There are times to be aggressive.

And there are times to exercise caution.

Now is the latter.

That might surprise you. After all, stocks have been on a tear all year.

They’ve rallied in the face of high interest rates, inflation concerns, uncertainty over what the Fed may or may not do, and recession fears.

This is classic risk-on behavior. But stocks don’t go up forever, even in bull markets.

After an historic start to the year, the market looks due for a breather… at least at the index level.

Let me explain…

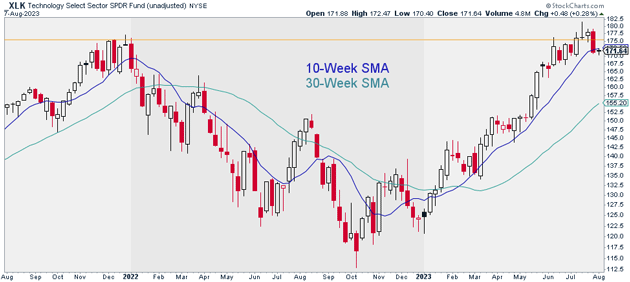

The first chart you need to be aware of is the Tech Sector Fund (XLK). XLK broke out to new all-time highs a few weeks ago.

That was a bullish development. But there was just one problem…

XLK couldn’t stick the landing. It had a “false breakout,” which often leads to fast moves in the opposite direction.

Source: StockCharts

Source: StockCharts

If tech sells off here, it would be a problem for the indices. That’s because tech makes up 29% of the S&P 500… and 50% of the Nasdaq.

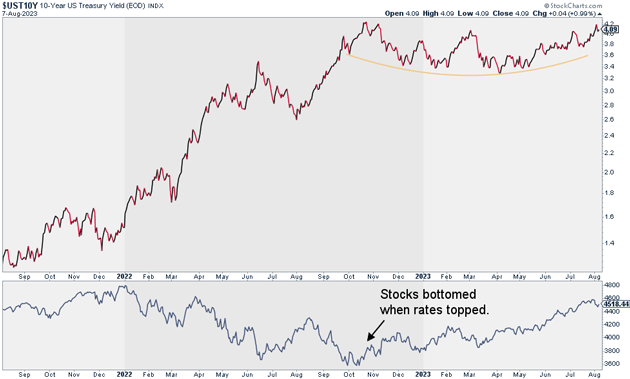

I’m also concerned about interest rates rising rapidly again.

The chart of the 10-Year US Treasury yield below says it all...

For most of 2022, the 10-Year yield climbed. Stocks didn’t like that one bit. In fact, it wasn’t until interest rates topped out last October that stocks bottomed.

Since then, rates have more or less traded sideways. Stocks got used to higher interest rates, so they started rising again.

The problem is that rates are inching higher once more. If they break out of the base they’ve been forming since late last year, stocks could sell off hard.

Source: StockCharts

Source: StockCharts

Of course, this doesn't mean all stocks will decline.

After all, there’s always a bull market somewhere. But traders need to choose their spots wisely.

Personally, I like playing the rotation out of red-hot sectors like technology into other sectors as a catch-up play.

Specifically, I like energy stocks.

In my premier advisory, RiskHedge Live, we’ve added four energy trades to our portfolio in recent months, including the Energy Select Sector SPDR Fund (XLE).

Justin Spittler

Chief Trader, RiskHedge