There’s a rare breed of companies that have no competitors. It pays to own them.

If Walmart closed tomorrow you could shop at Costco. If Bank of America went bust, you could wire your money to Wells Fargo. If Toyota stopped making the RAV4, you could buy a Ford F-150.

But if you’re Apple and you want a cutting-edge computer chip for the next iPhone, there’s only one company you can call. Taiwan Semiconductor (TSM).

There's no Plan B.

Apple sends TSMC an email once a year with a new chip design. Then, engineers in Taiwan use $300 million machines to print these designs onto large silicon wafers. I’m oversimplifying, but only a little.

Want to run AI? You need cutting-edge chips. Want cutting-edge chips? You need TSMC. Microsoft… Google… Nvidia… all the tech giants bow at its altar.

TSMC’s new earnings report is a showstopper. It reveals its AI related revenues are set to triple this year, and total sales are on track to grow 30%. A $1 trillion company growing revenue by 30% is like an elephant winning a sprint against cheetahs.

And here’s the kicker: this monopoly—the kingmaker of the AI age—trades at just 19 times earnings. That’s cheaper than the S&P 500!

Congratulations to Disruption Investor members who are sitting on 100%+ gains since we bought TSMC. It’s a monopoly stock that keeps on winning.

- "People haven't grasped how powerful the new ChatGPT is."

One of OpenAI’s lead researchers told me this over lunch in San Francisco last weekend. My eyes widened with excitement.

As we discussed last week, ChatGPT creator OpenAI’s new model “o1” is a game changer. For the first time ever, an AI beats PhD scholars on the toughest questions.

o1’s superpower is the more it “thinks,” the smarter it gets.

So far roughly 90% of AI spending has gone toward training the models. It’s like teaching a child to read.

Amazon, Google, Microsoft, and Meta have been building data centers the size of small cities to train their AI systems.

OpenAI’s new model brings this “bigger is better” attitude to "inference" too. In plain English, when you ask ChatGPT a question and it answers, that’s inference.

|

That means much more powerful, capable, AIs are coming soon.

But the most important investment conclusion from o1 is spending on inference is set to surge.

Nvidia (NVDA) CEO Jensen Huang recently said, “inference will be 1 billion times larger than training.”

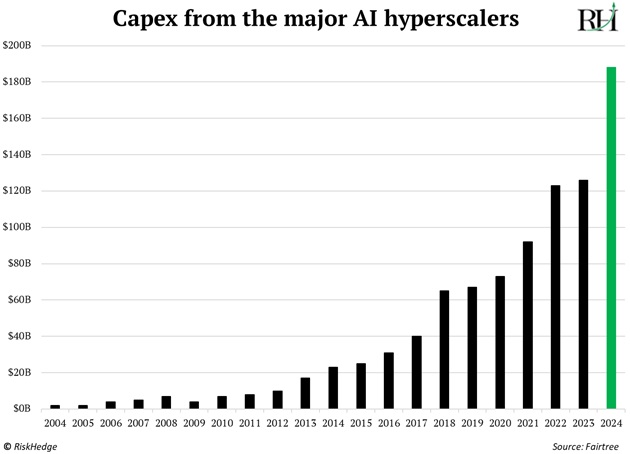

Investors balk at the $180 billion being spent building AI data centers this year. That figure will seem like pocket change compared to AI spending in 2-3 years.

And who will be the biggest winners from this? The designers (like Nvidia) and makers (TSMC) of AI chips need to power the massive digital factories they run in.

- A lot of Wall Streeters think all this AI spending is wasteful.

Goldman Sachs (GS) recently sounded the alarm about how little money companies are earning from AI relative to the amount being spent.

At a glance, it looks like they have a point. As I mentioned, Amazon, Google, Microsoft, and Meta are on track to pour a staggering $180 billion into AI data centers this year alone.

Yet OpenAI—the top-earning AI startup—will only make a measly $3.7 billion this year.

But Wall Street has it all wrong. AI is much more than ChatGPT subscription fees.

Credit card giant Mastercard processes $8 trillion in payments annually. AI is now letting it catch 20% more fraud attempts "on top of all the amazing things we had already been able to do."

How many millions (billions?) of dollars is that worth?

Or take consulting giant Accenture, which quietly pocketed $1 billion in AI-related contracts in just the past three months.

These real-world AI success stories aren't counted in the "official" AI revenue numbers. That’s our opportunity.

Expect a flood of "traditional" companies to start revealing their AI wins. When these announcements start rolling in, AI stocks will surge even higher as everyone realizes this technology is the real deal.

We’re still early in the AI opportunity. Continue to invest in the winners, like we’re doing in Disruption Investor. (Upgrade here.)

- Today’s dose of optimism…

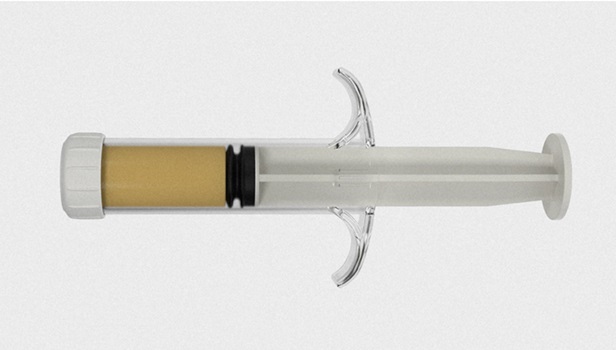

Meet Traumagel, the hummus-like gel that’s going to save many lives.

Source: Police Magazine

Imagine you're a medic racing against time to save someone with a severe wound. Your best options haven’t changed in over a century: gauze, some pressure, and prayer.

Traumagel transforms how we handle life-threatening bleeding.

It’s basically a syringe of gel made from algae and fungi, nature's own blood-stopping recipe. Squeeze it into a wound, and within seconds, the bleeding begins to slow.

The FDA recently gave Traumagel its stamp of approval.

If you want to stay on the cutting edge of innovation and technology, join our new passion project: The Rational Optimist Society.

Stephen McBride

Chief Analyst, RiskHedge