Buy low, sell high.

It’s one of the first “lessons” every investor learns.

And the idea is simple. You buy stocks when they’re cheap and sell when they get more expensive.

But what if I told you there’s a way to make just as much money (if not more) by buying stocks after they’ve shot up…

This approach is more controversial. After all, buying stocks that have already spiked feels risky.

But as I’ll show you, if you do it the right way, you’ll collect reliable profits much more quickly than conventional “buy low, sell high” investors.

In fact, you could have recently used this strategy to collect 32% in 10 days on Digital Turbine (APPS)… 61% in 10 days on eXp World Holdings (EXPI)… and 168% in less than a month on GrowGeneration (GRWG).

- By now, you’re probably wondering what ignited these rallies…

It’s simple: an explosive earnings move.

Now, it’s no secret that a great earnings report can trigger big moves in stocks. It’s why professional investors pay close attention to earnings season, which we’re in right now. But most investors don’t know how to dependably capture these huge gains…

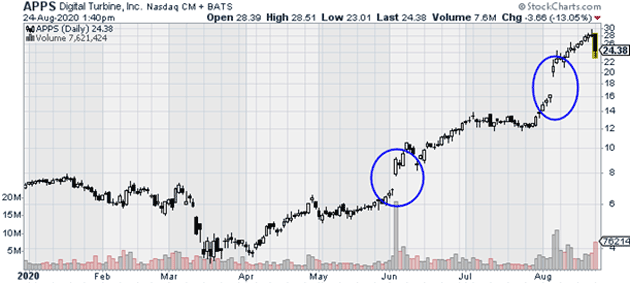

Look at this chart of Digital Turbine. Notice what happened when it reported stellar earnings on June 2.

APPS “gapped” 31% on massive volume after reporting great earnings. In other words, it opened the trading day significantly higher than where it closed the prior day.

Many investors wouldn’t “chase” a stock after an explosive move. But they should have. It surged nearly 80% higher over the next two months!

Then two weeks ago, APPS gapped up a second time after once again reporting stellar earnings. This time, it spiked 30% on earnings… and another 32% over the next 10 trading days.

Source: StockCharts

Source: StockCharts

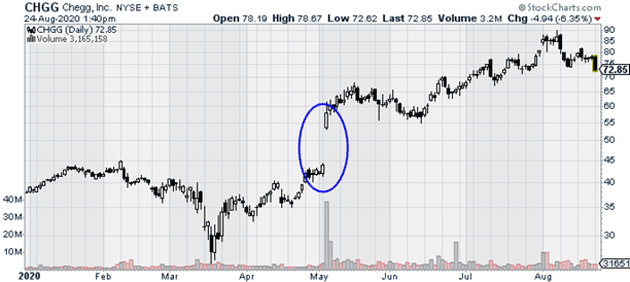

We saw the same thing recently play out with education disruptor Chegg (CHGG).

Like Digital Turbine, Chegg’s stock soared after reporting stellar earnings… It gapped up 32% on May 5. From there, it rallied 49% over the next three months!

Source: StockCharts

Source: StockCharts

But here’s the thing…

This strategy—buying stocks after they “gap up” on strong earnings—doesn’t just work on fast-growing tech stocks. You can use it on every kind of stock.

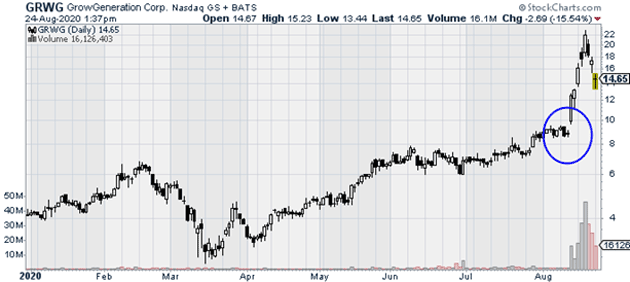

In fact, you could have recently collected 162% profits in just over a month by buying the cannabis picks-and-shovels stock GrowGeneration (GRWG).

Source: StockCharts

Source: StockCharts

By now, you can see that this strategy routinely hands out big, quick gains.

But you may still be wondering… why? It’s simple…

- The “smart money” is behind these explosive earnings moves…

When I say smart money, I’m talking about major financial institutions like hedge funds.

These are the savviest investors in the world. They have information and connections that little guys would kill for.

But that’s not the only reason you should strive to invest along with the big boys. Many of these firms oversee billions of dollars. They’re the only ones who can cause a large stock to jump 15%... 20%... or even 30% in a day.

When you oversee that much money, you only “bet the farm” on a stock that you have a ton of conviction in.

But this pattern isn’t just for nimble traders.

- It can also set you up for big long-term capital gains…

You could have bought Facebook (FB) on an earnings gap in July 2013 for just $34. Today, Facebook trades for over $270. That’s nearly a 700% gain... or enough to turn every $10,000 into almost $80,000.

Source: StockCharts

Source: StockCharts

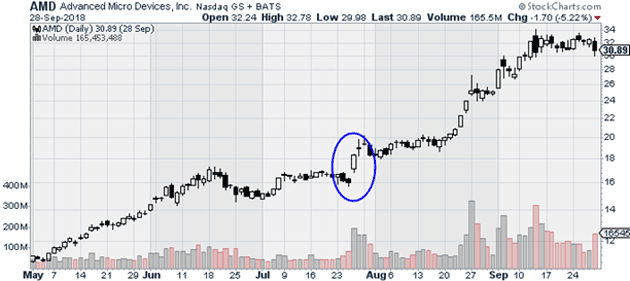

You also could have used this strategy to buy Advanced Micro Devices (AMD) for just $17 in 2018. Today, AMD is trading 388% higher... and it’s been the #1 performing stock in the S&P in 2018 and 2019.

Source: StockCharts

Source: StockCharts

You could have used it to buy streaming giant Roku (ROKU) in August 2018 for just $25. Less than two years later, Roku’s share price had 7X’ed!

Source: StockCharts

Source: StockCharts

If you missed out on these explosive moves, don’t worry.

- Opportunities like this pop up every earnings season…

And you can easily identify them yourself. Here’s what to look for:

- A big “gap up.” Remember, this is where a stock shoots up much higher than where it closed the previous day. Ideally, a stock will also break out to near all-time highs… or at least break through prior resistance levels.

- Heavy volume. I like to see volume that’s at least 100% greater than the stock’s average trading volume.

- A strong close. Stocks that close the day at or near highs offer the best opportunities for big gains.

- That last point is extremely important…

You see, an earnings gap means nothing if the stock gives back most of its gains by the end of the day. Instead, we want to see a strong close. This is a sign of insatiable demand. These are the stocks that most often continue rallying for weeks or even months after their initial jump.

So to really get the most out of the strategy, you have to do one of the hardest things in investing. You must wait.

Be patient and wait for a strong close to confirm the big move. Then, buy the next morning if the stock has “followed through.”

Of course, I realize that not everyone has the time to monitor all this. After all, hundreds of companies a day can report results during earnings season.

That’s where I can help.

- My IPO Insider subscribers have enjoyed several big wins off this strategy…

IPO Insider is my premium research advisory. In it, I focus on newly public stocks with explosive upside. Many of our best trades this year have come thanks to playing these earnings gaps the right way.

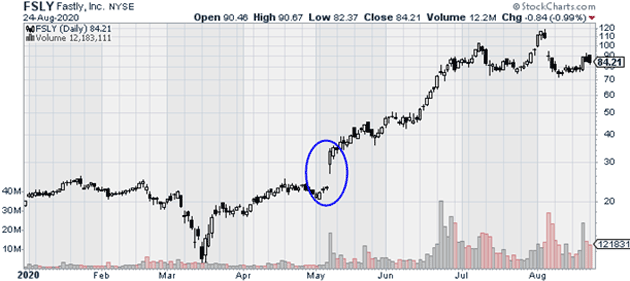

For example, this chart shows the performance of edge computing pioneer Fastly (FSLY).

My subscribers got into Fastly on April 27… a week before it reported blow-out earnings.

As you can see below, Fastly gapped up 46% on its strong results! Trading volume was also heavy that day. And Fastly closed within pennies of its high.

I’m sure you can guess what happened next. Fastly took off! It rallied 251% over the next two months.

Source: StockCharts

Source: StockCharts

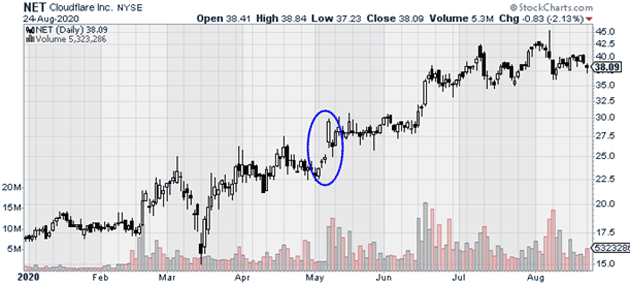

The same thing played out with Cloudflare (NET), another high-flying edge computing stock in the IPO Insider portfolio.

On May 7, Cloudflare gapped up 18% on heavy volume after reporting excellent quarterly results. Over the next three months, Cloudflare rallied another 54%.

Source: StockCharts

Source: StockCharts

Livongo Health (LVGO), which I recommended in February, also went on a tear after it reported incredible results in early May.

Like Fastly and Cloudflare, Livongo gapped up 12% on heavy volume. But it didn’t stop there. It nearly tripled in value over the next three months…

Source: StockCharts

Source: StockCharts

I’m showing you this so you can see how reliable this strategy is when executed correctly…

- Last week, I used this strategy to add another stock to our portfolio…

This is a widely overlooked artificial intelligence (AI) company that’s capitalizing on one of today’s biggest opportunities: the work from home megatrend.

But I don’t expect this small stock to fly under the radar much longer. The company recently reported phenomenal earnings. Its sales grew nearly 50% last quarter. Management significantly raised its revenue guidance for the year.

So, I’m sure you can guess what happened. The stock gapped up 15% on its results. Volume was through the roof. And the stock closed near its intraday highs.

I wouldn’t be surprised if this stock rallies at least another 50% in the next few weeks or months.

You can get in on this stock with us before it moves by signing up for a risk-free trial of IPO Insider. Use the link below if you’re interested. It will take you to a private webpage where I present a unique strategy almost anyone can use to make an extra $30,000 a year trading “hated stocks.”

On that page you’ll also find special discounted pricing for RiskHedge readers that is not available elsewhere.

Thanks for reading,

Justin Spittler

Chief Trader, RiskHedge