Before I get to today’s trade, I want to thank everyone who took the survey I sent out. I received over 500 (!) responses, and I got to read firsthand what you’re looking for to succeed in trading stocks.

It was extremely helpful, and now I’m ready to share what’s next.

More details to come soon—or you can go here now to see for yourself.

Now, on to today’s trade...

For the past few weeks, “defensive” stocks have been the hot trade.

The Consumer Staples Select Sector SPDR Fund (XLP) has rallied 11% since the beginning of July. The Utilities Select Sector SPDR Fund (XLU) has gained 16% over the same stretch. Both ETFs closed at new all-time highs on Friday.

The Real Estate Select Sector SPDR Fund (XLRE) has been on a tear, climbing 20% since the first week of July, while the Health Care Select Sector SPDR Fund (XLV) is up 9%.

These groups have massively outperformed the broad market. And that has some investors spooked.

But not me. I believe this is just run-of-the-mill rotation, which is normal during bull markets.

That said, the easy money in defensive stocks has been made.

Without getting too technical, all four of the defensive sector ETFs have hit “overbought” territory on their weekly charts.

This often marks local tops… meaning money may soon flow elsewhere. My money is on the “risk on” groups playing catch up.

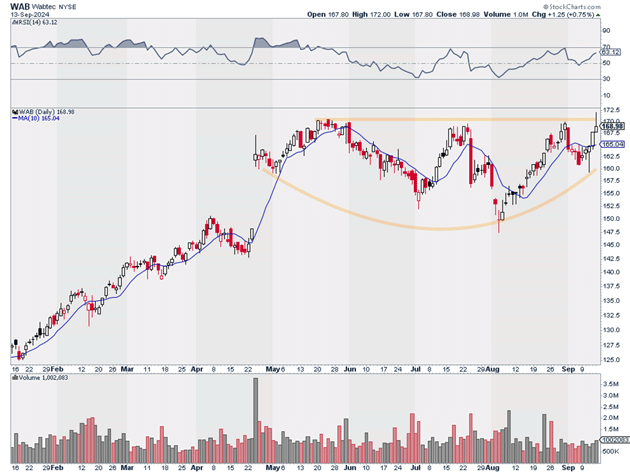

That brings me to my latest Trade of the Week: Wabtec (WAB).

Wabtec, or Westinghouse Air Brake Technologies Corp., is a $30 billion industrial company that makes brakes for trains. It might not sound like the most exciting company. But WAB has been one of the strongest industrial stocks this cycle.

It’s rallied 59% over the past 12 months and is currently trading just 1% below its all-time highs.

This is the relative strength I look for. It tells me WAB is in a prime position to lead industrials higher in the weeks ahead.

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

I suggest picking up shares in WAB today. I believe the stock could hit $250 over the next 12 months.

Exit your position if WAB closes below $157. That gives us a risk-reward ratio of 7:1 on this trade.

Action to take: Buy WAB at current market prices.

Risk management: Exit your position if WAB closes below $157.

Justin Spittler

Chief Trader, RiskHedge

PS: And if you’re interested in taking advantage of what I’ve prepared for you after seeing the overwhelming responses to my survey, just go here. Thank you.