Investors finally put 2022 to bed… The fastest hiking cycle in 50 years is coming to an end… Why history suggests stocks will rise in 2023… Where I’m placing my bets for the highest returns… “These numbers scare me big time”

1) 2022 will go down as one of the worst years in history for American investors…

The S&P 500 and Nasdaq 100 plunged 19.5% and 33.3%, respectively. It was the worst year for US stocks since 2008.

By itself, the stock market's performance wasn’t that bad. But crashing bond prices landed a surprise one-two punch on investors who assumed the bond portion of their portfolio was safe. Thanks to the Fed rapidly jacking up interest rates from 0.08% to 4.33%, US bonds suffered their worst year in history.

As a result, the commonly used 60/40 stock-bond portfolio suffered its largest drop since 1932, during the Great Depression.

Other than commodities and energy stocks (good call if you listened to Chief Trader Justin Spittler’s recommendation to buy those in February), it was a “nowhere to hide” year.

2) I can say with 100% certainty that 2023 will be very different.

In today’s issue, I’ll lay out my “script” for the stock market for 2023. For reasons you’ll see, I see stocks climbing 10‒20% in 2023, and I expect the 2nd half of the year to be better than the first.

Why? One word: inflation.

Inflation reached 9.1% early last year—a level not seen in the US since the ’70s. And the only way to tamp down inflation was for the Federal Reserve to aggressively hike interest rates.

The problem is rising interest rates are a major headwind for stocks. And while the stock market can withstand a slow hiking pace… a rapid one is poison for stocks.

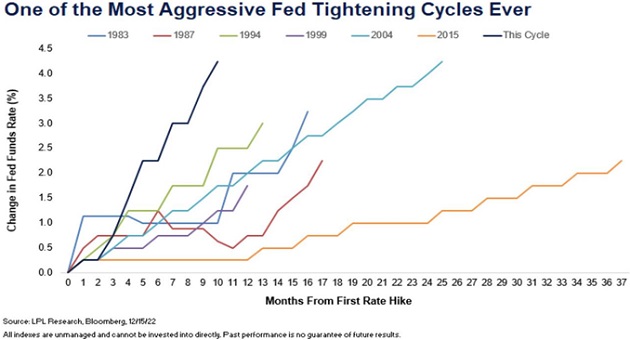

Here’s a comparison of the current hiking cycle (dark blue line) to the ones from the recent past. The Fed’s 2022 hiking cycle was the most aggressive in 50 years. In a matter of months, it raised interest rates more than it typically does in 3+ years.

But this trend will reverse in 2023.

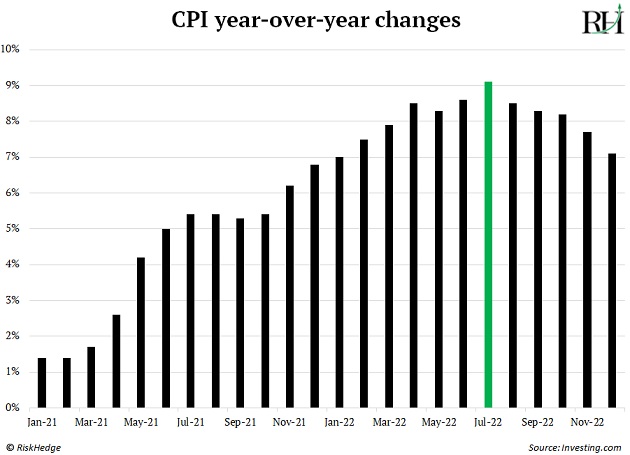

Inflation is now falling. Look at the chart of CPI. It’s been trending lower since August…

At this pace, CPI will fall to 2% before the year is over. That’s the Fed’s stated target inflation rate.

So, the hardest part is behind us. The Fed will decelerate and eventually stop hiking interest rates this year. They may even cut rates in the second half, when it’s more obvious we’re in a recession.

3) Now, zoom out and look at 2023 from a historical perspective…

What are the odds the stock market declines two years in a row?

Low…

In the last 100 years, the US stock market has only declined in consecutive years four times: 2000–02, 1973–74, 1939–41, and 1929–32.

In all those instances, the market was in much worse shape than today.

In 2000–02, the stock market had a LONG way to fall after reaching its most overvalued level in history during the dot-com bubble. Today, the market trades at about 18 times earnings—which is in line with historical averages.

In both 1973–74 and 1939–41, inflation was rising rapidly. Today, inflation is falling.

And 1929–32 was the start of the Great Depression. The unemployment rate was as high as 25%. Today, it’s at 3.7%.

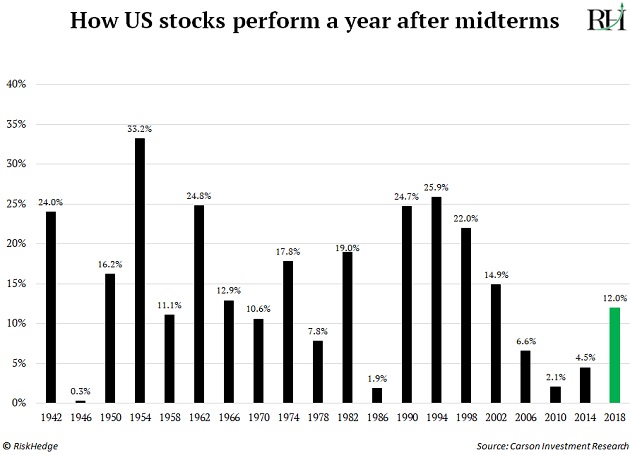

4) In October we published research showing how stocks often soar in the 12 months after midterm elections.

Since 1942, there have been 20 midterm elections. US stocks climbed higher in the next 12 months after every single one.

That’s 20 for 20. A perfect track record. See the results for yourself here.

Now, 20-for-20 isn’t a huge sample size… but consider this.

We’ve had every possible political combination in the past 80 years.

A Republican president with a Democratic Congress… A Democratic president with a Republican Congress… Republican president and Congress. Democratic president and Congress.

The market climbed higher every time. I bet it’ll do the same in 2023.

Specifically, I think the market will edge a bit higher in the next 3‒6 months. The biggest gains will be backloaded in the second half of the year. By that time, inflation will be below 4%, and the threat of further rate hikes will be put to bed.

5) Which stocks will rise the most?

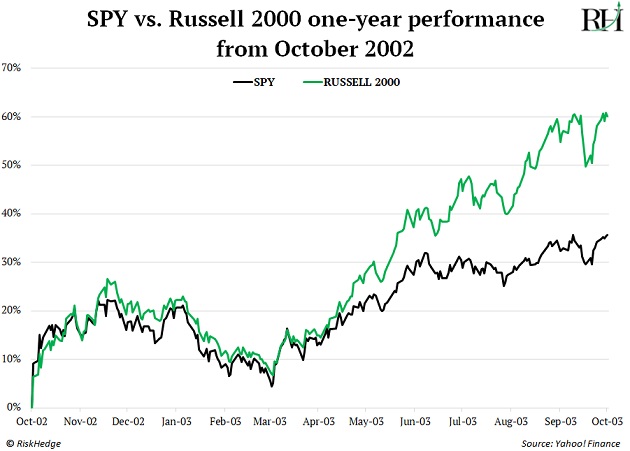

My team and I studied the last three post-bear market rallies. The clear winners were small caps.

When markets bottomed in 2002 following the dot-com bubble, the S&P 500 rose 35% in the next year. But the small-cap Russell 2000 Index soared by 60%.

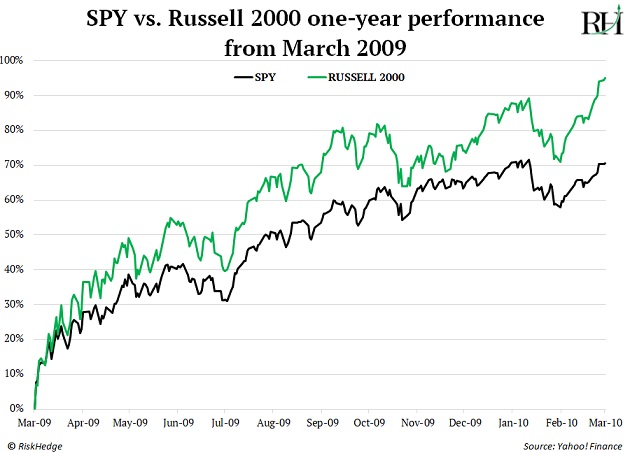

In 2009, after the Great Recession, the S&P 500 gained 71% one year after hitting its lows. Meanwhile, the Russell 2000 jumped by 95%.

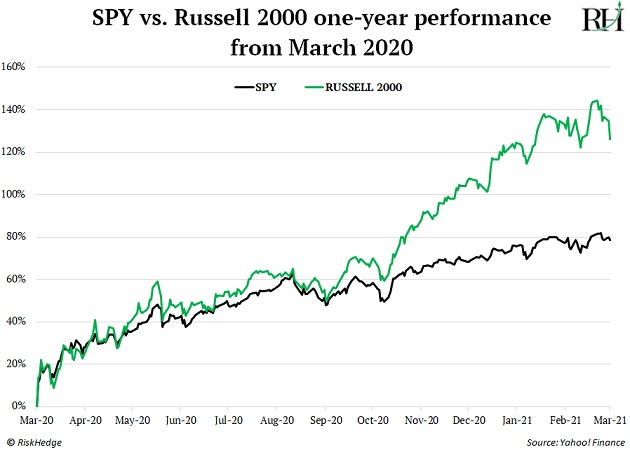

And look at 2020. The S&P 500 climbed 80% in one year after the COVID-19 lows. But the Russell 2000 was better yet again, skyrocketing 126%.

Chris Wood

Chief Investment Officer, RiskHedge

In the mailbag...

Today, an insight from a fellow reader...

I think it's going to be a very tough year. I have worked in the veterinary field for the last 35 years. My worst year was 2008. I was down 1%. That is the only time I have been down. This business has had explosive growth during my career. Veterinary care is one of the last things people stop spending their money on. The last two months have seen a year-over-year double-digit decrease in appointments made. Usually if there is a slowdown it's 5% or less. Hope I'm wrong of course, but these numbers scare me big time. —Dwayne

Where do you see stocks headed in 2023? Write me at chriswood@riskhedge.com.