Nvidia (NVDA), the world’s most important stock, reports earnings this evening.

Given the huge sums of money being plowed into artificial intelligence (AI) infrastructure, I expect Nvidia to knock it out of the park once again.

But I’m a little cautious about its stock. Nvidia has produced awesome results several quarters in a row. Expectations are sky high, and good results may be “priced in.”

If you’ve been reading The Jolt, you know I’m cautious on the overall market. The S&P 500 surged 15% from November through January. But now, we’re in the seasonally weakest period.

The last two weeks of February are typically the weakest of the year. So, a quick 5%–10% decline here would be perfectly normal.

Long-term investors who own high-quality stocks in megatrends, like we do in Disruption Investor, don’t need to change a thing. But if you’re trading, proceed with caution.

- In WTF happened in 2023? I showed you America was waking up from its innovation slumber.

We’ve been stuck in a mini “dark age” for disruption over the past 15 years. New innovations were mostly “meh.”

Snagging dates on Tinder… uploading photos to Instagram… ordering pizzas through DoorDash (DASH)… and watching Netflix (NFLX) are cool, but shallow. They also enable laziness and promote isolation.

They didn’t push humanity forward like jet engines, refrigeration, or indoor plumbing did.

The good news: We’re entering a new golden age of disruption… as long as governments don’t screw it up.

- Ireland, Germany, China, and Virginia all recently blocked the construction of new data centers.

AI thirst for energy is off the charts.

AI models like ChatGPT are powered by thousands of energy hungry computer chips inside vast data centers. These systems generate so much heat they need specialized vents and fans humming 24/7 to keep cool.

A single AI system consumes the same amount of energy per day as roughly 33,000 households!

Governments are concerned AI will use up every ounce of spare electricity. This is forcing AI companies to go “off the grid” and build their own power sources.

For an endless supply of clean, safe energy, we must go nuclear.

Microsoft (MSFT) is working on plans to power its data centers with mini nuclear reactors.

It’s also training an AI model to slash the time it takes to get nuclear power plants approved by 90%.

Tech defeating red tape—you love to see it.

And one of America’s largest data center operators—Digital Realty (DLR)—recently floated the idea that new data centers should run on their own “submarine style” independent nuclear reactors.

One of the worst decisions mankind ever made was turning our back on nuclear energy. We essentially outlawed the cleanest… safest… densest form of electricity because we confused nuclear energy with nuclear bombs.

Humanity progresses by discovering new energy sources and using them to invent things. Coal power gave us steam trains. Oil gifted us “horseless carriages” (cars).

We were robbed of a new innovation age because environmentalists smothered atomic energy at birth.

Now AI is fueling a nuclear renaissance and I’m fired up about the future.

A few things this will make possible: flying cars, desalination (turning seawater into fresh water) and electricity too cheap to meter.

The only limits are our imaginations.

This renaissance is causing demand in uranium to spike. I first recommended the “Exxon Mobil” of uranium, Cameco (CCJ), in 2018. It’s quadrupled since then, and there’s plenty of juice left.

- A new chart of the century is out…

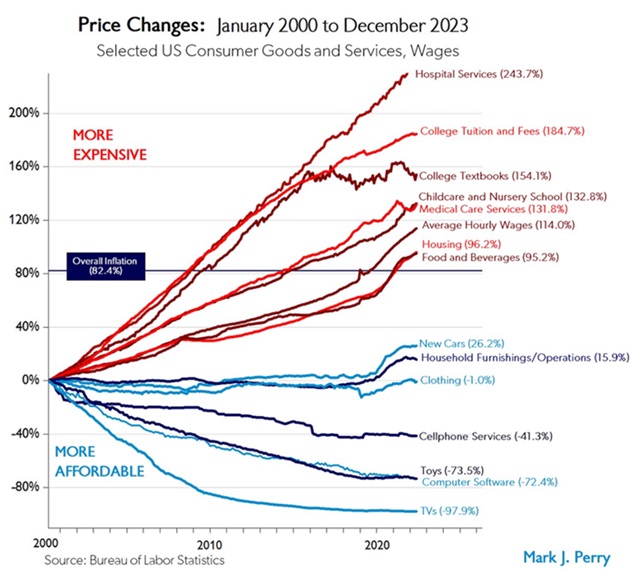

This chart tracks the prices of 14 important things since 2000.

The latest version came out last week. Take a look:

Healthcare costs (top red line) continue to surge faster than anything else. They’re even outpacing college tuitions, which is saying something.

Healthcare has become a playground for bureaucrats. Government regulation has been a total disaster for everyone except for busybody administrative jobs and health insurance companies.

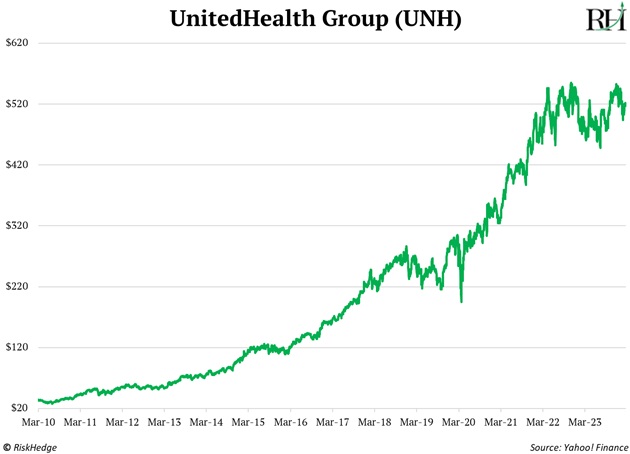

UnitedHealth surged 1,600% since Obamacare passed.

There’s so much red tape it now takes up to 15 years to get a new drug on pharmacy shelves. Doing so costs $2.7 billion on average.

AI can help fix it. One example: ChatGPT for drug discovery.

AI can “ingest” mind-bending amounts of medical data. It then connects the dots to offer new ideas that would take us mere mortals a lifetime to discover.

Biotech company Genentech recently slashed the time it takes to screen new drugs from “years” to just nine months.

And a drug discovery startup incubated by Google (GOOG) aims to halve the time it takes to find new medicines. The startup just inked deals with two of the world’s largest drug companies: Eli Lilly (LLY) and Novartis (NVS).

When drugs cost billions of dollars to develop, you must be darn sure you’ll make your money back. So pharma companies only work on drugs that treat widespread diseases.

That’s why there are less than 50 new drugs approved each year.

That means folks suffering from rare illnesses are left out in the cold. By slashing costs, AI could help cure many of these uncommon diseases.

AI will save millions of lives before it kills anyone.

Picture this…

An expert robo-doctor in your pocket who knows you’re sick before you feel the slightest bit ill. The AI knows your medical history and orders a new special drug, made for people just like you.

This future is possible if AI is allowed to work its magic in healthcare.

Instead of rubber stamping 50 new drugs/year… let’s make it 50,000.

Chris Wood and I are investing in leading AI healthcare companies in Disruption Investor.

- Today’s dose of optimism…

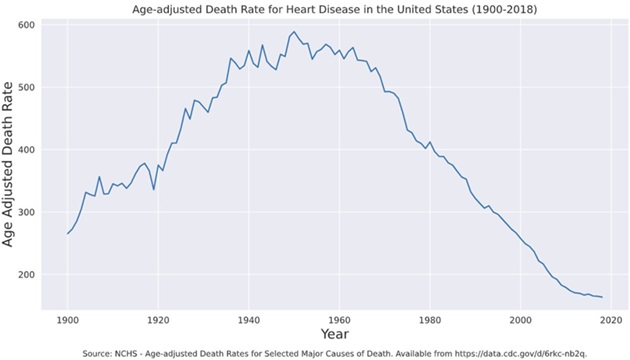

Heart disease is America’s #1 killer.

It kills roughly 700,000 people each year.

The good news: heart disease death rates plunged 75% since 1950 and are now lower than at any point in recorded history.

Source: NCHS

Source: NCHS

My advice: Don’t smoke. Exercise to “out of breath” at least every other day. And cut down on the carbs.

Then wait for the AI-powered doctor in your pocket to solve the rest.

See you Friday.

Stephen McBride

Chief Analyst, RiskHedge