Ethan Brown’s life changed forever on April 22, 2019.

That day, he submitted a 224-page document to the Security Exchange Commission’s (SEC) website.

The document divulged sensitive information about the company he spent 10 years building.

It revealed how quickly his company was growing… how much money it was making... and an analysis of the threats that might one day put Ethan’s company out of business.

Up to that point, this information was confidential. It was a closely guarded secret.

If you took the time to read this document, you’d have uncovered one of the best investing opportunities to come along in years.

I know because I read the whole thing... all 224 pages.

This was a huge moment for Ethan.

He stood to make a fortune… or suffer the biggest financial loss of his life.

- “Judgement Day” came just 10 days later…

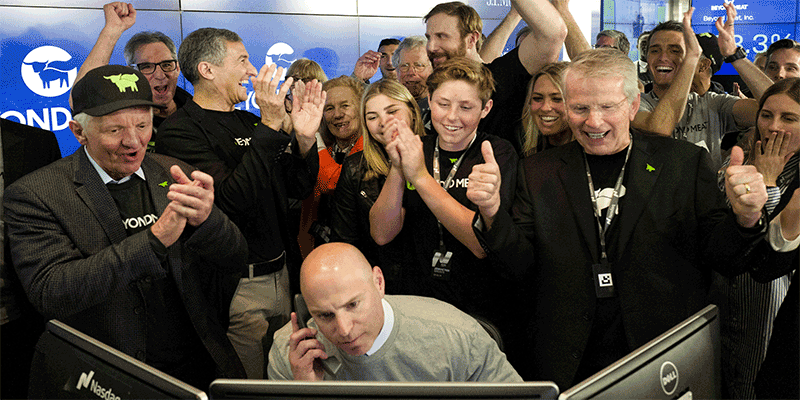

On May 2, Ethan took his company public.

That morning, he would find out if he made the right choice. Under the white-hot spotlight of the public markets, he would learn what his company was really worth.

At 9:30 am, the opening bell of the New York Stock Exchange rang.

All hell broke loose.

Investors went nuts to buy the newly trading stock in Ethan’s company. Shares opened the day up 84%.

Over the next six-and-a-half hours, shares of Ethan’s company traded hands 23,118,966 times. Shares closed the day 43% higher than where they opened, and 163% higher than where they were initially priced just 10 days earlier.

Most stocks don’t rise that much in five years. Forget about one day.

But the party was just getting started.

- Eighty-four days later, one share of Ethan’s company was worth $239.71…

That’s an 859% explosion from its initial public offering (IPO) price of $25. An IPO is when a company offers shares to the public for the first time.

This is the story of Beyond Meat (BYND)—an innovative company that makes plant-based meat that not only tastes like real meat... it “bleeds” like real meat when you cut into it.

Ten years of hard work brought Beyond Meat to this point. But the filing of that 224-page document, called an “S-1/A,” signaled its move up to the big leagues of publicly traded stocks.

Every company that IPOs must submit one of these. As I mentioned, this document lays out what a company’s all about.

An S-1/A also sets the terms for an IPO. It reveals the size of the offering—i.e. how many shares the company will offer and at what price.

In this case, Beyond Meat’s offered $241 million. It went public at a $1.5 billion valuation. Less than three months later, it was worth more than $13 billion.

Beyond Meat achieved one of the most successful initial public offerings (IPOs) ever. Few people saw it coming. Unless you’re a hardcore vegetarian, you’d likely never heard of Beyond Meat before its IPO.

Today, it’s practically a household name. A 9X return in under three months will grab investors’ attention.

- Ethan made a killing off Beyond Meat’s IPO…

So did early investors who bought into the company while it was still private.

But this wasn’t some roped-off, insider-only investing opportunity.

The chance to make big, quick profits was sitting there, open to anyone with a brokerage account.

Many everyday investors made out like bandits on Beyond Meat. One of my colleagues doubled their money on the stock in just a few weeks.

But you could have blown away those returns by simply buying BYND the minute it started trading.

A $10,000 investment ballooned into more than $52,110 in just 12 weeks!

- Believe it or not, wildly profitable IPOs like Beyond Meat are not all that rare…

Guardant Health (GH), which specializes in cancer diagnostics, soared 490% just eight months after its October 2018 IPO.

Software company MongoDB (MDB) spiked 470% after its November 2017 IPO.

Cybersecurity company Zscaler (ZS) gained 460% after going public in March 2018. And ShockWave Medical (SWAV), which sells medical systems used to treat cardiovascular disease, returned 300% in three months.

I’d bet 99 out of 100 investors have never heard of these companies. And yet they quietly made small, quick fortunes for investors who understood how to play them.

- It’s nearly impossible to get returns like this anywhere else…

Sure, you could trade options.

But buying options is too risky for most folks. One false move and you lose everything.

IPO investing is much simpler. It allows you to bag uncommon profits with common stocks.

Unfortunately, most investors aren’t tipped off to the best IPOs until its too late. They only hear about the mega IPOs.

Which is a shame... because those rarely deliver.

Uber (UBER), Lyft (LYFT), and Slack (WORK) are the latest examples of mega IPOs that flopped.

Each of these IPOs got 10X more airtime than all of the hugely successful IPOs I mentioned above, combined.

And yet, you would have gotten your “face ripped off” investing in them.

UBER has plunged 32% since its May 9 IPO. LYFT plummeted 36% since its March 29 IPO. And WORK has dropped 26% since June 20.

Please understand, when it comes to IPOs, the media is your worst enemy.

Over and over again, they hype up giant, popular IPOs like Uber. Over and over again, these giant, popular IPOs flop. And over and over again, the media totally ignores the IPOs of smaller, lesser-known companies that go on to hand out big profits.

It’s no wonder profitable IPOs fly under the radar of most investors.

If you didn’t take advantage of these recent IPOs, it’s not too late. There are plenty more revving their engines on the runway, preparing for takeoff.

- The backlog of “unicorns” is massive...

A unicorn is a private company worth $1 billion or more that does not yet trade on the stock market. Think of them as future IPOs.

They’re called unicorns because they used to be rare. Not anymore. According to CB Insights, there are 393 “unicorns” worldwide. Nearly half of those are US companies. Together, these companies are worth more than $1.2 trillion!

This “future IPO” list is my bible. I check it every day, and I’ve done “deep dive” research on many unicorn companies.

There are around 50 “gems” on that list that I can’t wait to buy when they go public.

- Two promising unicorns will IPO later this week…

SmileDirectClub (SDC) is set to IPO this Thursday. SmileDirectClub sells invisible teeth liners, but you don’t need to visit a dentist or orthodontist first. You simply visit one of its locations or make a mold of your teeth at home.

Its treatment costs just $1,895. That less than 1/3 of what typical braces cost.

SmileDirectClub’s sales are growing at an incredible 190% year over year. And there’s still plenty of opportunity ahead. Hundreds of millions of people worldwide have crooked teeth. Less than 1% receive treatment each year.

The one big knock on SmileDirectClub is its IPO valuation. The company is set to go public at a valuation of almost $8 billion. That’s a bit rich for my taste. And, according to my database of IPO returns, IPOs that big don’t often explode out of the gate like Beyond Meat did. So, I’ll be watching this one for a pullback.

Cloudflare (NET)—another exciting unicorn—will IPO on Friday. Cloudflare is a web performance and security company. It serves nearly 10% of all global internet requests.

Like SmileDirectClub, Cloudflare is rapidly growing. Its sales have grown 50% per year since 2016.

I could see Cloudflare stock getting off to a very strong start. Several recent IPOs similar to Cloudflare have performed great. CrowdStrike (CRWD)—a cloud computing company—spiked 200% after its June IPO. Fastly (FSLY)—an internet security company—has jumped 120% since it went public in May.

I’ll update you on SmileDirectClub and Cloudflare following their IPOs.

Did you make a killing on Beyond Meat, Roku, or another hot IPO? Tell me about it at justin@riskhedge.com.

Justin Spittler

New York, New York