Should you be worried about inflation again?

Inflation, as we all know, measures how quickly the prices of everyday goods and services rise.

A high inflation rate means life is getting more expensive. It can also create problems for the stock market.

We saw this play out between late 2021 and late 2022. Inflation became such a problem that it forced the Federal Reserve to raise interest rates in an effort to squash inflation.

This helped ignite a bear market where the S&P 500 fell 27% over the span of 10 months.

Of course, inflation was much, much higher back then. For much of that time, inflation was north of 6%. In June 2022, it hit a high of 9.1%.

Today, it’s 2.7%. But the fear isn’t where inflation sits today. It’s where it might be headed. Over the past two months, the official inflation figure has edged higher.

There’s concern this will continue. I’m not saying this because of something an economist said. I’m saying it because of what the markets are telling us…

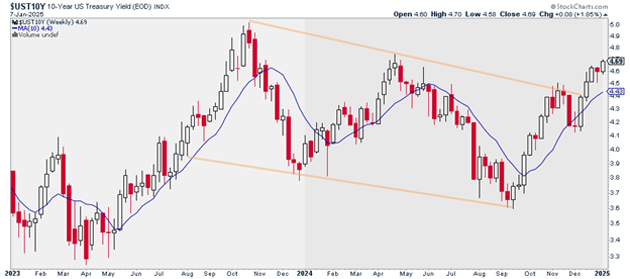

Look at interest rates. The yield on the 10-year US Treasury recently broke out of a multi-month consolidation pattern. It’s now trading at its highest level in nearly a year:

Source: StockCharts

Source: StockCharts

Interest rates climb when inflation rises because bonds need to pay above the inflation rate to be attractive investments. Otherwise, you’ll lose money owning them. No one will want to buy them.

Interest rates often climb before we see an uptick in the official inflation rate readings. This is because markets are forward-looking.

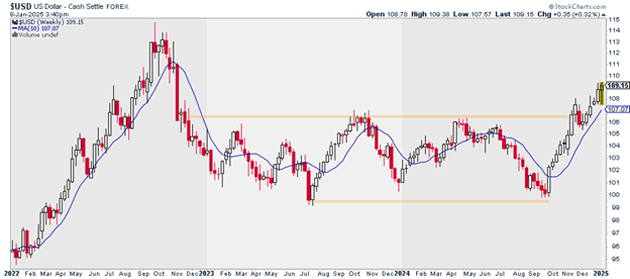

The US Dollar Index (USD)—which tracks the dollar’s performance against a basket of global currencies like the euro and Japanese yen—is also reflecting elevated inflation expectations.

As we can see below, this index recently broke out of a multi-month consolidation pattern. The dollar has a very close relationship with the 10-year US Treasury yield. So, it gives more weight to the breakout in rates, and it’s further proof the market is concerned about inflation.

Source: StockCharts

Source: StockCharts

At the same time, we’ve seen many rate-sensitive industry groups struggle lately.

The SPDR S&P Homebuilders ETF (XHB) has fallen 19% since late November. The SPDR S&P Biotech ETF (XBI)—another rate-sensitive group—has fallen 13% since mid-November.

This further confirms the notion that the market is taking the prospect of rising interest rates more seriously.

Bottom line: Now is NOT the time to press the gas. Be extremely selective about the kinds of stocks you own. Take smaller positions than you normally would. You can also size up when the markets stabilize.

Justin Spittler

Chief Trader, RiskHedge

PS: Looking for guidance on the top stocks to be in during this environment? You might want to check out Express Trader. In it, I send you the top three (and only three) trades to place each week. It’s a simple, straightforward blueprint that cuts out all the noise and is very easy to follow. Go here to learn more.