“There are no houses wherever I look…

Any that come on the market are either too expensive or gone the next day…”

RiskHedge Managing Editor Jason Roberts is searching to buy his first home.

It’s not going well.

|

Credit Suisse confirms this mysterious force has turned 5.2 million people into millionaires. It's called the "Power Law"... And in a brand-new presentation, RiskHedge chief analyst Stephen McBride shows you how to use it to boost your stock market gains... |

“At this point, my generation has to wait for a housing collapse for a chance at home ownership.”

Jason, 29 and looking in Massachusetts, is not alone.

I know many folks down here in South Florida who’ve been searching for a home for months with no luck.

Truth is: There’s a severe shortage of houses across the US…

As RiskHedge Chief Analyst Stephen McBride recently shared with his Disruption Investor members:

The latest National Association of Realtors (NAR) data shows there are only 860,000 homes for sale right now, an all-time low. It would take just six weeks to sell every home on the market.

This is the fewest homes for sale in almost every market across America, ever.

Whether you see this as good or bad depends on your situation. If you're young and looking to buy your first home, like Jason, the lack of homes is a major source of stress.

But if you already own a home, the housing shortage has most likely boosted your net worth.

In 2021, the median home price hit $346,900—up 16.9% from 2020. It hasn’t been that high since 1999. There were 6.12 million homes sold last year, the most since 2006.

This is what a housing “boom” looks like. Last year, the mainstream media covered it from every angle. It’s taken a backseat over the past few months, with the war in Ukraine, inflation, and spiking gas prices on everyone’s minds.

But make no mistake: This housing boom is alive and well. And as RiskHedge Chief Analyst Stephen will show us… there’s an easy way to profit, whether or not you own a house.

First, let’s look at what’s continuing to drive this housing boom...

-

Housing affordability comes down to two things:

Home prices and mortgage rates.

As I just mentioned, prices are sky-high.

If you own a home, check your “Zestimate”—Zillow’s home valuation tool I wrote about in August. My home’s risen another 19% since, and there’s a good chance yours is up more than you think.

And now, for the first time in years, mortgage rates are making a meaningful rise—which means the cost of borrowing money to buy a home is rising.

This is key, because most folks, especially young families who tend to drive new home purchases, can’t pay $350,000 in cash for a house. So they borrow in the form of a mortgage.

A 30-year mortgage with a 4% interest rate costs $1,432/month. If the rate increases by 1%, the house would cost $1,610/month—a difference of $178. That adds up to $2,136 per year. Or a nice vacation.

So small moves in the mortgage rate can make or break affordability.

The fact rates are rising with home prices already near record highs has folks worried. They think this 1‒2 punch will make housing even more unaffordable… and eventually send home prices into a downward spiral.

Stephen says while that’s happened in the past, this isn’t your normal housing market.

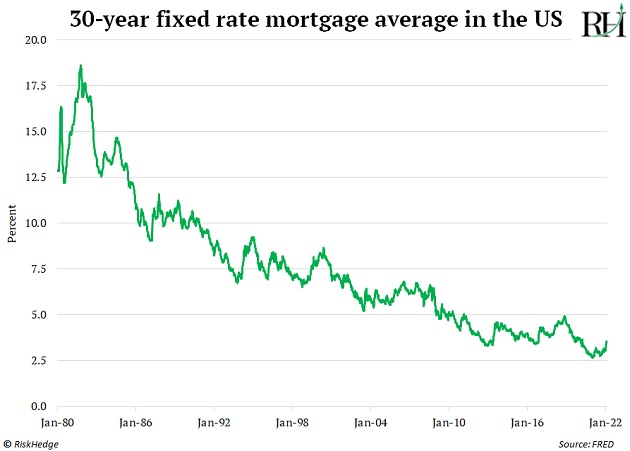

Take a look at the 30-year mortgage rate chart since 1980:

Stephen:

You have to squint to see the recent uptick in rates. And despite this move, the cost of servicing a mortgage is still lower than at virtually any other time in US history. You can borrow money for 30 years at under 4%!

Yes, mortgage rates are “up” from last year. But they’re still cheaper than at almost any other point in history.

He went on to explain a key factor at play that’s never existed before…

Keep in mind, millions of Americans refinanced at historically low rates over the past two years. In fact, one in five homeowners has a sub-3% loan locked in! They got the deal of the century… especially with inflation now running at 7%+.

The vast majority of these homeowners will NOT sell their homes… precisely because they’ve locked in the best deal they’ll ever get.

Stephen’s key point is when you sell your home, your mortgage liquidates. Then you have to take out another mortgage at prevailing (higher) interest rates to buy a new home. That deters the millions of folks who have locked in cheap mortgages from selling their homes.

Recall that the housing boom is driven by a shortage of houses for sale. Rising interest rates will exacerbate this shortage… because fewer folks will be willing to sell and lose their precious sub-3% mortgages.

So what’s the solution to America’s housing shortage?

One industry holds all the cards…

-

Buying homebuilder stocks is Stephen’s #1 way to play the housing boom.

The solution to America’s severe housing shortage is simple: Homebuilders HAVE to build more houses.

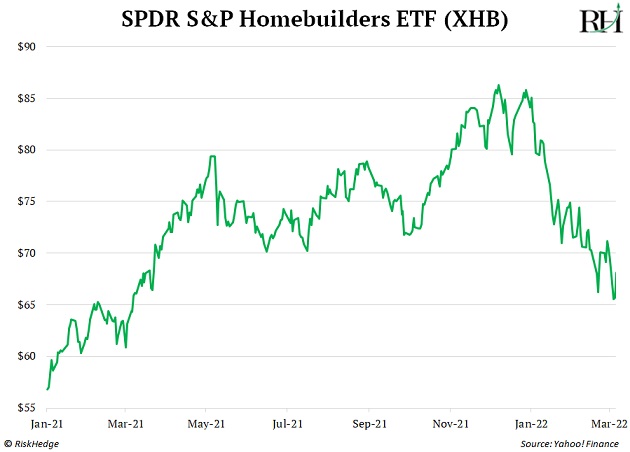

After a red-hot 2021, homebuilder stocks have cooled off.

As you can see the Homebuilder ETF (XHB) is down about 20% in 2022.

Stephen says this is a great opportunity to buy homebuilder stocks at a discount. And XHB is a solid way to get broad exposure with one click. It owns a basket of homebuilder stocks.

A better option is buying Stephen’s top homebuilder stock, currently a “BUY” in his Disruption Investor portfolio.

This stock’s valuation recently hit a 15-year low. Yet, the company reported great earnings a few weeks back.

Quarterly revenues jumped 19%... And this homebuilder closed over 18,000 homes in the last three months of 2021. In fact, one in every 10 homes sold in America is built by this homebuilder.

This is an opportunity to buy shares of America’s largest and fastest-growing homebuilder for a big discount.

You can get more details on this stock—and two others to capitalize on what Stephen’s calling the “Great Millennial Meltup”—by clicking here.

Chris Reilly

Executive Editor, RiskHedge