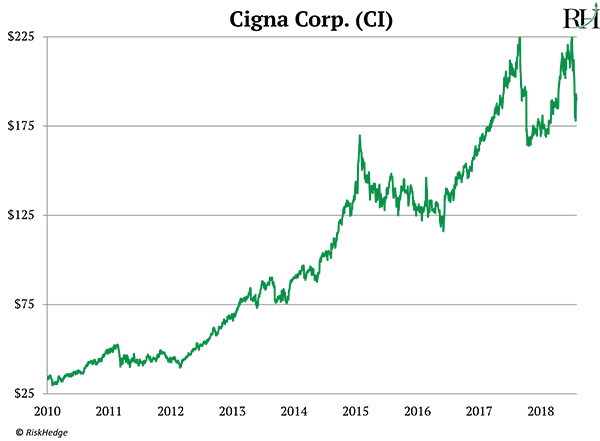

And here’s Cigna (CI), America’s third-largest health insurance stock:

Since March 2010, the S&P 500 has gained 154%.

These three rocketed 589%, 286%, and 332%.

Talk about a boom!

- Obamacare was the greatest thing ever to happen to health insurance stocks...

In 2009—the year before Obamacare—UnitedHealth turned a $3.8 billion profit.

This year it’s on track to rake in $13.5 billion.

You might expect to see a 3.5x surge in profits in a cutting edge tech stock...

But in a tired old industry like health insurance?

Since 2009, UnitedHealth’s profits have ballooned roughly as much as Google’s!

- So... did Obamacare help the little guy like it was supposed to?

There’s no question Obamacare propelled health insurance stocks to their best decade in history.

And the profit boom enjoyed by health insurers came straight from families’ pockets.

Keep in mind, health insurance premiums were already rising before Obamacare. From 1999 to 2009, they climbed 125%.

Then from 2009 through today, premiums got another 150% more expensive.

Roughly one in every five dollars spent in the US today goes toward healthcare. In fact, Americans now spend more on healthcare than anything except housing.

Are you familiar with the "crowdfunding website GoFundMe? It allows people to raise money for all kinds of things.

Sadly, every one in three dollars raised on GoFundMe goes toward medical bills today. In total, $650 million was raised to pay medical bills in 2018.

Despite paying through our teeth for insurance, only one in six folks are happy with their health coverage, according to Gallup poll.

In short, healthcare—and health insurance in particular—is America’s most broken industry.

- What makes an industry ripe for disruption?

My team and I set out to figure out what makes an industry “disruptable.”

We created RiskHedge’s disruption grading system.

In short, it measures the price you pay for something, and compares it to what you get.

Too big a gap means an industry is ripe for disruption.

Take cable TV. From 1998 to 2013, the price of cable TV more than doubled. Yet TV didn’t change all that much.

You still watched the news on NBC or Fox…

Maybe you tuned in to see 60 Minutes… Survivor… or Who Wants to Be a Millionaire…

And caught the game on ESPN or CBS.

Yet cable companies like Comcast (CMCSA) kept hiking prices year after year.

When prices surge without much improvement in quality, it attracts disruptors like a moth to a flame.

Of course, Netflix (NFLX) came along and wiped the floor with cable companies.

Over 35 million Americans have dumped cable TV in the past five years. Meanwhile, Netflix now has more subscribers than the largest five cable companies combined!

- Healthcare is the mother of all disruptable industries.

RiskHedge’s disruption grading system ranks industries on a scale… from vulnerable, to stable.

The higher an industry’s score, the more likely it will be turned on its head.

Before Netflix knocked cable companies off their perch, they had a disruption score of 131.

Prior to disruptor Uber (UBER) sinking the taxi industry, taxis had a score of 230.

And get this… today healthcare has a disruption score of 450!

Healthcare is practically BEGGING to be disrupted.

As I said, healthcare premiums have shot up 275% since 2000. While there have been major breakthroughs like gene testing and 3D-printed body parts, they have little to do with the cost of delivering healthcare.

Believe it or not, America’s largest retailer, Walmart (WMT), is my top choice to disrupt healthcare.

- “Walmart Health” opened its first location next to Walmart's retail store in Dallas, Georgia this past week.

Walmart Health is essentially a mini-hospital.

You can now walk in and get basic medical services like a doctor’s checkup… your teeth cleaned… an X-ray… a hearing test… and vaccines.

And here’s the kicker… Walmart is charging between 30–50% less for these services than hospitals do.

Walmart Health aims to “unbundle” the healthcare industry.

All types of medical services are lumped into health insurance today. We pay giant premiums that cover everything from major surgery like a hip replacement, right down to something that should be routine, simple, and cheap—like a flu shot.

With everything “bundled” under one insurance policy, nobody really knows what anything costs. Say you get a blood test at the hospital. Do you know if its going to cost you $300... $1,000... or $3,000?

Chances are you don’t. Chances are you have no clue how much you owe until you get a bill in the mail.

Name another industry that works that like that. Name another industry where the pricing is so arbitrary and opaque.

I expect Walmart Health and similar services to crack the healthcare “bundle” wide open.

Soon most folks will get their basic services at a local health clinic—like a Walmart Health. These local clinics won’t have ties to large hospital networks and insurance companies. And they will cost a fraction of what routine healthcare costs today.

Walmart is a Jedi-master at slashing unnecessary costs. For example, in 2006, it launched a line of generic prescription drugs, each costing $4. Today, it runs one of the biggest pharmacies in the US with $35 billion in sales last year.

- Disrupting healthcare is a mammoth task.

Insurance companies, many hospitals, and the government all have a vested interest in keeping the current system alive.

As I mentioned, health insurers are making record profits. So too are hospitals like HCA Holdings (HCA), which runs America’s largest chain of hospitals. HCA’s profits jumped 70% last year to a record $3.8 billion.

The current healthcare system has powerful friends. Expect the disruption of healthcare to meet serious resistance.

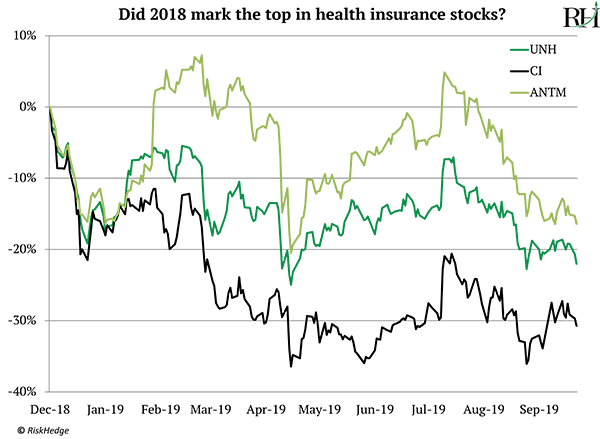

But I suspect the “great healthcare” boom is winding down.

Here’s a chart of America’s three largest health insurers over the past year.

After an incredible run over the past decade, they’ve plunged 16%, 19% and 28% in the past year:

Pretty ugly trend, right?

Would you get a flu shot or an X-Ray at a Walmart Health clinic? Tell me at Stephen@RiskHedge.com.

Stephen McBride

Editor, Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

Reader Mailbag

We received a ton of responses to my letter about the disruption of real estate agents. Here are a few:

Stephen, I had to write you to let you know that your letter was an amazing coincidence.

You ask if I would ever use a real estate agent to sell my home and my answer is an absolute NO! We have sold three houses in the past eight years and not one was sold with the help of a realtor.

–Terry

I did buy my most recent house directly without the use of a realtor on either side. It was a $1.4M deal, so we avoided a fair amount of fees.

–Chris

I used Redfin when I bought my current house. There’s no hand-holding while you’re shopping. If you want to get in to see a property, they pay regular real estate salespeople a token amount to let you in. Redfin didn’t get involved until we were ready to make an offer. They handled the offer and negotiation and handed me back 1/2 the agent fees because of their skinny model.

An added plus: When Wells Fargo “lost” our mortgage application and threatened to screw up the closing, Redfin not only got it fixed but got Wells Fargo to waive over $1,000 in bank fees.

–Roger

Absolutely, I would sell the house online. The real estate agent does little to earn the 3–6% return on their time.

–John

I have sold two houses privately without using an agent. I think it depends on the market and the area you are selling in. I sold both of my places in less than three weeks, but the market was pretty active for the type of house and both were in good areas. My son also sold his privately as well in about a month.

–Brian

Stephen, we bought our current condo using Zillow and contacting the owner directly. Bought it during the first visit. It worked out very well.

–Jack

The last five property deals have been realtor-less on my side. All deals went smoothly without any hitches whatsoever. I have offered to have them help me buy or sell at a lesser percentage and they have refused every time. So as far as I'm concerned, they are cutting their own throats.

–Tim

In 1995, I bought 85 acres of bare land from a developer and did the transaction without an agent. In 2002, I resold this land to another developer for a fat profit and no agent. I saved many thousands of dollars with DIY real estate transactions. It's not always easy to find a buyer/seller that will go along with such a thing, but it's well worth a try.

–Don

Stephen, we sold a home in VT, FL, and PA WITHOUT real estate agents. Saved tons of cash and they sold quickly. No way would it have been worth real estate agents, and we got fair market value on all thanks to extensive online research and realistic expectations.

–Keith

Another great article—Thanks. We'll be in a position to sell our house soon and are planning on doing it "for sale by owner." Zillow will make that much more practical than it was in the past, but we'll still have an uphill battle and plan on pricing the house under market. I hadn't heard of Opendoor, but now will be contacting them first.

–Ross

Stephen, so funny you are sending this message on buying and selling homes. My wife and I recently sold our condo, and I really considered listing with Redfin. I think we could have paid about half in fees. But in the end, we went with a realtor—it’s just a bit too new still I feel. I was thinking about you, though, and looked at Redfin as a potential industry disruptor.

–Jason