The bulls are back with a vengeance.

Over the past couple weeks, we’ve seen a monster move in equities.

The SPDR S&P 500 ETF Trust (SPY) has jumped nearly 10% in a little over two weeks. The Invesco QQQ Trust (QQQ), with its heavier concentration in tech stocks, has done even better. It’s spiked 14% over the same stretch.

Naysayers are calling this a “dead cat bounce.” Basically, they think it’s a sucker’s rally meant to lure investors back into stocks before the market rolls over.

I see things differently.

I believe we’re witnessing a “lockout rally.” This is when stocks take off without pausing.

Lockout rallies catch most folks by surprise, hence the name. You either get left behind or “pay up” to get involved.

There’s also a third option. Instead of chasing high-flying stocks, you can buy stocks that aren’t yet extended.

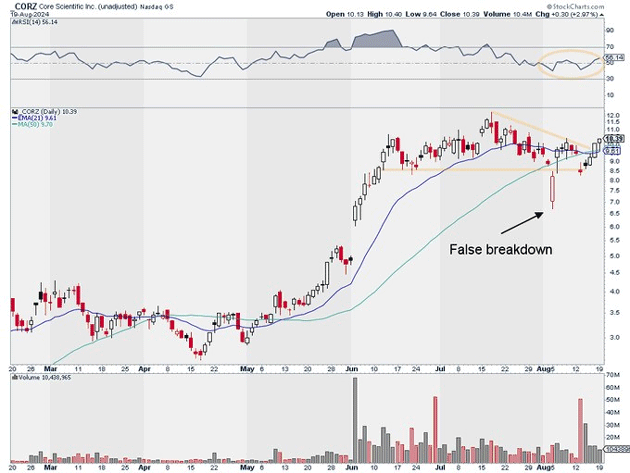

That brings me to my latest Trade of the Week: Core Scientific (CORZ).

CORZ is a $2.7 billion data center/bitcoin mining stock. And it’s one of the strongest stocks on the planet.

This year, CORZ has returned more than 200%. But we’re definitely not chasing CORZ here.

To understand why, take a look at its daily chart.

As you can see, CORZ is coming off a “false breakdown.” This is when a stock looks like it’s about to fall off a cliff, only to reverse course.

Like a lockout rally, false breakdowns catch most by surprise… leading to powerful moves in the opposite direction.

In short, CORZ could be setting up for a major rally.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest putting on a starter position in CORZ today. We’re playing this one small because CORZ is a smaller, more speculative name.

I believe CORZ could hit $16 over the next 12 months.

Exit your position if CORZ closes below $8.75. That gives us a risk-reward ratio of more than 4:1 on this trade.

Action to take: Buy CORZ at current market prices.

Risk management: Exit your position if CORZ closes below $8.75.

Justin Spittler

Chief Trader, RiskHedge