Happy New Year! The market and our offices are closed today, but I wanted to remind you of an important trading lesson as a way to kick the year off right.

It comes down to these three words:

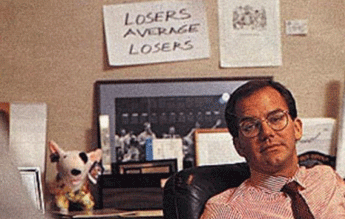

“Losers average losers.”

Paul Tudor Jones famously had these three words pinned above his desk:

Source: Mind the Product

Source: Mind the Product

This isn’t just an iconic photo of one of the greatest traders who’s ever lived. It’s also one of the most important lessons for traders. It doesn’t matter if you’re just getting started or you’re a seasoned pro.

Buying laggards is a recipe for disappointment.

You’re much better off adding to winning positions.

This is the same strategy I follow in my trading advisory, Express Trader. When one of our trades is working really well, we continue to hold until I see a legitimate reason to sell.

See, trends in motion tend to stay in motion.

In other words, stocks that are rising are more likely to keep rising… and vice versa.

Many traders try to “bottom fish” and buy when the market is still falling. This exposes them to quick losses that make it hard to stay in a trade.

Always remember: Cheap stocks are often cheap for a reason. There’s no reason why a stock down 20% can’t fall another 20% or more.

This is why bottom fishing is so risky. You need to nail the timing!

But let’s look at the flipside.

When you buy a stock in an uptrend, momentum has your back.

Most stocks are like life rafts floating down a strong river. The current will sweep the raft in the direction the river is going. Those who paddle against the current will only exhaust and frustrate themselves.

So, what should you look for instead?

Well, the numbers don’t lie...

According to studies, 37% of a stock’s price movement is due to the performance of its industry group. Another 12% is due to strength in its overall sector.

In other words, about half of a stock’s performance has nothing to do with the company itself!

You can make great money by simply investing in stocks in the strongest groups.

By buying stocks in strong sectors and in an uptrend, you can save yourself from taking unnecessary losses… and from wasting time waiting for beaten-down stocks to turn around.

It’s also easier to manage risk when you buy a stock in an uptrend. That’s because you can use the stock’s recent low as a line in the sand to exit your position.

In Express Trader, I always let my readers know when it’s time to move on to the next opportunity. If you’d like to join us, go here for details.

To sum it up: Ride winners. Cut losers.

This strategy is simple, and it works.

Justin Spittler

Chief Trader, RiskHedge