Picking tops and bottoms in the market is a fool’s game.

Investors who try it often regret it.

They end up selling too early, only to miss out on big gains. Or they buy back in too early and suffer big losses.

There isn’t one magic indicator that will tell you exactly when stocks have topped or bottomed out.

But there are ways to know when the market is nearing extremes.

And one of my favorite ways to do this is to pay close attention to market sentiment.

- Sentiment is the overall mood of investors…

Near market tops, most investors are greedy.

At market bottoms, your average investor feels much different. They’re too scared of losing money to touch stocks.

Now, there are plenty of ways to measure market sentiment.

But one of the most time-tested ways is paying attention to magazine covers.

I’m not talking about Vogue, People, or the National Enquirer.

Think Bloomberg, Forbes, or Time magazine.

These can be great resources of information. But let’s face it…

The folks who write these publications aren’t world-class investors. They’re journalists.

Most of the time, they write about what’s hot in the markets. That’s how you sell issues and subscriptions.

- Because of this, magazine covers are some of the best contrarian investing signals…

See for yourself. The Economist published this cover in late February of last year. The tech-heavy Nasdaq index went on to fall 20% over the next three weeks.

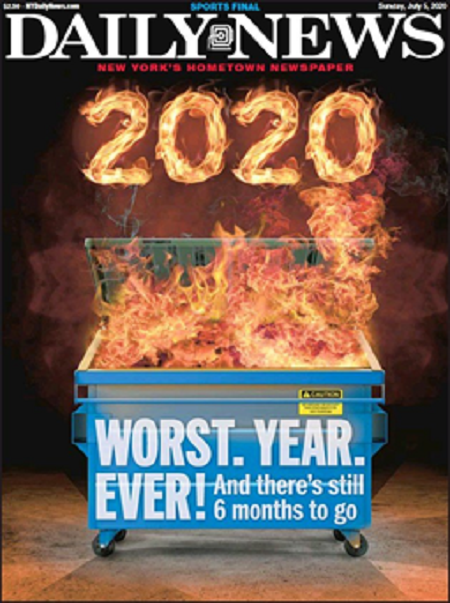

A few months later, the Daily News used this image for their July 5 issue. They were suggesting that 2020 was a “dumpster fire” that would only get worse.

Investors who saw this might have panicked. They may have sold their stocks and hid in cash.

But the S&P 500 kept climbing from there. It closed the year up 16%... well above its historical annual return.

In short, hyped-up magazine covers are often the kiss of death for bull markets. Scary magazine covers are often screaming buy signals at market bottoms.

I’m telling you all this because one of last year’s hottest markets recently had its “magazine moment”...

- I’m talking about SPACs…

SPAC is short for special purpose acquisition company.

In short: SPACs are vehicles private companies use to go public. They’re a cheaper and faster way to take a company public than a traditional initial public offering (IPO).

SPACs have been around for decades. But they became incredibly popular last year.

And it’s not hard to understand why. Many SPACs were printing money...

Space tourism company Virgin Galactic (SPCE) soared 239% between November 2019 and February 2020. DraftKings (DKNG) also had a phenomenal run… surging more than 270% in 2020.

We also booked a 395% return on VTIQ between March and June last year in my IPO Insider advisory. That’s enough to turn every $10,000 invested into nearly $50,000.

SPACs were red-hot... and the talk of the investing world.

- Then, SPACs had their magazine moment…

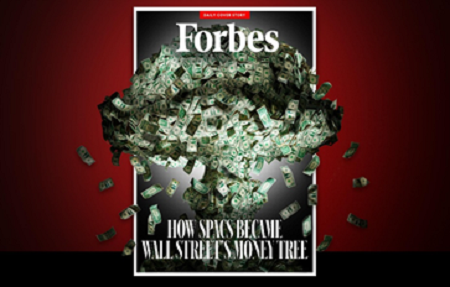

This is what Forbes used for one of its cover stories in November. (That’s a mushroom cloud of money you’re looking at)...

The headline says: “How SPACs Became Wall Street’s Money Tree.”

Can you guess what happened next?

- Late last year, I warned that a giant bubble was forming in the SPAC market.

I even titled the November issue of IPO Insider “The Biggest Bubble of 2020 Is About to Pop.”

Then right here in the RiskHedge Report I wrote, “This Year’s Hottest Investment Could Soon Go Up in Flames.”

My reasoning was simple.

When a part of the market gets red-hot, it attracts a lot of money. Eventually, investor enthusiasm reaches a peak that’s wildly out of whack with the fundamentals. And that’s exactly what’s happened in SPACs.

All told, the SPAC market raised $83.4 billion in 2020. That was more than a six-fold increase from 2019’s total, according to Dealogic.

And that was only the beginning.

So far this year, the SPAC market has raised $100 billion in proceeds. That’s more money than the entire market raised in all of 2020.

There’s just one problem: Demand for SPACs hasn’t kept up with the market’s explosive growth.

- Last week, not a single new SPAC went public.

That hasn’t happened since March 2020… when the stock market was in a full-blown panic thanks to COVID.

The week before that, just 3 SPACs went public.

In short, the SPAC market has pulled a complete 180 in the past few weeks. It’s come to a screeching halt.

Now, the mainstream media is mocking the SPAC market. Just look at this cover that New York magazine featured in early April.

Many investors want nothing to do with SPACs.

But keep in mind... magazine covers are a contrarian indicator.

When sentiment gets this sour, you should start looking very closely at a market—not run away from it.

And that’s exactly why SPACs now have my attention.

- I see huge opportunities brewing in the SPAC market…

And there are plenty of reasons for this.

With fewer new SPACs, supply is finally coming back into balance. Soon, there should be far less money chasing fewer SPAC deals than there was a few months ago.

Many SPACs are also now dirt cheap.

Thanks to the recent pullback, many SPACs are trading near their net asset values (NAV). (NAV is the theoretical value of a company’s assets minus liabilities.)

The risk/reward for many SPACs today is about as good as it gets.

Finally, existing SPACs look to be in the early stages of bottoming out. See for yourself.

This chart shows the performance of the Defiance Next Gen SPAC Derived ETF (SPAK), which invests in a basket of SPACs. We use SPAK in IPO Insider as a way to assess the overall health of the SPAC market.

Source: StockCharts

Source: StockCharts

You can see SPAK got hit especially hard during the recent pullback. The good news is that SPAK has bounced hard off its lows.

I believe this is the beginning of a bottoming process for SPACs as a whole.

Still, it’s not the time to blindly buy SPACs. Instead, I suggest using today’s terrible sentiment as an opportunity buy best-of-breed SPACs at deep discounts.

I’ll have a lot more to say about this opportunity soon…

Justin Spittler

Chief Trader, RiskHedge