Get out of oil stocks... Justin Spittler’s top sector for 2023… The biggest threat to the stock market today... Central banks are on a gold buying spree… Plus, Cornerstone Club just released its new allocations…

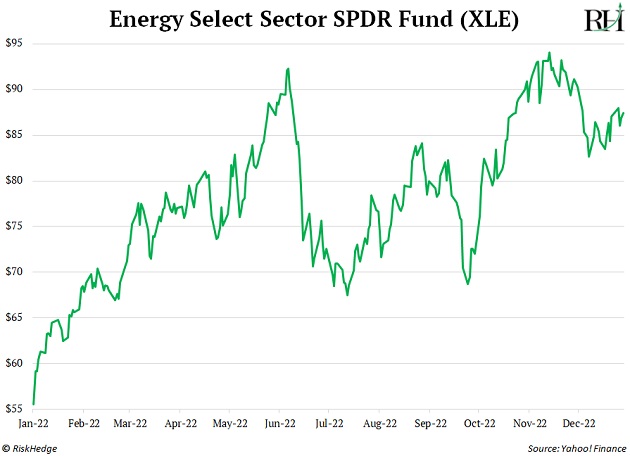

1) Energy stocks DOMINATED 2022.

Not only was energy the only sector in the S&P 500 to finish the year green...

The group, as measured by the SPDR Energy ETF (XLE), had its best year ever... soaring 57%:

Pat yourself on the back if you were smart enough to own energy stocks in 2022.

Now, it’s time to take profits.

2022 was as good as it gets for energy, particularly Big Oil. Russia’s invasion of Ukraine sent the price of oil flying. And companies like ExxonMobil and Chevron raked in record profits because of it.

But this was a one-off event. Crude prices have already plunged 40% from highs.

Oil companies now face an unsolvable problem—their dirty businesses don’t fit the “green” future the world is moving towards.

Regulation is on the rise. Wall Street is pulling investments because of environmental guidelines. Most importantly, world governments are outright banning fossil fuels.

Like they always do, these heavy-handed government commands will produce unintended disruptions. “Green” energy is nowhere near ready to step up and replace oil. But politicians are all but forcing oil companies to stop investing in new oil sources. Goldman Sachs reported:

Even as oil prices climb higher, the flow of money into new oil and gas projects has stalled as investors increasingly avoid industries that produce fossil fuels and heavy carbon emissions.

This lack of investment will lead to an exaggerated boom-bust cycle in oil prices.

For now, boom is turning to bust, and it’s a bleak outlook for oil stocks. And while 2022 probably won’t go down as oil’s “last hurrah”... I recommend cashing in any profits and rotating to an up-and-coming sector.

2) Regular readers know chief trader Justin Spittler recommended “dirty” energy stocks last February.

…If you’re looking for a smart place to put your money while waiting for tech stocks to bottom out, consider investing in commodities and dirty energy stocks.

Although they’re unloved by most investors… I expect they’ll be two of the most profitable sectors to own for the next couple months…

He was spot on. So, which stocks does Justin like for 2023? He answers:

This year, I think the big winners will be communications stocks.

Communication companies include social media giants like Meta Platforms (META), which owns Facebook and Instagram, and streaming giant Netflix (NFLX).

Last year, these stocks got pummeled. The Communication Services Select Sector SPDR Fund (XLC) plunged 38%. META and NFLX dropped 64% and 51%, respectively.

At this point, the worst is likely over for the sector. So, I’m expecting a “reversion to mean” recovery for the sector in 2013.

However, not all beaten-down sectors will do well. Real estate stocks will continue to struggle. I say this because the real estate market lags behind the stock market. In many markets across the country, housing prices haven’t come down nearly enough.

But I have no doubt that they will. The Federal Reserve has made it clear they’re committing to raising interest rates and keeping them at elevated levels for as long as it’s needed to crush inflation.

Higher rates should weigh on new construction, and home sales have ground to a halt, and that’s a problem for real estate stocks. So, I’d steer clear of the industry until the dust settles.

Let me know what sectors you think will be the winners and losers of 2023 at chriswood@riskhedge.com.

3) Justin also says to keep a close eye on the US dollar…

US stocks hate a strong dollar.

More than 50% of global transactions are settled in dollars. Additionally, most commodities are priced in dollars.

Put simply, a rising dollar makes things outside of the US more expensive. It slows down the global economy and eats into corporate profits.

The surging dollar is a main reason why markets struggled so much last year. At one point, the dollar shot up 20%.

And while it’s eased up over the past few months, Justin thinks the dollar is poised to move higher again.

That’s because the dollar index (USD) appears to be forming a classic bottoming pattern. It’s no longer declining and appears poised for a move higher:

Source: StockCharts

Source: StockCharts

If the dollar index rises, stocks will likely suffer in the short run.

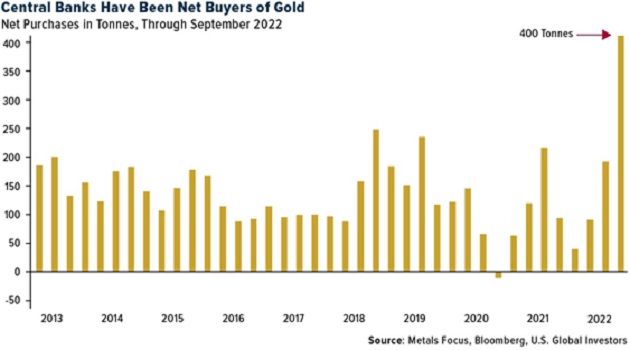

4) Gold is on a tear...

The precious metal is up 15% since November 3, and just hit a six-month high.

Government central banks have taken notice.

The latest data shows central banks are buying gold in amounts unprecedented in modern times…

You’d have to go all the way back to 1967 to see them accumulating gold at such a rapid pace.

It makes sense…

We’re heading into a recession. And before this year is over, central bankers will have to ease monetary conditions, just like they always do. By buying gold, central banks hedge against the fall of their currencies.

I’ve always owned at least a little gold. And I recommend everyone do the same.

For owning physical “hold in your hand” gold, a great option is Hard Assets Alliance. They’ve made buying gold extremely simple… no matter if you’re a beginner or someone who’s been buying gold for years.

With Hard Assets Alliance, you can buy, sell, and store gold right from your computer. We’re talking fully insured, physical gold stored at the world’s most trusted vaults.

And their network of wholesale dealers ensures you always get the best possible price. Use this link to get 12 months of free storage.

5) Our Cornerstone Club advisory agrees that the time to buy gold has arrived.

Cornerstone Club uses a rules-based method with a 50-year track record of beating the market. It rotates into sectors that are performing well and out of sectors that are not. Last year, the S&P 500 and Nasdaq plunged 19.4% and 33%, while the Cornerstone method declined just 7%.

For the first time in almost a year, Cornerstone recommends allocating part of your portfolio to gold. The new issue came out on Tuesday. If you’re not a member yet, go here to discover more.

Chris Wood

Chief Investment Officer, RiskHedge

In the mailbag...

Today, a warning from a fellow reader... Watch out for the IFI indicator:

Here is another anecdotal stock indicator for 2023 to add to the Cat & Dog veterinary one....

The Illegal Fireworks Indicator (IFI)! I live outside of a town of about 150,000 people in a state that doesn’t approve of any truly fun fireworks. Last year, there was a quite impressive expenditure of illegal fireworks within eye- & earshot of my home. This year? Virtually nothing. You’d have thought maybe somebody poached a couple of deer, but definitely would NOT have suspected it was New Year’s Eve. Illegal fireworks are the very definition of unnecessary/discretionary spending. If this drop in the IFI is because people are cutting back on their spending, then watch out.—Anonymous