Markets are in the red… and most year-to-date charts look terrible.

The Nasdaq is down 21%…

The S&P 500 has fallen 13%...

And many investors are asking the same question:

Should I sell everything…

Or go “all in” on the bargains that are forming in many stocks?

|

Last Call for RiskHedge Report Readers: SIC 2022 IS LIVE! But it’s not too late to join us. You can still get your Virtual Pass and receive immediate access to SIC sessions from the top minds in finance. Virtual Passes include videos, audio, and transcripts—so even if you can’t watch all the live presentations, you won’t miss a thing. Click here to get your Virtual Pass at 44% off. (From Our Partners) |

This is the wrong question.

You see, most people treat investing with an all-in or all-out mentality…

They’ll hold everything when markets are doing well, and look to sell it all when markets turn bad.

But investing isn’t binary...

There’s a better way to invest during times of uncertainty…

One that doesn’t force you to choose if you’re in or out…

It’s a proven strategy that allows us to build positions in world-class companies today…

In a cost-effective way that limits our risk...

While turning any further downside in the markets to our advantage…

-

I’m talking about an investing strategy called “dollar-cost averaging”…

With this technique, you place a fixed dollar amount into an investment on a regular basis.

Say you plan to invest $10,000 in one stock.

Instead of buying $10,000 in one go, you’d split it up into, say, four chunks of $2,500 over four months.

You’d be “scaling in” slowly as opposed to “going all in” from the beginning.

By investing this way during downturns, you accomplish two things: you lose LESS money on the way down and you make MORE money from the recovery to follow.

Let’s look at the power of this strategy using the most disruptive company on the planet: Amazon (AMZN)…

-

I won’t tell you how Amazon could have turned you into a millionaire…

You’ve heard that story countless times.

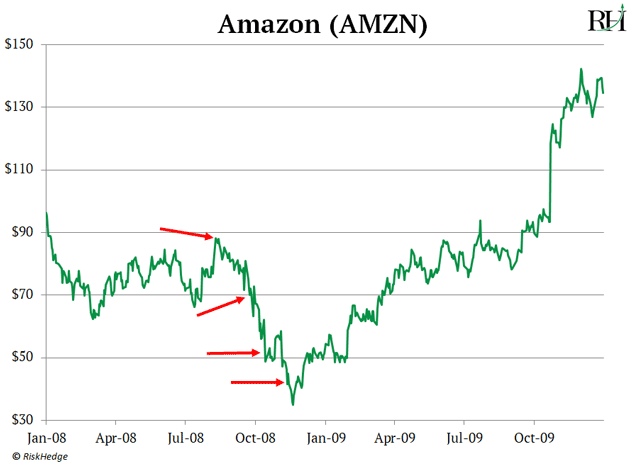

Instead, I want to zoom in on what happened to Amazon during the 2008 financial crisis.

No one talks about how AMZN fell off a cliff like nearly every other stock that year.

In just four months, the stock crashed more than 60%!

If you invested a $10,000 stake “normally”—putting in the full allotment from the get-go, at the peak in August, at around $90 a share—you’d be left with just $3,900 come November, when shares dropped to $35.

That’s a tough loss to stomach.

-

But here’s what would have happened if you used the power of dollar-cost averaging…

You’d split up that same $10,000 into four separate $2,500 investments.

You’d invest your first “tranche” of $2,500 at $90 a share…

A second tranche in September at $70 a share…

A third installment in October at $50…

And finally, a fourth in November at $40.

You’re risking less money each time… and you’re getting in at better entry points.

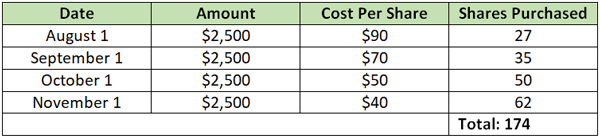

Here’s how it looks:

By doing it this way, you’re lowering your average cost.

In other words, you’re accumulating more shares for less money, as you can see here:

You end up buying into Amazon at an average price of only $57.47 per share! ($10,000 / 174 total shares purchased)

That means instead of losing 60% in the downturn, you’ve cut your losses to 39%.

-

And more important… you’re set up to collect bigger profits.

AMZN went on to explode to $135 a share by the end of 2009.

In the first example, $10,000 all-in at $90 per share turns out to a solid 50% gain. A nice $5,000 profit.

Not bad.

But remember, by using our dollar-cost averaging strategy, our cost basis isn’t $90. It’s much lower… $57.47.

We’d book much bigger gains of 135%... handing us a much bigger $13,500 profit.

-

I hope you see why this strategy is perfect for today’s uncertain markets…

We can’t know exactly when this market will bottom. And that’s okay. We don’t need to know the exact bottom to make the right move today.

Now’s the time to start establishing positions in the most dominant and disruptive companies on earth.

If prices drop another 20% from here, dollar-cost-averaging will turn the decline to our advantage.

And if the bottom happens soon—we’ll set ourselves up for big profits by “planting our seeds” today.

It’s a win-win.

And hands down the # 1 way to stack the odds in our favor right now.

Stephen McBride

Editor — Disruption Investor