Are you buying “loser” stocks?

I don’t mean to be rude.

But this is a mistake I see traders (and investors) make all the time.

They buy “laggards” instead of the strongest stocks.

Laggards underperform when the market is going up… or worse, don’t participate at all.

I get why people do this. It’s only natural to think the stocks leading the market higher will run out of steam and top out.

This is why many rookie traders gravitate toward underperformers, hoping to play “catch up.”

This strategy rarely works out.

You see, the strongest stocks are the strongest for a reason. They’re often the best companies. They’re the names big institutions want to buy hand over fist.

And that brings us to our Trade of the Week: $62 billion semiconductor company KLA Corp. (KLAC).

Semiconductors are on fire. Thanks to the excitement around artificial intelligence, “semis” have been the strongest industry in the entire market.

Many traders are looking to fade this strength. I want to “buy the dip” on semis.

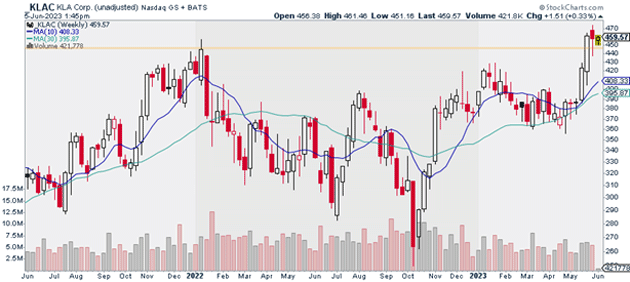

Specifically, we’re going to buy the breakout on KLAC. You can see what I mean below.

KLAC broke out of a huge base two weeks ago. Last week, it retested that key level. Buyers stepped in and flipped that former resistance level into support.

Source: StockCharts

Source: StockCharts

Now, I know the recent pullback in KLAC probably doesn’t look like much of a dip.

But here’s what you need to understand: The strongest stocks never make it easy for everyone to get in. So, we need to take advantage of this opportunity while it lasts.

I suggest buying a half position in KLAC today. Look to scale into a full position on future dips.

I’m targeting $680 for KLAC over the next 12 months. I also suggest placing a daily stop-loss at $410. That gives us nearly 50% upside, and a risk-reward ratio of 5:1.

Action to take: Buy a half position of KLAC at current market prices.

Risk management: Exit your position if KLAC closes below $410.

Justin Spittler

Chief Trader, RiskHedge