Stephen McBride: Chris, today I want to share what I believe is the most exciting—and potentially the most lucrative—development in this artificial intelligence (AI) boom. And I’m not talking about the latest ChatGPT…

This is a brand-new AI “tool” that just launched a couple weeks ago. So it’s not yet getting the attention it deserves. Especially because it goes by a pretty boring name. But it’s set to unlock hundreds—potentially thousands—of new businesses in a flash. And it needs to be on every serious investor’s and entrepreneur’s radar.

This won’t be a needle-mover for the big tech companies. Rather, it’s a massive opportunity for the smaller, little-known companies in America. The kind of companies you specialize in.

Chris Wood: So there was an enormous shift in the AI landscape back in 2016 that really opened the door for certain tiny companies to beat the big players at their own game. In short, big tech has had its hands tied when it comes to AI over the past seven years.

And it’s all because of a sexist, abusive “teenage girl.”

Stephen: “Tay”...

Chris: Tay. Microsoft’s (MSFT) horribly failed, reputation-damaging AI chatbot. She was ruthless. And she had to be shut down after just 16 hours...

Source: The Guardian

Source: The Guardian

Of course, Microsoft didn’t program her to spew hate. Shortly after the company launched Tay, folks on Twitter started tweeting the bot with all sorts of racist remarks. Keep in mind, Tay wasn’t as sophisticated as today’s chatbots. So, like a parrot, she simply repeated these horrible comments back to users.

Stephen: This wasn’t just a black eye for Microsoft. It scared every tech giant into keeping their AI products under wraps. Google (GOOGL) hired a small army of AI “ethicists.”

For big companies, there simply was too much that could go wrong.

Chris: Google, for example, has the best AI tech by far. But it’s been mostly working quietly on it for the past few years. When ChatGPT burst onto the scene late last year, Google’s AI division lead Jeff Dean was in no rush to launch a competing chatbot. He urged caution... saying the company has too much “reputational risk” and is moving “more conservatively than a small startup.”

Stephen: Of course, that didn’t last long. Google quickly realized how truly revolutionary ChatGPT is. It did a 180—it had no choice.

Google launched Bard, its own chatbot, last month. And it’s not the only one not “scared” of AI anymore.

Microsoft poured another $10 billion into ChatGPT creator OpenAI... and now uses ChatGPT in its Bing search engine.

Source: The New York Times

Source: The New York Times

Coincidentally, Google, Microsoft, Amazon (AMZN), Meta (Facebook), and Twitter all just made big cuts to their “response/ethical” AI teams...

They know the AI race is on. The era of pussyfooting around is over.

Chris: Thing is, as we said, it’s the smaller companies that have the most to gain. And not just because of their nimbleness. If Google figures out how to add $1 billion to its massive $280 billion in annual revenue through AI, the market will yawn. Maybe its stock will jump 5%.

But a tiny company adding $1 billion to its revenue through AI? That’s game-changing. It can launch a tiny stock to 5X gains easily.

Just look at OpenAI—ChatGPT’s creator. Most folks had never heard of this company—or were only vaguely familiar with it—before ChatGPT.

It was founded as a non-profit. Now, it’s one of the most valuable private companies in the world—worth $29 billion.

Stephen: And going forward, it’s still the smaller, lesser-known names that have the most to gain, even after big tech’s desperate pivot...

One of the great things about AI is it lets you do a lot more with a lot less. Renowned tech analyst Benedict Evans put it perfectly: “One way of thinking about AI is that it's like giving every company infinite interns.” This allows the smaller names to grow exponentially faster than the big tech firms can. Readers can still access your top “undercover” AI play, Chris, at this link... currently trading at under $2/share.

Chris: Let’s talk about the new AI tool you’re most excited about.

Stephen: Right, so most folks don’t know this, but one of the big drawbacks with ChatGPT is that it was only trained with data up to 2021. So it can’t answer questions about current events.

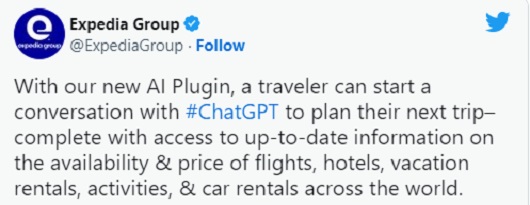

Something called “plugins” solves this. They give ChatGPT access to real-time data for the first time. They also allow ChatGPT to formulate responses using information from third-party sources.

For example, right now, a handful of companies like Expedia (EXPE), Instacart, and Kayak are using these new ChatGPT plugins. Think of them as specialized chatbots that can help you book flights, order takeout, you name it.

Source: DataEconomy

Source: DataEconomy

But this will extend far beyond just a handful of companies...

WGMI Media puts it like this:

Plugins are basically a way of “plugging in” your own data directly to ChatGPT to make its responses more accurate and effective. Here’s one way of seeing it: Plugins are like the App Store, and now you can make your own Apps for ChatGPT. This opens up a whole new world of opportunities for entrepreneurs to capitalize on the growing demand for AI-powered solutions.

Famous venture capitalist David Sacks also sees the big potential, saying plugins “could be the most powerful developer platform ever created.”

Source: Twitter

Source: Twitter

Chris: “Plugins are like the App Store” is a good way to put it. The App Store has been huge for Apple. It contributed to growth that saw Apple’s stock soar 2,800%.

As we’ve said, things are moving at lightning speed. As investors... it’s easy to fall behind. That’s why you and I have been at this for months, researching and recommending the best ways to capitalize.

Stephen: Yes, and to reiterate: As impressive as ChatGPT is, it’s not the real disruption here. It will be the game-changing apps built on top of it. Plugins have unlocked this potential. We’re in the early innings of the AI “app” era.

I’m talking specialized apps that can do your tax returns or write personalized marketing strategies. The opportunities are endless. Sure, there will be some apps that won’t amount to much at all. It reminds me a lot of the early iPhone days...

Remember “iBeer?” The app turned your smartphone into a virtual pint. iBeer was goofy, but it gave us a glimpse into the future. And the App Store turned out to be a lot more than a gimmick.

Within a few years, we were all using world-changing apps like Uber, Cash App, and Instagram. And some of the world’s biggest, most dominant tech companies skyrocketed after adding their respective apps to the iPhone. Like Amazon, Google, and Netflix (NFLX), which rose as high as 950%, 1,000%, and 6,500%, respectively.

Think about it like this: ChatGPT and other “AIs” are like the iPhone. But the real money will be made on the breakthrough apps built on top of them.

Chris: It’s an exciting time to be an AI investor. It’s all moving so fast, and I think investors who manage to stay on top of the rapid advancements could see substantial gains.

That’s why you and I are doing something we’ve never done before. In short, we put together a limited-time offer to get both our Disruption Investor advisory and my Project 5X advisory for the lowest combined price possible. That includes our “Definitive Guide to AI” report, along with four AI stock recommendations... including my top “undercover” AI play with 7X upside.

Go here to see if it’s right for you.

Stephen McBride

Chief Analyst, RiskHedge