It’s time to double down on one of today’s hottest trades…

Copper.

Copper is one of the world’s most critical commodities. It’s used in everything from electrical wire to piping.

It’s always been vital to the global economy. But it’s becoming more important by the day, thanks to megatrends like artificial intelligence and the “electrification of the grid.”

But don’t just take my word for it. Consider what Stanley Druckenmiller—arguably the greatest trader to ever live—told CNBC last week:

Copper is a pretty simple story… Takes about 12 years to produce copper, and you got EVs, the grid, data centers, and—believe it or not—munitions. These missiles all got enough copper in them… that we just think the supply-demand situation is incredible for the next five or six years.

In other words, copper isn’t a “flavor of the month” trade. It’s a megatrend.

This is why I suggest adding to Freeport-McMoRan (FCX) today.

I recommended buying Freeport—one of the world’s largest copper mining companies—on April 30.

Specifically, I suggested building out a starter position in FCX over the coming weeks.

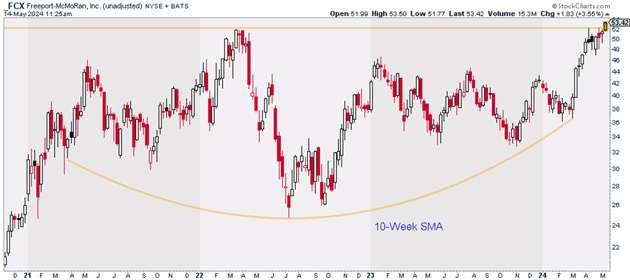

I said this because FCX has been on a tear as of late. But FCX hasn’t pulled back as I expected. Instead, it’s starting to break out:

Source: StockCharts (click to enlarge)

Source: StockCharts (click to enlarge)

This speaks to how strong FCX and copper miners in general are at the moment.

In fact, I see FCX headed much, much higher in the coming months.

This is why I suggest turning your starter FCX position into a half position today. I believe FCX could hit $70 within the next 12 months.

Exit your position if FCX closes below $49. That gives us a risk-reward ratio of more than 3:1 on this trade.

Action to take: Buy FCX at current market prices.

Risk management: Exit your position if FCX closes below $49.

Justin Spittler

Chief Trader, RiskHedge