I’d like you to meet the most powerful stock picker in the world.

His influential words will often crash a stock… or cause it to soar.

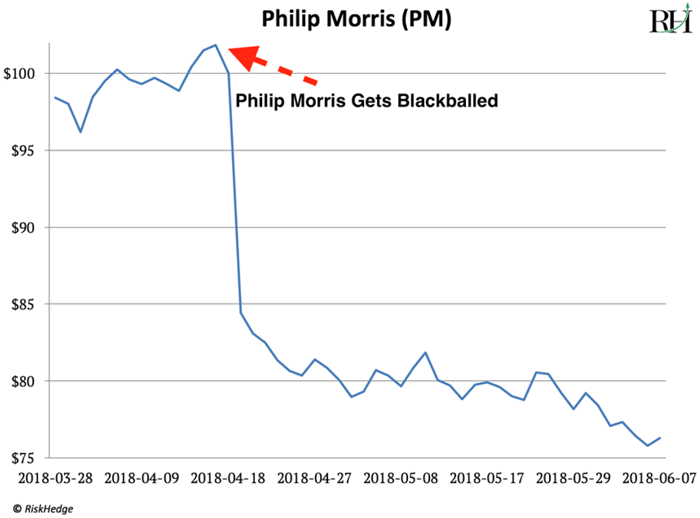

In April, he dropped the hammer on Philip Morris (PM), the world’s largest tobacco company. It plunged 25%, as you can see right here:

Source: Yahoo Finance

And back in 2013, his endorsement led to a 114% gain in an index that tracks the stock market of the United Arab Emirates.

He recently made a new disruptive announcement that’s causing billions to flood into an under-the-radar investment. I’ll tell you about that in a moment.

- First, you should know the world’s most powerful stock picker is not a human. It’s a company called “MSCI.”

MSCI creates and tracks indexes. A stock index, as I’m sure you know, is simply a group of stocks. The S&P 500, the Dow Jones, and the Japanese Nikkei are all indexes.

MSCI dominates the index game. It controls over 190,000 indexes, many of them so ingrained in the markets that we often refer to them without realizing it.

Consider the statement "emerging market stocks gained 1% today.” We’ve all heard this dozens of times. But stop and think what it actually means. There are thousands of emerging market stocks. Which ones in which countries are we talking about?

This statement refers to the MSCI Emerging Markets Index. It’s so ingrained as the accepted benchmark that it’s synonymous with “emerging market stocks.”

- 12.4 trillion investment dollars worldwide track MSCI indexes.

Many giant pools of money like university endowments, ETFs, and pension funds must own the stocks included in the MSCI index they track. And often, they are prohibited from owning stocks that are not in the index.

As you can imagine, this gives MSCI a lot of power. Earlier, I mentioned how Philip Morris stock plunged in April. This happened when MSCI announced that it will be kicking all tobacco stocks out of its indexes. That’s all it took for poor Philip Morris shareholders to get steamrolled for a 25% loss.

I’ll give you another recent example of MSCI’s stock-picking power. In 2013 the company said it would start including stocks from the countries of the UAE and Qatar in its Emerging Markets (EM) Index. Over 1.9 trillion investment dollars track it.

It didn’t take long for big Wall Street money to start flowing into these small markets. Within 12 months the Qatari stock market had soared 48%... and the UAE skyrocketed 114%.

As you can see, MSCI decisions literally move markets.

- On June 20, MSCI announced it will add Saudi Arabian stocks to its EM Index starting in May 2019.

MSCI will allocate 2.6% of its EM index to Saudi Arabian stocks. As I mentioned, $1.9 trillion tracks this index. Which means this decision will cause at least $49.4 billion to flood into the Saudi market in 2019 alone.

The Saudi stock market is tiny. Its total value is about $500 billion. Apple (AAPL) is 2x the size of every publicly traded firm in Saudi Arabia combined.

- $50 billion flooding into Saudi Arabia’s market is the equivalent of $780 billion gushing into US stocks.

All the data tells me this will spark a boom in Saudi stocks. Since 1994, MSCI has promoted 20 countries to its Emerging Market index. The average return leading up to the year of inclusion was 55%.

That italicized part is very important. MSCI made this announcement on June 20. But it won't add Saudi stocks to the index until May 2019, which means the big money that tracks MSCI indexes are starting to pump in billions now.

- Saudi Arabia is a wealthy country…

It’s the world’s 15th-largest economy, bigger than Canada and even Australia.

It owns 22% of the world’s oil reserves, which is worth an estimated $1.3 trillion. It has $500 billion in foreign currency reserves—more than Germany, France, and the US combined. And it controls a massive $230 billion sovereign wealth fund.

In other words, Saudi Arabia is not your typical “emerging” market. Most emerging markets, like China and India, are emerging from poverty. Saudi Arabia is emerging from self-imposed religious seclusion.

After 40 years of keeping its doors mostly shut to out the outside world, Saudi Arabia is finally opening up. It officially opened its stock market to foreign investors three years ago, which paved the way for MSCI’s landmark decision.

- We’re buying the Saudi Arabia ETF KSA today.

Blackrock created this ETF (KSA) in 2015. KSA is the best performing country ETF this year. It shot up over 19% while US stocks are up 6%.

KSA owns large Saudi companies, including the world’s fourth-largest industrial company and the Middle East’s two largest banks.

There’s currently $275 million invested in KSA. The amount of dollars invested in the fund has shot up 1,700% this year alone. I expect this trend to continue leading up to Saudi Arabia’s MSCI inclusion in May 2019.

KSA pays a decent dividend of 2.02%. It has an expense ratio of 0.74%, which is about average for “country” ETFs. The 75 Saudi stocks it owns are fairly valued; some even tilt toward bargain status. The price-to-earnings ratio of the fund is 17, lower than the S&P 500’s 24.

We’re buying the Saudi Arabia ETF KSA at today's price of $31.

KSA is up 2.7% since the initial announcement on June 20. We haven’t missed anything yet. I’m convinced the big gains are ahead of us. Remember, the 20 countries promoted to MSCI’s Emerging Market Index since 1994 had average returns of 55% in the year leading up to inclusion.

I believe it’s a wise move to get into KSA before tens of billions of investment dollars flood into Saudi Arabia over the next 10 months.

That’s all for today. As a heads up, I’m working on an essay about the death of an important American industry. Few see this coming, but my research shows its going to disrupt up to 3% of American GDP and at least a dozen stocks that many investors wrongly believe to be “safe.” Look for it in your inbox next Thursday afternoon.

Talk soon,

Stephen McBride

stephen@riskhedge.com

Chief Analyst, RiskHedge