Editor’s Note: Today, we continue our conversation with our friend Jared Dillian—bestselling author and former head of ETF trading at Lehman Brothers.

If you missed Part 1, Jared says private equity is the biggest bubble since housing in 2008. In short, the $8 trillion private equity market, propped up by leverage and financial engineering, is beginning to crack. And today, Jared shares why this matters to investors. Read on below.

If you didn’t access Jared’s new private equity exposé—Operation Watchtower—you can do so here.

***

Chris Reilly: Jared, we left off Wednesday talking about the big bubble forming in the private equity space.

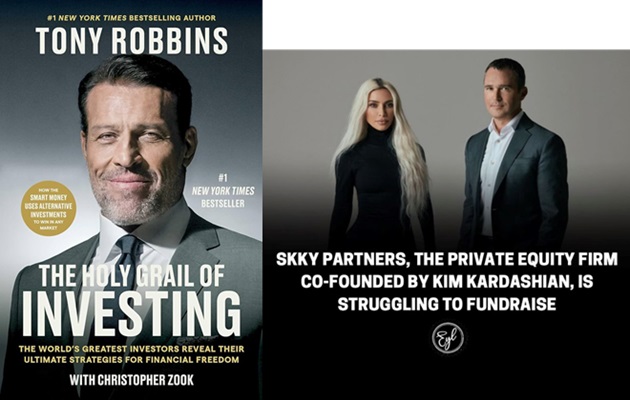

From a sentiment perspective, you’ve talked about Tony Robbins’ book calling private equity “The Holy Grail of Investing.” Kim Kardashian even has a private equity firm now...

Why is it not necessarily a good thing that you have these celebrities touting and getting into the space?

Jared Dillian: Yeah, the Tony Robbins book in particular, I mean calling it “The Holy Grail of Investing...”

The thing that makes private equity attractive is that you have returns that approximate the stock market—and maybe do a little better—but with zero volatility.

If you have something that's not marked to market on a daily basis, you can't see the volatility. So that’s the real competitive advantage for private equity. They lock up funds for 10 years, and you can't get your money out and you don't know what this stuff is worth.

But with interest rates where they are in competition for deals, the returns are going to go down over time. There's no cash flowing back to investors now because there's no exit, there are no IPOs, there’s no liquidity event. And in some cases, there've been cash calls... people have had to keep putting money into their private equity investments.

And the other part of this is that this is really big for pension funds and endowments. A lot of endowments have 30% of their holdings in private equity. This is roughly based on the Swensen model—David Swensen at Yale University—but it’s not sustainable.

Chris: So what about the everyday investors who invest in the public markets? They have their retirement accounts, maybe they dabble in some big tech stocks on the side here and there...

They hear about private equity and think, “Okay, this sounds like trouble for big institutions and accredited investors, but not me.”

But you're saying that this development could add fuel to the fire when it comes to the next bear market, or the next crisis or next recession. So how could this have a ripple effect to the point where regular investors are losing money and they need to think about how to protect themselves or potentially profit from this?

Jared: There are really two ways. Let’s say someone owns a business—you have someone who owns a dental practice—and private equity has been rolling up a bunch of dental practices and they've been buying them at 10X–12X.

If we get a bear market in private equity and there are redemptions, and there's forced selling of businesses, they'll be back to selling at 4X–5X.

|

So the takeaway is if you’re a business owner and you think your valuation is X, when private equity unwinds, it's probably going to be worth 50% of X. So valuations are high. You might want to think about selling your business now rather than later.

The other part of this is that private valuations should mirror public valuations. And this is why I said I don't think private equity is going to be the cause of the crisis, but I think it's going to exacerbate it.

Basically, what will happen is we’ll have a bear market in stocks. Stocks will go down 20%, and the private equity firms will probably not mark down their holdings. But there are going to be a lot of questions about the value of those holdings. You'll get redemption requests, and then it all starts to de-lever and unwind.

If you think about how you have a universe of 3,000 publicly traded companies and 50,000 private companies... as those private businesses are sold over the course of years, it’s going to depress valuations in the public markets because private valuations should mirror public valuations.

So if we have a significant bear market in the public markets, it's probably going to be a longer bear market in terms of duration. Rather than being over in 18 months, it could be three, four, or five years before the markets recover.

Chris: Makes sense. So what can readers do to get ahead of this situation and potentially profit?

Jared: One action you can take is to short the private equity firms, and I'm comfortable shorting those stocks because really these aren’t stocks that have explosive upside. The upside is very much capped.

If you look at a chart of all these private equity firms—whether it's Blackstone (BX), TPG (TPG), Apollo Global Management (APO), KKR & Co. (KKR), or Ares Management Corp. (ARES)—these aren’t charts that are going to explode higher.

You can be short them, and the stocks aren’t hard to borrow. So if you have a portfolio of stocks, you could apply a hedge to that portfolio—about 30% or 40% of it using private equity firms—and that's going to be an effective hedge.

Chris: Good talk. Appreciate the insights, Jared.

Jared: Anytime.

Chris: And reader, if you’d like in-depth analysis on the hidden risks behind the private equity meltdown—and exactly what’s going on—make sure to check out Jared’s Operation Watchtower exposé.

Chris Reilly

Executive Editor, RiskHedge