There are 2,208 billionaires on earth, according to Forbes.

But only 3 are rich enough to qualify as “centi-billionaires”—worth $100 billion or more.

Amazon (AMZN) CEO Jeff Bezos is #1.

Microsoft founder (MSFT) Bill Gates is #2.

#3 will probably surprise you.

It’s not super-investor Warren Buffett. It’s not Facebook (FB) CEO Mark Zuckerberg.

It’s not a hedge fund manager... a banker...or a Russian oligarch.

- The third richest person on earth is a French guy who sells women’s purses...

This past week, Bernard Arnault’s personal fortune grew to $100.4 billion.

If you don’t know the name, Arnault is CEO of luxury empire LVMH (LVMUY)—best known as the parent company of Louis Vuitton. He also owns $80 billion fashion giant Christian Dior (CHDRY).

Gates and Bezos made their fortunes “the regular way”—by developing game-changing products that hundreds of millions of people use every day. Eight in every 10 computers run on Microsoft’s software. Over 100 million Americans subscribe to Amazon’s Prime delivery service.

Arnault got rich in a whole different way. He built super luxury brands like Louis Vuitton, Givenchy, Hublot, and Dom Perignon.

A prestigious brand is a powerful thing. A no-name handbag from Target might cost $100 tops. But women line up around the block to hand over $5,000 for a Louis Vuitton.

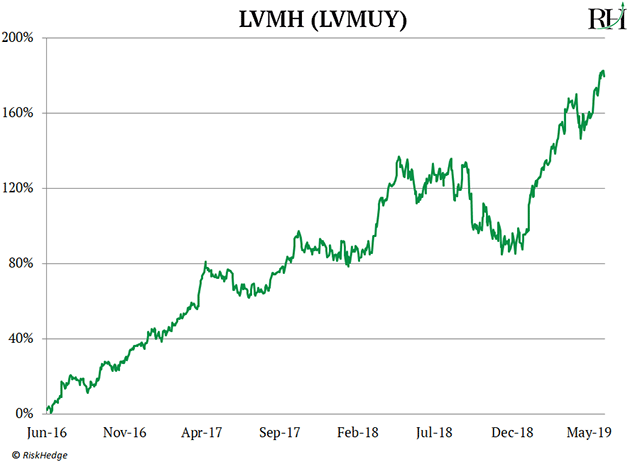

LVMH’s business is booming. Profits have surged 89% in the past three years, and its stock has shot up 180% since 2016 vaulting Arnault into the centi-billionaire club.

- Gucci is booming too...

Like Louis Vuitton, Gucci is a super luxury brand. If you want a pair of Gucci sneakers, prepare to drop a thousand bucks at least.

It might sound ludacris to spend the equivalent of a small mortgage payment on shoes, but Gucci’s are flying off the shelves. Sales at its parent company, Kering (PPRUY), jumped 50% in 2018.

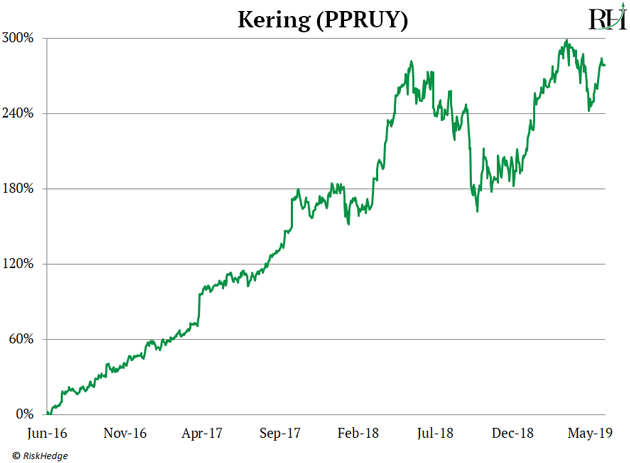

Kering’s stock is on fire. It’s surged 285% in the past three years, as you can see on this chart. That’s double the gains of Amazon and Microsoft over the same period.

- But what about the “death of retail?”

By now you know all about how online disruptors like Amazon are putting regular stores out of business.

According to leading retail research firm Nielsen, more than 21,000 stores have shut their doors in the past five years.

Yet online disruption hasn’t hurt luxury sellers one bit. Super luxury companies have proven totally immune to the internet wrecking ball. In fact, a 2018 study from “Big 4” accounting firm Deloitte found sales for luxury retailers soared 81% in the past five years!

Instead, it’s the middle-of-the-road retailers that are getting crushed.

Toys “R” Us… Sears… Bon-Ton… Borders… Circuit City… and RadioShack are all bankrupt.

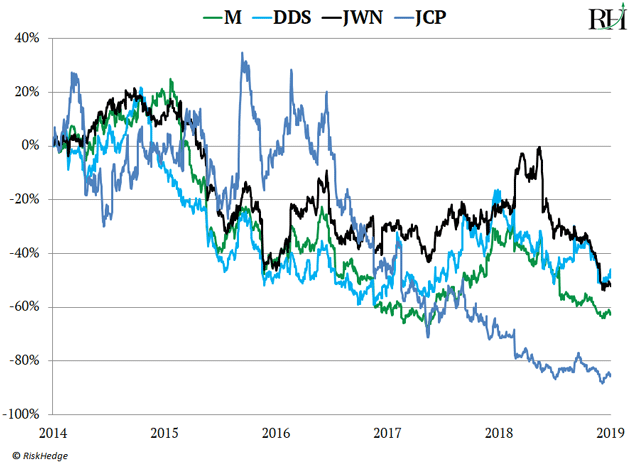

Meanwhile, many other middling retailers are barely clinging to life. Macy’s (M), J.C. Penney (JCP), Dillard’s (DDS), and Nordstrom (JWN) still have a pulse, but they’re fading fast, as you can see here:

- These disrupted stores made one mistake there’s no coming back from...

They tried to be everything to everyone.

The “department store” business model used to work okay. Open a big store... sell everything from blouses to outdoor grills to video games. As long as the store was located in a place with enough people coming through—like a city or a shopping mall—it could do good business.

Those days are long gone. Internet shopping has blown up unspecialized, “middle of the road” stores.

- Meanwhile, low-end discount stores are doing just fine...

According to Deloitte, discount store sales have surged 40% in the past five years.

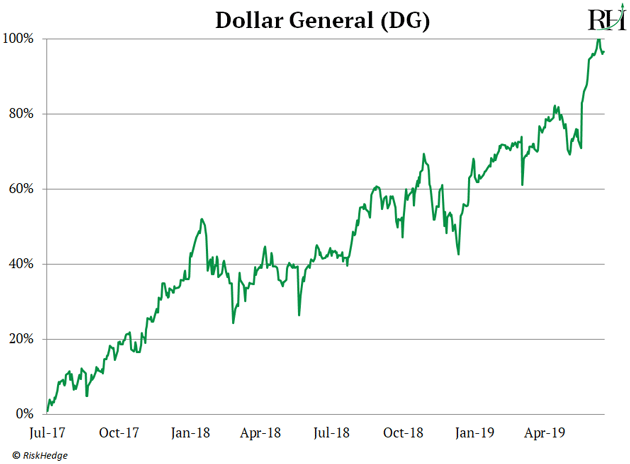

Dollar General (DG), for example, is America’s largest dollar chain. You could have doubled your money on its stock in the past two years:

Dollar General is now the largest US retail chain by store count. It operates almost 16,000 stores—more than McDonalds… Starbucks… or Walmart.

Revenue has shot up 145% in the past decade. And it’s not just low-income folks shopping there. According to JP Morgan, households earning between $50,000 and $75,000/year are Dollar General’s fastest-growing customers.

- The hollowing out of the “middle” is a disruptive theme rippling across many industries...

Where will it strike next?

Regular RiskHedge readers know self-driving cars will gut the auto industry like a fish. In fact, it’s already begun. The stock of America’s largest car maker, General Motors (GM), has been dead money for five years. Rival Ford (F) has plunged 42%.

Super luxury carmakers are doing just fine though. Sportscar maker Ferrari’s (RACE) stock has surged 190% since going public in 2015!

So what should a disruption investor do with this information?

Steer clear of “average” stocks. Avoid mediocre, conventional, or “good enough” businesses.

For better or worse, the middle is dying as its lunch is eaten from above and below.

What mediocre company will be disrupted next? Tell me your thoughts at stephen@riskhedge.com.

Stephen McBride

Editor – Disruption Investor

Stephen McBride is editor of the popular investment advisory Disruption Investor. Stephen and his team hunt for disruptive stocks that are changing the world and making investors wealthy in the process. Go here to discover Stephen’s top “disruptor” stock pick and to try a risk-free subscription.

Reader Mailbag

RiskHedge reader Tom asks about US computer chip stocks:

Do you think American chip manufacturers will bounce back when the trade war sorts itself out?

Thanks for your question, Tom.

As I mentioned a couple of weeks ago, China bought almost 60% of all the computer chips America produced last year. The big question for these stocks is how the tensions between the US and China get resolved. If a trade deal is signed, chip stocks could hit all-time highs.

Thinking longer term, disputes around chip technology could linger for years to come. That will likely put a leash on how far these stocks can run up.