We’re fresh off the heels of our first major event of the year: the 5X Phase Summit…

It was the first time ever microcap expert Chris Wood and I have gone “live” together publicly.

And I should give you fair warning:

If you like snazzy productions… then this might not be for you. This presentation is raw. We rushed it out as quickly as we could. Because time is short…

I can’t do justice to Chris Wood’s whole case here. But in short, he’s discovered a little-known market setup that’s only happened twice before in his 20-year career.

|

[The 5X Phase Summit with Chris Wood—Now Playing] Did you watch? In today's "5X Phase Summit" Chris walked viewers through his strategy for finding tiny companies on the verge of MASSIVE growth... ones that have delivered his readers gains of over 1,800% on a single trade. He also revealed what he's calling the #1 buying opportunity in 22 years. The replay is only available for a limited time, so click here to start streaming immediately. |

And the last time it happened, some of Chris’s readers saw 500%, 1,000%, and even 2,000% returns in under a year.

We know many of you have busy lives and couldn’t make the event. So if you’d like to know the easy way to capitalize on this opportunity, click here to watch the replay.

After watching that, make sure to read today’s follow-up interview between Chris and me. It covers something important we didn’t get the chance to talk about during the event…

See, one of his microcap picks was acquired for a large premium last month—just like he predicted.

It caused the tiny stock to shoot up 260% overnight—giving his premium Project 5X members a nice payday.

Below, Chris shares why he picked Resonant… and a key strategy anyone can use to spot tiny stocks with large profit potential.

Reilly: Chris, that was a fun event… But one thing we didn’t talk about was the big acquisition of Resonant (RESN), the tiny 5G filter play with game-changing technology you discovered for your readers.

Can you catch us up on why you picked Resonant?

Wood: Sure. In short: I saw that Resonant was a tiny company with a big breakthrough for the massive 5G market. Specifically, what got me interested was its revolutionary radio frequency (RF) filter technology.

In short: The job of an RF filter is to let the right signals in and keep the wrong signals out. Without these filters none of our wireless devices would work.

But today’s filters can’t handle the frequency and bandwidth requirements needed for 5G. Resonant’s RF filter technology fixes that. And I was able to see it up close.

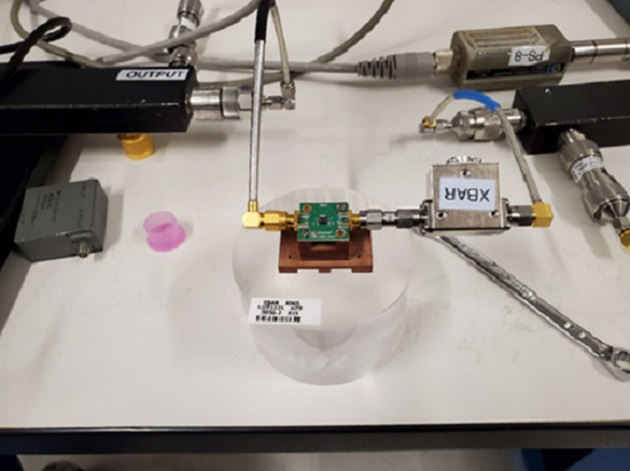

In October 2020, I flew out to Resonant’s headquarters. Here are two pictures I took.

Resonant’s CEO (left) and me (right)

Resonant’s CEO (left) and me (right)

A prototype of the company’s game-changing 5G filter technology

A prototype of the company’s game-changing 5G filter technology

The trip was well worth it. I confirmed their technology and I recommended the company to my premium subscribers right away.

Reilly: But that wasn’t all you saw in the company when you recommended it… You mentioned the chance of a big acquisition…

Wood: Right… So, when I’m analyzing microcaps, one of the things I look for is the potential for the company to be acquired for a big premium. “Premium” refers to how much higher the buyout price is than the stock price pre-acquisition.

The acquiring company—which is usually large—will offer to buy a smaller company’s shares for more than they trade for on the market. It usually does this because the microcap they’re after owns technology and patents they want for their business.

Reilly: Give us an example please…

Wood: Let’s say a company called Microcap A has breakthrough technology that could be worth billions someday. But it’s an early-stage company with a stock price of just $1.

Meanwhile a company called Largecap B wants to get its hands on that technology. So it buys Microcap A for $2/share. Microcap A was acquired for a 100% premium.

That would be a big win for the microcap’s shareholders. Their stock doubled in value overnight.

How it plays out in reality is actually more like this:

One or both of the companies would announce the acquisition and the price. And the microcap’s stock price would immediately jump to within 5‒10% or so of the buyout price. (It doesn’t jump to the full acquisition price because there’s always some risk the transaction won’t close.)

So as the close of the transaction date gets closer, the stock price will get closer to the actual buyout price.

When the transaction closes, the stockholders receive a cash payout for the agreed amount.

Reilly: How long does it typically take for this to play out?

Wood: These transactions often take a month or more to close. Sometimes longer. And there’s always the risk that the transaction doesn’t close at all.

So, here’s my #1 strategy for profiting off acquisitions in the microcap space:

I prefer to sell my stock in the company that’s being acquired right after the announcement.

Reilly: Why’s that?

Wood: It’s not worth it to me to wait around for the additional 5‒10% gain. Especially when we’re already talking about a gain of 100%+.

We followed this strategy with Resonant.

In short: The largest RF filter manufacturer in the world, Murata, wanted to own Resonant’s tech.

Murata offered to buy Resonant for $4.50 per share… a 260%+ premium.

When the acquisition was announced after market close on February 14, 2022, Resonant’s stock immediately shot up from $1.23 to about $4.40.

We sold the stock on February 15 for $4.39, which was only about 2.5% less than the offered acquisition price.

Reilly: You predicted Murata would buy Resonant for a big premium before March 31, 2022. And that’s exactly what happened. Here’s what you said in your December 3, 2021, alert:

Murata’s exclusive rights to Resonant’s XBAR technology for use in mobile communications devices expire on March 31, 2022.

This is very important.

It means other companies in the mobile space can hire Resonant to design XBAR-based 5G filters for them starting on April 1. Murata does not want this. Because XBAR provides a huge advantage in terms of speed and cost of design.

What’s more, Resonant CEO George Holmes still expects to sign an XBAR partner for non-mobile applications by the end of this year. Such a partnership would really force Murata’s hand to make a play for the company and potentially create the scenario for a bidding war to acquire Resonant.

It’s possible that Murata allows its XBAR exclusivity to lapse, and doesn’t make a bid for Resonant even if the company secures a non-mobile partner as it expects. But I think that’s unlikely.

So, I think something big is going to happen with Resonant before March 31, 2022. And we’ll be happy we hung on when it does.

Wood: And of course it doesn’t always play out perfectly like this. But the potential for a big acquisition is a very appealing aspect to microcap investing. It’s just one of many reasons I’ve dedicated my career to the space.

Reilly: Thanks, Chris.

If you’re interested in discovering more about Chris’s unique and proven strategy for profiting off tiny stocks, make sure to watch the replay of our big event right here.

Chris Reilly

Executive Editor, RiskHedge