Chasing stocks is a no-no…

Or is it?

It’s worth discussing.

After all, most folks think you should NEVER chase—or overpay for—a stock that has already risen a lot.

It sounds reckless… undisciplined… something a rookie would do.

That’s the conventional wisdom, at least.

But there are certain stocks that you often SHOULD “chase.”

I’m talking about leaders.

Let me show you... but first, welcome to the first issue of my new e-letter Trading With Justin. Each week, I’ll help you “up your trading game” as I share important strategies, insights, and lessons.

Leaders, as longtime readers know, are my favorite stocks to trade.

They deliver the biggest gains… hold up best during pullbacks… and are often the easiest to trade. That is if you can catch them.

You see, leaders are the first stocks to get going when the tide changes.

They start running before the market or their peers—i.e., industry groups—confirm the move.

Let me illustrate with an example…

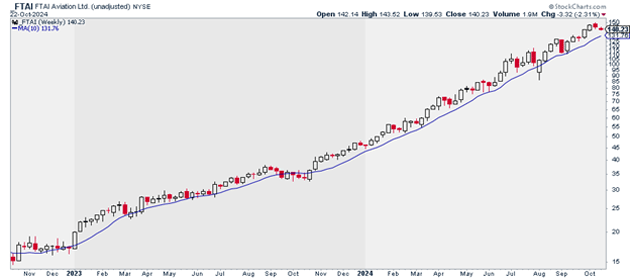

FTAI Aviation Ltd. (FTAI) is one of the strongest stocks of this bull market. It’s rallied 725% since the start of 2023.

Even more impressive is that FTAI never had any real pullbacks, or even sideways trading patterns, along the way. It basically moved up and to the right the entire time.

At any point, you could have looked at this chart and thought FTAI was extended. But it kept rocketing higher.

These are the kinds of stocks you should chase!

Source: StockCharts

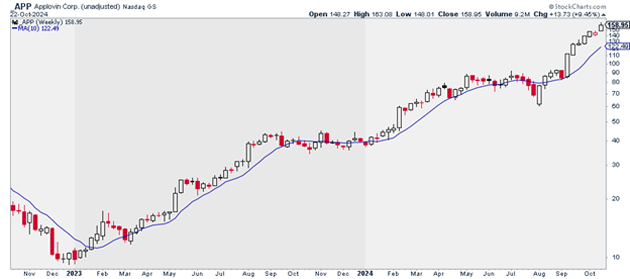

AppLovin Corp. (APP) is another example...

APP is the year’s best-performing software stock excluding MicroStrategy (MSTR), which is basically a leveraged bet on bitcoin (BTC).

APP has soared more than 1,600% since the start of 2023. Most folks will look at a chart like this and avoid the stock. They would assume it’s run up too much. Gravity has to set in eventually, right?

Not exactly. APP has nearly tripled since the start of 2024:

Source: StockCharts

It broke out to new all-time highs back in early September.

iShares Expanded Tech-Software Sector ETF (IGV) didn’t take out its prior cycle—i.e., 2021 highs—until three weeks later.

So, you would have missed the huge breakout in APP if you were waiting for IGV or other, weaker software stocks to confirm the move.

But leaders are called leaders for a reason.

I mention all this because I see newer traders making the same mistake over and over again.

They see leading stocks like FTAI or APP ripping higher, and their instinct is to avoid those stocks and buy laggards.

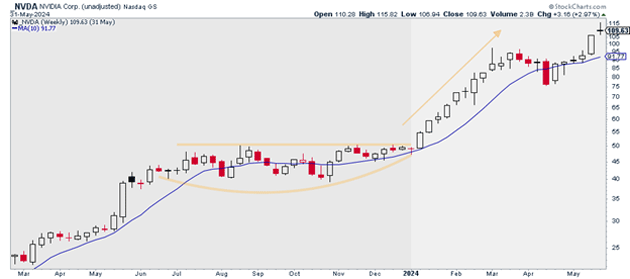

Remember when Nvidia (NVDA) broke out of a massive, multi-month base earlier this year?

This triggered an explosive move for NVDA. Shares of the artificial intelligence chip giant nearly doubled in just three months! To date, it's up more than 184% since leaving that station:

Source: StockCharts

Many traders saw this huge move unfolding and, instead of buying the clear industry leader in Nvidia, opted to buy a lesser semiconductor stock like Advanced Micro Devices (AMD).

Unfortunately, catch-up plays don’t usually work out as well as traders hope. You’d be much better off owning the Alpha Dog.

Justin Spittler

Chief Trader, RiskHedge