Did you know the worst US stock market crashes of all time happened in October?

There was the Bank Panic of 1907…

The Wall Street Crash of 1929…

And Black Monday in 1987, when the Dow plummeted 22.6% in one day.

And those are just the “biggies”…

There’s also the mini crash of October 1989… the October 1997 sell-off… and the October 2008 stock market crash—when the Dow fell 18% in a week.

Because of this, October is feared on Wall Steet as “crash month.”

Today, let’s look at the facts to see…

-

Is there any truth to the “October effect?”

Is this a real worry? Or just a silly superstition like Friday the 13th?

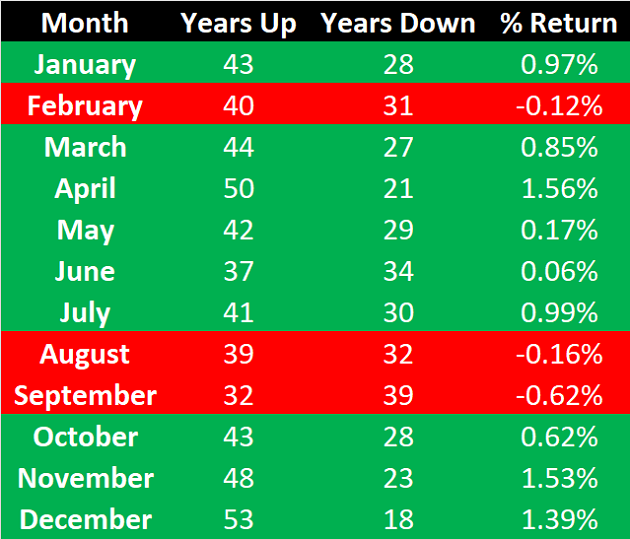

To answer that, let’s examine the average return of stocks each month, going all the way back to 1950.

As you can see, stocks have risen an average of 0.62% in October going back 70 years.

That doesn’t exactly scream “crash.”

But more important, look at the last three months…

October tends to kick off the best three-month period of the year.

Seventy years of data says now is the best time to buy stocks in anticipation of a strong finish to the year.

Of course, this conclusion comes with a big caveat. Seasonal trends can only tell us what happens “on average.” It’s useful info, but don’t mistake it for a crystal ball.

Last October, the market fell 6%. The October before that, it rose 3%. Anything can happen in any individual year.

The important thing is this:

-

Now that it’s October, you’re all but guaranteed to see scary headlines trying to grab your attention…

“The October Crash is looming…”

“Get out of stocks now, crash month is here…”

Ignore them.

Don’t let these misleading stories shake you out of the markets.

Instead, focus on the big, disruptive trends that really matter.

-

Like the rise of the Millennial investor...

Last year, Millennials—adults aged 25–40—surpassed Baby Boomers as the largest generation ever.

According to Chief Analyst Stephen McBride:

Millennials are about to become the richest generation on earth. Today’s Millennials are about to inherit $68 trillion in wealth from their Baby Boomer parents.

In fact, Millennials will inherit a mind-boggling $24 trillion alone in 2021 according to a recent UBS report.

And they aren’t squirrelling away those trillions under the mattress waiting for a rainy day.

Instead, Millennials are entering the stock market in droves.

Last year all the major brokerages like Charles Schwab, E-Trade, and TD Ameritrade saw a record number of new account openings. And it was mostly young folks who were signing up.

Robinhood, the Millennial generation’s favorite trading app... has added over 10 million new accounts in the past year.

This is the type of market-shaping news you should focus on. Not fear-mongering about an October crash that’s unlikely to come.

Stephen says the rise of the Millennial investor is a MASSIVE trend that everyone needs to be aware of. The richest, largest generation on the planet is pouring into the market at once. And Stephen says it’s “jet fuel that will propel the stock market higher for a long time.”

Just how high… and for how long?

One legendary market technician, who seems to agree with Stephen’s thesis, recently put a specific figure on it.

Wall Street firm Fundstrat’s Tom Lee says:

-

The S&P 500 could soar 362% by 2038 as Millennials are “poised to become the most important driver of the US economy over the next two decades.”

Here’s Lee quoted in Business Insider:

With the prime age (30 to 50) of the Millennial generation not expected to peak until 2038, the stock market should have a long runway of future growth.

The year 2038 is a long way away… and predicting stock market returns 17 years out is far from an exact science. But we agree with Lee: You want to bet with the enormous Millennial tailwind working in the stock market’s favor.

To make the most of this opportunity, Stephen recommends three specific, generational stocks that will play a huge role in Millennials’ lives over the coming decades.

I’m not talking about risky plays like GameStop, AMC, or trying to guess the next hot “meme” stock from a message board.

Instead, Stephen has found a much better way to capitalize on the Millennial Melt-Up for 10X your money or more…

In this briefing he shows you exactly how it’s done… and he details the three stocks to buy today to set yourself up for big profits.

Chris Reilly

Executive Editor, RiskHedge