No new trade this week…

Instead, I want to share the results of my RiskHedge Live beta test.

Longtime readers know I’m extremely proud of this trading service, which I designed to capture the market’s fast moves.

After being in beta testing from June-December of last year, the results for RiskHedge Live are in.

Below, I discuss our beta test performance with Executive Editor Chris Reilly and share what I got right and wrong. Then, Chris gives me an official grade for 2023.

Be sure to read to the end for a special offer to join RiskHedge Live at the lowest price possible…

***

Chris Reilly: Justin, the results are in for your RiskHedge Live beta test.

As you know, a small group of RiskHedge readers paid to gain first-look access to your private trading room last June.

During this beta test phase (June-December), we closely tracked every trade.

Let’s look at how you did. I’ll give you an official grade—between A+ and F—taking everything into account. We’ll also discuss what’s in store for 2024, and how you’re playing the current market.

Justin Spittler: Let’s do it. We should start by explaining how my advisory is different from most others.

Chris: I wouldn’t even call it an advisory. Your trading room is anything but a traditional service.

Look, we’ve been friends for eight years, and I’ve been editing your work since back when we were colleagues before RiskHedge.

You did the whole “traditional newsletter thing” very well.

For example, we launched IPO Insider in 2019 and made subscribers very happy with trades like Cloudflare (NET) +366%, VTIQ +395%, and Fastly (FSLY) +330%, among others.

You wrote up the monthly issues, updated readers on the IPO market, and sent alerts when a faster-moving opportunity presented itself.

But toward the end, you felt the format was restricting your ability to help members as much as possible.

Justin: Yes. I’ll be blunt: Writing a monthly 15-page newsletter felt “off” to me after a while. Those traditional, longer-form updates are better suited for investing letters.

As a full-time trader, I monitor hundreds of charts a day. I look at price action and act on that price action—fast.

Simply put, I wanted my subscribers to receive my trade recommendations the moment it was time to pull the trigger... not an hour later, which often happened by the time it got edited, proofread, and loaded up in our email-sending software.

Speed matters. And RiskHedge Live has proven, I think, to be the perfect solution.

Chris: So we built RiskHedge Live to have three qualities:

-

Easy to use

-

Fun

-

Community-oriented

“Easy to use” because people are busy.

“Fun” because many investors find trading intimidating, but this is a service anyone can benefit from.

And “community-oriented” so members could grow and share their wins along the way. And trade more profitably—regardless of experience, portfolio size, or sophistication.

After six months, I’m proud to say we’ve really built a great community in the room.

Justin: I agree. It’s been fun interacting with our members.

Chris: But at the end of the day, it all hinges on you producing great results. So, let’s talk about that.

First, your win rate. 56% of your trades were profitable. Comments?

Justin: That’s about what I shoot for. That probably sounds odd to readers who aren’t familiar with trading, because it means almost half of our trades are unprofitable.

But as most any veteran trader will tell you—and as my own personal experience confirms—a high win rate isn’t all that important. It’s far more important what you do with your profitable and unprofitable trades.

Chris: You’re talking about cutting losing trades early, and letting winning trades run?

Justin: Yes. Not to get philosophical, but the Pareto Principle rules in trading. It states that 20% of your trades will produce 80% of your results. Our real task as traders is to let the big winners flourish while keeping a tight leash on all other trades.

Chris: That being the case, while your winners won’t necessarily outnumber your losers by a wide margin, your winning trades should produce far bigger profits than your losing trades.

Let’s look at the results through that lens.

You recommended 55 trades during the beta test. That includes 49 stocks and six crypto/crypto-related investments.

Your three biggest winners were Solana (SOL) +219%, Valkyrie Bitcoin Miners ETF (WGMI) +97%, and CrowdStrike (CRWD) +77%.

Your three biggest losers were Transocean Ltd. (RIG) -32%, Marathon Digital (MARA) -30%, and Super Micro Computer (SMCI) -23%.

Congratulations.

Justin: Thank you. As you know, you can’t be a successful trader without managing risk, even in a year like 2023 with stocks rising 24%.

I’ll reiterate: While all the glory comes from the big wins, cutting laggards is just as important. There are thousands of stocks in the market, so there’s no reason to hang on to one that isn’t rising fast enough.

We cut NU Holdings (NU), for example, for a 3% gain for this exact reason:

There are always more opportunities coming, and I refuse to waste time or capital in a stagnant trade when we can be in a winner.

Chris Reilly: That’s a good point to reiterate to our readers.

Next, let’s talk about your total return—and how it stacked up against the main benchmarks. Then I’ll give you an official grade.

First, in the interest of objectivity, let’s go over some calls you got wrong last year.

Justin Spittler: Sure. To me, getting things “wrong” is all part of the process. Peter Brandt, a legend and one of the greatest living traders, says, “I hate to be the bearer of bad news, but taking losses is the primary job description of a market speculator.”

It’s a genius observation because he’s absolutely right. The longer I trade professionally, the more I realize the big wins pretty much take care of themselves. Finding trades that gain 100%, 200%, or more is the easy part.

I know it’s not sexy, and I know I’m repelling some folks by repeatedly talking about managing stagnant or losing trades. But the truth is, you are going to have plenty of trades that don’t play out as expected. Manage them well, and you’ve done the hardest part.

Chris: Example?

Justin: My whole track record is an example. Looking at the beta test period, 18 of my recommendations—or one-third of them—produced returns between -6% and +6%. These were duds. But that’s okay! We made a little bit of money on them overall.

A novice will look at this and conclude I wasted one-third of my time. Untrue. It’s by taking swings and managing risks that we find the huge winners.

If you want a specific trade as an example… look at Transocean. It was my absolute worst trade during the year. However, every recommendation I make comes with position sizing guidance. In short, the riskier the trade, the smaller the position.

We only took our smallest position—which I call a "starter position”—in Transocean. So even that trade did little damage to our capital.

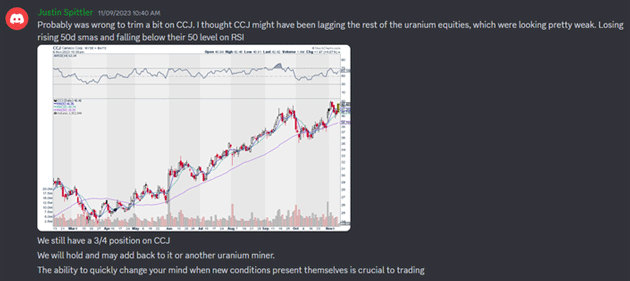

Cameco (CCJ), the uranium stock, also comes to mind. We happily rode the uranium bull market to nice profits last year. But I trimmed this position a little too early. In hindsight, that was the wrong move.

Chris: Here’s a screenshot of exactly what you said in the RiskHedge Live trading room about it:

To summarize, you said, "Probably was wrong to trim a bit on CCJ. We still have a 3/4 position. The ability to quickly change your mind when new conditions present themselves is crucial to trading."

Justin: See? Traders can’t be perfectionists. And we ended up walking away with a nice profit. We sold CCJ on Thursday for a 21% gain after it sliced through all its key moving averages.

Chris: Alright. It’s time. Let’s look at the final results.

RiskHedge Live posted a total return of 89% during the beta test period (June-December 2023).

That easily beat the total 2023 returns for the S&P 500 (24%), the Dow (14%), and the Nasdaq (43%).

2023 was a good year for markets overall. But your recommendations surpassed pretty much every benchmark, which is extra impressive considering markets struggled during the first few months of RiskHedge Live (July-October).

If there’s an area for improvement, it’s the win rate we discussed earlier.

You achieved a 56% win rate, which is good, but not quite excellent. The 89% average return, however, is superb, and a real accomplishment. Altogether, you’ve earned an A.

Justin: Thanks. I think our ability to trade anything really set us apart last year. We made good money in uranium. And in crypto, including several bitcoin mining ETFs that are as easy to buy as any stock.

The ability to quickly pivot and participate in the strongest areas of the market, I think, is our greatest edge inside RiskHedge Live. Most investors have “styles.” Value investors hunt for bargains; they’re not going to buy a crypto. Tech investors aren’t going to touch uranium stocks.

Rather than being beholden to a style or sector, we go where the opportunity is.

Chris: Where’s the opportunity now?

Justin: Markets are still hot. But I wouldn’t be surprised if we get a pullback soon, for two reasons.

-

Markets have run up fast since November 1, squeezing nearly two years' worth of average gains into just over three months. And as Ryan Detrick at Carson Group tweeted, "The S&P 500 is up 14 of the past 15 weeks and up more than 20% the past 15 weeks. In the history of the stock market, that has never happened before."

-

February has historically been the second-worst month for stocks going back to 1950.

A pullback would be healthy and normal here. But in the meantime, I’m following price action as always and leaving the “predictions” to everyone else.

Chris: Any sector you like in particular right now?

Justin: Solar is starting to look interesting and may have bottomed.

The Invesco Solar ETF (TAN) is now back to its pre-COVID highs, and that level is holding so far. Also, Nextracker (NXT)—a recent solar IPO—has been performing quite well. It's rallied 92% since it went public last February.

Enphase (ENPH)—the largest solar stock—rallied 11% on Wednesday after missing on sales and lowering guidance.

Bottoms often occur when stocks stop falling on bad news. I have no solar exposure currently. And it could be months before TAN begins a new uptrend. But this is a hated industry worth watching.

Chris: Thanks, Justin.

For readers interested in following along with RiskHedge Live and getting Justin’s up-to-the-minute trade ideas, now is the best time to join.

We’ve opened the doors to Justin’s private trade room for a special price, $400 off for a full year (or $100 off for three months). This offer is only valid until tomorrow at midnight. Details here.

Justin Spittler

Chief Trader, RiskHedge