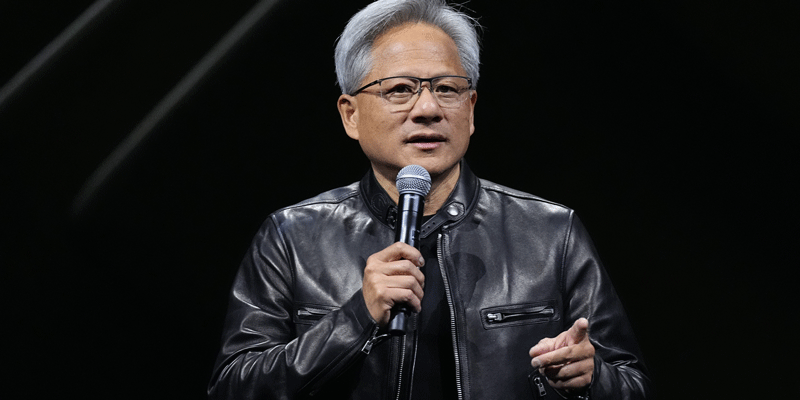

Did Jensen Huang just do a 180 on quantum computing?

Last week, the CEO of Nvidia (NVDA) was asked about the technology.

He said that “very useful quantum computers” are likely to be 15–30 years away.

Jensen’s words carry extreme weight. After all, Nvidia is the global leader in artificial intelligence. It’s safe to say he knows what he’s talking about.

That’s why his comments sent quantum computing stocks into freefall.

Rigetti Computing (RGTI) plummeted 45% the next day. IonQ (IONQ) nosedived 39%. Several other quantum names fell more than 40% in a day.

The bleeding didn’t stop there. Many leading quantum stocks went on to plunge more than 60% over the course of just a few days following Jensen’s comments.

Keep in mind, quantum computing stocks were the hottest trade in the entire market up until this point.

Prior to the selloff, RGTI had surged more than 3,100% since September. D-Wave Quantum (QBTS) had skyrocketed more than 1,300% over the same period. Quantum Computing (QUBT) had surged more than 7,500% since June.

They were easily the hottest stocks on the planet!

Sentiment changed in the blink of an eye when Jensen made his comments. Many even started saying that he popped the “quantum bubble.”

But a lot has changed over the past week. Last night, Nvidia announced that it will host its first Quantum Day in March. Jensen will attend the event alongside executives from D-Wave, IonQ, and Rigetti… among others. And as I type, quantum computing stocks are rebounding strongly, with IonQ up 30%+...

This makes me wonder…

Is quantum computing really 15–30 years away? Or could the technology deliver commercial applications much sooner?

I honestly don’t know the answer. I’m not a technologist. I’m a trader.

My job is to manage risk first. And after their parabolic moves, it’s become more difficult to manage risk on quantum computing stocks.

The stocks are swinging wildly in both directions. That doesn’t mean you can’t make money off them. You just need to be more careful at this stage.

If you’re going to trade these highly volatile names, I suggest using smaller position sizes. This simple risk-management technique will keep your downside potential manageable, while also capturing big upside in the event of another big leg up.

Justin Spittler

Chief Trader, RiskHedge

PS: It’s also easier to manage risk when you buy a stock in an uptrend.

See, trends in motion tend to stay in motion. Stocks that are rising are more likely to keep rising… and vice versa.

In Express Trader, I drill down on the strongest sectors to identify the three best individual stocks in the market for that week. And I let you know when it’s time to move on to the next opportunity. See if it’s right for you here.