Can you name America’s greatest invention?

The U-S-A pioneered many world-changing disruptions.

The internet, airplanes, computer chips, TV, nuclear power, and refrigerators were all invented by Americans.

But the award for the #1 invention of all time goes to… fixed-rate mortgages.

When Americans sign on the dotted line to buy a house, they typically lock in their monthly payment. Roughly 95% of current US mortgages are “fixed rate.”

It’s the total opposite in almost every other country.

Here in Ireland, homeowners are getting squeezed as interest rates surge. My aunt’s monthly mortgage payment jumped 13 times in the past 16 months!

You surely know borrowing costs are spiking to multi-decade highs. Many folks are predicting this will lead to a housing crash.

Wondering whether home prices are set to plunge?

Concerned a housing bust could crush the stock market?

Then today’s letter is for you.

- “It’s 2008 all over again”...

You know exactly what “2008” means.

During the '08 financial crisis, 9 million Americans lost their homes.

Another 10 million lost their jobs.

And stocks cratered 56%.

The source of this carnage was a collapse in US housing. Between 2006 and 2009, the average home lost over a quarter of its value.

The fallout scarred a whole generation of Americans.

For the past decade, folks have been biting their nails, waiting for housing to take another dive. So when home prices dipped last year, predictions of a 2008 rerun were everywhere.

Mortgage rates almost tripled over the past two years, raising the cost to buy a home.

Buyers purchasing an “average” house today can expect to pay $2,600/month. That’s $1,000 more than someone who bought the same house two years ago!

Folks predicted this would price millions of would-be homebuyers out of the market. “Strap in, because it’s '08 all over again,” we were told.

- My friend, who’s a portfolio manager, recently reminded me of an important investment truth...

Some of the greatest investments come from finding “anomalies” in the market: “To find these opportunities, ask yourself: What IS happening that SHOULDN’T be?”

Surging prices and mortgage rates pushed housing affordability down to its lowest levels since 1989. Yet home prices climbed for a fourth straight month.

This SHOULDN’T be happening, but it IS. Housing is one of the biggest anomalies (opportunities) in America today.

I’m a long-time housing “bull.” I first told RiskHedge readers to buy homebuilder stocks back in 2019.

As housing expert Barry Habib always says during our calls, “The most important driver of home prices is supply and demand.”

Surging mortgage rates did put homeownership beyond the reach of many potential buyers (demand). But it also took millions of homes off the market (supply).

When borrowing costs collapsed to record lows during COVID, homeowners jumped at the chance to refinance. Millions of first-time buyers raced into the market, too.

In fact, more than 40% of all US mortgages stem from 2020 and 2021.

That’s how borrowing costs for 99% of homeowners are below the current 7% rate your bank offers.

I present to you the magic of the fixed-rate mortgage in all its glory.

Millions of Americans locked in 3% mortgages over the past few years. What homeowner in their right mind would sell and surrender this gem?

Remember, buyers purchasing an average house today must fork out $1,000 more per month than their neighbors who bought in 2021.

In short, 3% mortgages are like a pair of golden handcuffs, preventing homeowners from selling.

The recently divorced or deceased: Those are basically the only people listing homes for sale today.

- This is nothing like 2008…

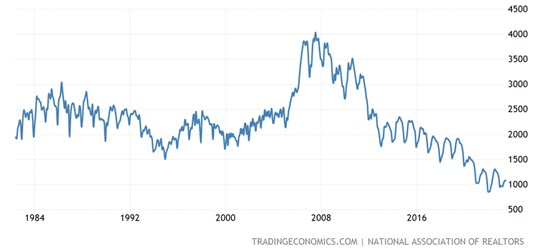

In 2008, there were 4 million homes listed for sale. You couldn’t give them away.

In 2019, there were 1.8 million homes on the market.

In 2023, the number of houses for sale is hovering just above 1 million. There are fewer homes on the market today than at any time since recording began.

Source: National Association of Realtors

Source: National Association of Realtors

Remember, the most important driver of home prices is supply and demand.

There are still many house hunters (demand) today. Meanwhile, the number of homes for sale (supply) is at record lows.

That’s why US home prices keep climbing.

If you’re a homeowner fretting that the value of your property is about to plunge, STOP.

The crash isn’t coming. The US housing market is stronger than anyone believes. Heck, today, the average listing is scooped up in less than three weeks!

I’m predicting home prices will hit record highs within the next year.

- Here’s how to profit from the boom nobody believes in.

Existing homes make up the bulk of the housing market. Roughly 90% of sales are houses that were previously lived in.

But virtually nobody is selling their home right now.

That means we must build millions of new homes.

“New builds” accounted for one-third of all homes sold last month. That’s a 2X jump from the long-term average.

Data from the National Association of Realtors shows new home sales as a share of the overall market are hitting record highs.

Source: The Wall Street Journal

Source: The Wall Street Journal

New builds are the only game in town for house hunters.

Existing home sales slumped 20% over the past year. Meanwhile, new homes moved in the opposite direction, jumping 20%.

This is GREAT for homebuilders.

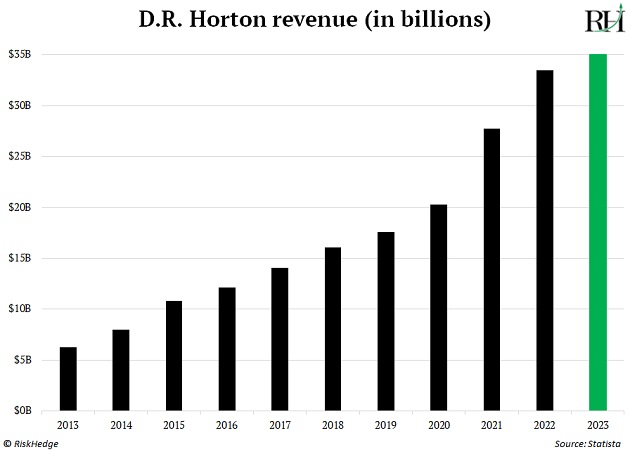

America's largest homebuilder, D.R. Horton (DHI), crushed earnings last week.

Revenues jumped 11% to a new quarterly record. D.R. Horton expects to sell 83,000 homes this year. For perspective, at the height of the housing bubble in 2006, it closed 54,000 homes.

America's largest homebuilder expects revenues to hit $35 billion this year. That puts it on track for 11 straight years of record sales.

Millions of would-be homebuyers are scrambling to try to find a place to live. D.R. Horton is selling the scarcest goods in America right now.

The best time to invest in homebuilders was in 2019, when I recommended them to RiskHedge readers. Today is the second-best time to buy.

You can buy the Homebuilders ETF (XHB). I prefer to own America’s top builder, D.R. Horton.

Don’t be fooled into thinking a housing crash is around the corner. We’re roughly halfway through a multi-decade housing expansion.

This boom still has legs, friends.

Stephen McBride

Chief Analyst, RiskHedge