Last month, I pulled back the curtain on my #1 trading strategy.

As I showed you, it takes advantage of a rare market phenomenon…

Something I call “forced buying.”

It’s one of the most lucrative strategies I’ve ever put to work. And today, I’ll share the exact setup I look for so you can put on your own trades today.

But first, let me recap why this strategy is so lucrative…

- Normally, investors buy and sell stocks at will…

But there’s select groups of stocks Wall Street is forced to buy. It’s required by law.

And the ones doing the buying are rarely small fish.

Instead, they’re big banks, hedge funds, and other powerful financial institutions with deep pockets. Together, these institutions control trillions of dollars.

No one on earth can move stocks like them.

- Consider what happened when Wall Street was forced to buy pot stocks recently…

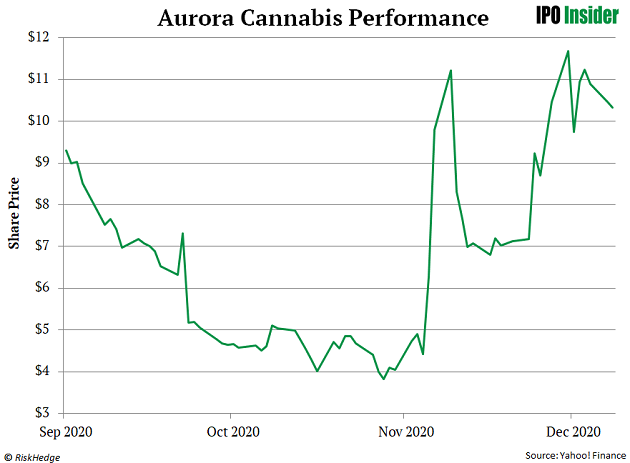

Aurora Cannabis (ACB) spiked 250% in a month.

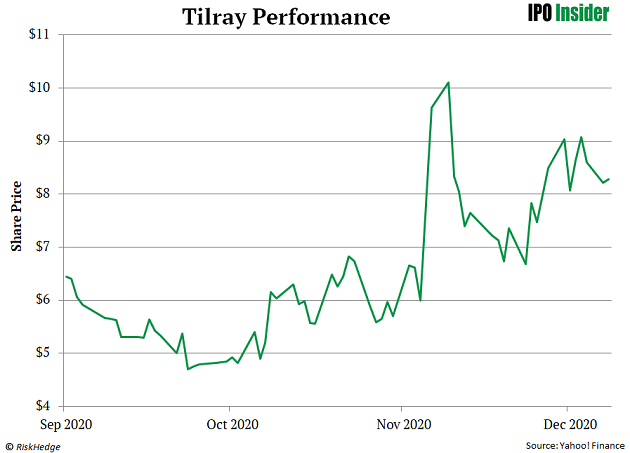

Tilray (TLRY) rallied 115% in 2 weeks.

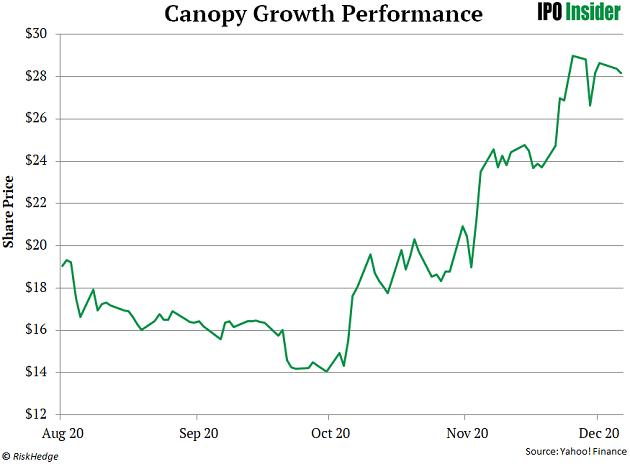

And Canopy Growth (CGC)—the world’s biggest pot stock—has more than doubled since the start of October.

A casual observer would tell you pro-cannabis legislation was behind these moves. And it’s true. A number of states have legalized cannabis in one form or another in recent weeks. Congress also passed a historic bill to decriminalize cannabis on Friday.

But these moves wouldn’t have been nearly as explosive were it not for this special market phenomenon.

- Regular RiskHedge readers know I’m talking about “short squeezes”…

Short selling a stock is betting that it will fall in value.

But the short sellers don’t actually own a stock they short. They borrow it from someone else and sell it into the market.

To close out the trade, they must always buy the stock back. As I mentioned, it’s required by law.

This forced buying can put intense pressure on a stock to rise. If the buying pressure is strong enough, it ignites what’s known as a “short squeeze”... which can lead to 40%, 50%, or bigger gains in as little as a few hours.

That’s a huge reason why pot stocks have exploded recently. Many of these stocks had sky-high short interests. They were among the market’s most hated stocks!

Still, profiting off short squeezes isn’t as simple as buying any stock with a high short interest. You have to know what to look for.

And there’s one particular setup that routinely leads to big gains. It works best on my favorite group of stocks: initial public offerings (IPOs).

- IPOs are prime short squeeze candidates…

That’s a bit of a shocker to some people.

After all, IPOs are some of the market’s fastest-growing and most disruptive stocks. Nonetheless, many IPOs are downright hated... which often leads to short sellers piling on bets against them.

There are a few reasons why investors often hate IPOs. For one, recently IPO’ed companies are brand-new stocks. That means they have no track record, zero price history... not even a single quarterly earnings report under their belt.

In short, IPOs haven’t yet demonstrated they can succeed as a public company... so they tend to attract lots of doubters.

Most IPOs aren’t household names yet either. And many investors avoid companies they don’t “know.”

This is why we see many top-tier IPOs stumble out of the gates. But forced buying kicks in big time when IPOs rebound and short sellers are forced to buy back shares.

But remember…

- Profiting off hated IPOs isn’t as simple as buying a heavily shorted stock…

Your timing also needs to be spot on.

And one pattern routinely ignites explosive short squeezes in IPOs.

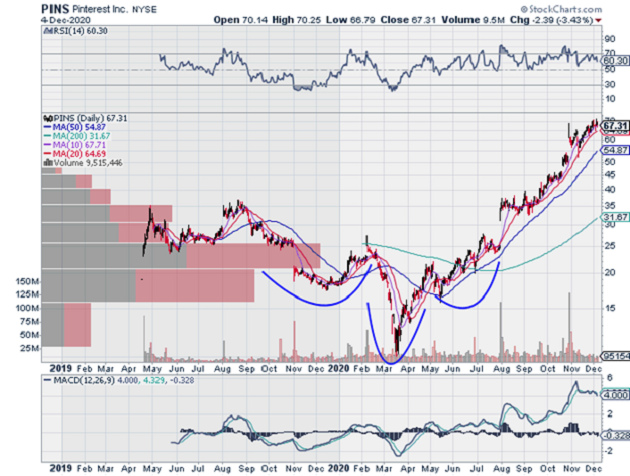

Look at this chart of social commerce giant Pinterest (PINS) since its April 2019 IPO. Notice the bottoming pattern it put in.

This pattern appears all the time in recent IPOs. Often, it’s a textbook “buy signal”… like it was here.

Source: Stockcharts

Pinterest has already rallied 84% since I added it to the IPO Insider portfolio less than 3 months ago.

- When this pattern is paired with a high level of short interest, the gains can be life-changing…

Look at this chart of Chinese electric vehicle company NIO (NIO).

Notice how it had almost the exact same setup as Pinterest.

This is called an “inverse head and shoulders” pattern. (You can see that it looks like someone’s head and shoulders flipped upside down.) Unlike a normal head and shoulders pattern, this pattern doesn’t signal potential tops. It signals bottoms. Take a look:

Source: Stockcharts

NIO was also an extremely hated stock. At one point, it was one of the most heavily shorted stocks on the market. Even today, it has a short interest of more than 30%. Anything over 10% is considered high.

When NIO started climbing, there was a mad rush by short sellers to buy back shares. This explosion in forced buying propelled the stock more than 2,000% higher since March.

By now, you can see just how lucrative this pattern is when combined with a high short interest.

If you’re ready to put this strategy to work today, look for these 2 things:

- Find a world-class IPO putting in a “reverse head and shoulders” pattern. You can identify this using simple stock-charting software, or a free site like stockcharts.

- Make sure the stock has a high short interest. As I mentioned, anything over 10% is a good place to start. On FinViz, you can easily view a stock’s short interest percentage by simply searching its ticker. Here’s an example using Rackspace Technology (RKT).

Source: Finviz

- I recently added two stocks that check these two boxes in my IPO Insider advisory…

One has surged 71% in just over two months. The other looks like it could break out any day now.

I wouldn’t be surprised if both of these stocks surge another 50%+ over the next three months or so.

That may sound like a bold call. But as I’ve demonstrated, those are exactly the kind of returns you can expect when you’ve found a hated IPO setting up for a big short squeeze.

I explain more here… including how you can use this strategy to make an extra $30,000 next year.

Justin Spittler

Chief Trader, RiskHedge